Table of Contents

- Introduction to Cattle Futures Trading

- What Are Cattle Futures Contracts?

- Types of Cattle Futures: Live Cattle vs Feeder Cattle

- Key Factors That Affect Cattle Futures Prices

- How to Use Cattle Futures for Hedging and Trading

- Step-by-Step Guide to Trading Cattle Futures

- Best Cattle Futures Trading Strategies

- Risk Management in Cattle Futures Trading

- Frequently Asked Questions (FAQs)

- Start Your Cattle Futures Trading Journey

1. Introduction to Cattle Futures Trading

Cattle futures trading represents one of the largest and most liquid livestock commodity markets in the world. Whether you’re a cattle rancher looking to hedge price risk or an investor seeking exposure to agricultural commodities, understanding cattle futures is essential for success in today’s markets.

The cattle futures market allows participants to buy and sell standardized contracts for future delivery of cattle. This market serves two primary purposes: price discovery and risk management. For cattle producers, these contracts provide protection against price volatility. For traders and investors, cattle futures offer opportunities to profit from price movements in the livestock sector.

The United States cattle industry represents a significant portion of agricultural production, making cattle futures an important economic indicator. With proper knowledge and strategy, participants can effectively navigate this dynamic market while managing associated risks.

2. What Are Cattle Futures Contracts?

Cattle futures contracts are standardized legal agreements to buy or sell a specific quantity of cattle at a predetermined price on a future date. These contracts trade on the Chicago Mercantile Exchange (CME), providing transparency and liquidity to market participants worldwide.

Each cattle futures contract represents a significant amount of livestock, making them powerful tools for price risk management. The standardized nature of these contracts ensures consistent quality specifications, delivery terms, and settlement procedures across all transactions.

Unlike stocks or bonds, cattle futures contracts have expiration dates and require physical delivery unless closed before maturity. However, most traders close their positions before delivery, using the contracts purely for price exposure and risk management purposes.

3. Types of Cattle Futures: Live Cattle vs Feeder Cattle

The cattle futures market offers two distinct contract types, each serving different segments of the cattle production chain.

Live Cattle Futures Contract Details

Understanding CME Live Cattle Futures: Contract Specifications Guide

When trading live cattle futures on the Chicago Mercantile Exchange (CME), understanding the contract specifications is essential for successful participation in this agricultural commodity market. Here’s a comprehensive breakdown of the key details every trader should know.

Contract Size and Pricing

Each live cattle futures contract represents 40,000 pounds of cattle, which equals approximately 18 metric tons. This standardized unit size allows for efficient trading and delivery processes across the market.

Prices are quoted in U.S. cents per pound, making it straightforward to calculate the total contract value. For example, if live cattle are trading at 225 cents per pound, one contract would be worth $90,000 (40,000 lbs × $2.25).

Trading Hours: Multiple Platforms, Extended Access

The CME offers trading through two primary platforms, each with different operating hours:

CME Globex Electronic Trading

- Regular Hours: Monday through Friday, 8:30 a.m. to 1:05 p.m. Central Time

- Trade at Settlement (TAS): Monday through Friday, 8:30 a.m. to 1:00 p.m. Central Time

- Note: This translates to 9:30 a.m. to 2:00 p.m. Eastern Time

CME ClearPort (for Block Futures)

For those needing extended trading access, ClearPort could operate around the clock (however, it rarely does).

- Operating Window: Sunday 5:00 p.m. through Friday 5:45 p.m. Central Time

- Brief Pause: No reporting occurs Monday through Thursday from 5:45 p.m. to 6:00 p.m. Central Time

Price Movement and Tick Values

The minimum price fluctuation is 0.00025 per pound, which equals $10.00 per contract. This small increment allows for precise pricing while maintaining reasonable contract values for most market participants.

For Trade at Settlement (TAS) orders, the minimum fluctuation can be zero or plus/minus 4 ticks in the minimum tick increment of the outright contract.

Product Codes Across Platforms

Different CME systems use distinct product codes for live cattle futures:

- CME Globex: LE

- CME ClearPort: 48

- Clearing: 48

- TAS: LET

Contract Availability and Expiration

Live cattle futures follow a bi-monthly listing schedule, with contracts available for February, April, June, August, October, and December. The exchange typically lists contracts for 10 months forward, providing traders with multiple expiration options for hedging and speculation strategies.

Settlement and Delivery

These contracts use a deliverable settlement method, meaning physical delivery of live cattle can occur any time within the delivery period. This physical delivery option helps ensure that futures prices remain closely aligned with the underlying cash market.

Trading termination occurs at 12:00 Noon Central Time on the last business day of the contract month, giving market participants a clear deadline for closing positions or preparing for delivery.

Why These Specifications Matter

We consider that understanding these contract specifications is crucial for risk management, position sizing, and trading strategy development. The standardized nature of these contracts creates liquidity and transparency in the live cattle market, benefiting producers, processors, and speculators alike.

Whether you’re a cattle rancher looking to hedge price risk or a trader seeking commodity exposure, these specifications form the foundation of successful live cattle futures trading.

CME Feeder Cattle Futures Contract Specifications

Contract Unit

50,000 pounds (~23 metric tons)

Price Quotation

U.S. cents per pound

Trading Hours

CME Globex:

Monday – Friday: 8:30 a.m. – 1:05 p.m. CT (9:30 a.m. – 2:05 p.m. ET)

TAS: Monday – Friday 8:30 a.m. – 1:00 p.m. CT (9:30 a.m. – 2:00 p.m. ET)

CME ClearPort:

Sunday 5:00 p.m. – Friday 5:45 p.m. CT with no reporting Monday – Thursday from 5:45 p.m. – 6:00 p.m. CT

Minimum Price Fluctuation

0.00025 per pound = $12.50

TAS: Zero or +/- 4 ticks in the minimum tick increment of the outright

Product Code

CME Globex: GF

CME ClearPort: 62

Clearing: 62

TAS: GFT

Listed Contracts

Monthly contracts of (Jan, Mar, Apr, May, Aug, Sep, Oct, Nov) listed for 9 months

Settlement Method

Financially Settled

Termination of Trading

Trading terminates on the last Thursday of the contract month. If the last Thursday of the contract month or any of the 4 prior weekdays is not a business day, trading terminates on the prior Thursday that is a business day and is preceded by a business day. Nov: Trading terminates on the Thursday prior to Thanksgiving Day.

4. Key Factors That Affect Cattle Futures Prices

Understanding cattle price drivers is crucial for successful futures trading. Multiple factors influence cattle prices, creating opportunities and risks for market participants.

Feed Costs and Grain Prices

Feed costs represent a significant majority of cattle production expenses. Corn and soybean meal prices directly impact cattle feeding profitability, making grain futures closely watched by cattle traders. When feed prices rise, cattle production costwo, It’s increase, potentially leading to higher cattle prices. However, there could also be an inverse relationship between the two happening and a farmer needs to observe that for when hedges are put on.

Weather and Environmental Conditions

Weather patterns significantly affect cattle operations through multiple channels. Drought conditions reduce pasture quality and increase feed costs. Severe winter weather can impact cattle’s health and weight gain. Favorable weather conditions typically support lower production costs and stable cattle supplies.

Supply and Demand Fundamentals

Cattle inventory levels, slaughter rates, and beef consumption patterns drive market fundamentals. The USDA releases regular reports on cattle numbers, providing essential data for market analysis. Consumer demand for beef, influenced by economic conditions and dietary trends, affects long-term price trends.

Economic Conditions and Consumer Spending

Economic recessions typically reduce beef consumption as consumers shift to less expensive protein sources. Strong economic growth supports higher beef demand and cattle prices. Employment levels and disposable income directly correlate with beef consumption patterns.

International Trade and Export Markets

U.S. beef exports represent a significant portion of domestic production. Trade agreements, currency fluctuations, and foreign economic conditions impact export demand. Disease outbreaks can trigger export restrictions, affecting domestic cattle prices.

Government Policies and Regulations

Agricultural policies, trade regulations, and food safety requirements influence cattle markets. Subsidy programs, environmental regulations, and inspection standards affect production costs and market access.

Seasonal Price Patterns*

Cattle markets exhibit predictable seasonal trends based on production cycles. Spring typically sees increased cattle marketing as winter feeding ends. Fall harvest seasons often bring marketing pressure as feed costs decline. Understanding these patterns helps traders time market entry and exit.

Disease Outbreaks and Food Safety Issues

Animal diseases can dramatically impact cattle populations and trade flows. Food safety concerns affect consumer demand and export markets. Disease prevention costs and vaccination requirements influence production expenses.

5. How to Use Cattle Futures for Hedging and Trading

Cattle futures serve both hedging and speculative purposes, providing tools for risk management such as inventory management.

Hedging Applications for Cattle Industry Participants

Hedging involves taking opposite positions in futures and physical markets to reduce price risk. This strategy helps cattle industry participants manage volatile commodity prices.

Long Hedging Strategies

Long hedging protects against rising cattle prices by purchasing futures contracts. This strategy benefits buyers of cattle who face price risk.

Meat Processors and Packers: Large meat companies like Tyson Foods, JBS USA, and Cargill Meat Solutions use long cattle futures hedges to lock in cattle purchase prices. This protects processing margins when cattle prices rise unexpectedly.

Restaurant Chains: Major foodservice companies, including McDonald’s Corporation, Wendy’s Company, and Restaurant Brands International, hedge beef costs through long cattle futures positions. This strategy maintains consistent food costs despite market volatility.

Grocery Retailers: Supermarket chains such as Walmart Inc., Kroger Company, and Albertsons Companies hedge beef procurement costs using long cattle futures. This approach helps maintain stable consumer pricing strategies.

Feedlot Operations: Cattle feeding operations often use long live cattle futures while selling feeder cattle futures, creating a feeding margin hedge that protects profitability regardless of individual price movements.

Short Hedging Strategies

Short hedging protects against declining cattle prices by selling futures contracts. This strategy benefits sellers of cattle who own the physical commodity.

Cattle Ranchers: Individual ranchers and large cattle operations like King Ranch, Deseret Ranches, and Waggoner Ranch sell cattle futures to establish minimum selling prices for their livestock. This protects against market downturns during the production cycle.

Feedlot Operators: Cattle feeding operations sell live cattle futures to hedge cattle they’re currently feeding. This locks in selling prices and protects feeding margins from adverse price movements.

Cow-Calf Producers: Ranchers raising feeder cattle sell feeder cattle futures to hedge calves that will be marketed in future months. This provides price certainty during the growing season.

Speculative Trading Opportunities

Speculators provide market liquidity and seek profit from cattle price movements without involvement in physical cattle operations.

Long Speculation

Traders expecting higher cattle prices buy futures contracts to profit from upward price movements. This strategy works when fundamental or technical factors support rising prices.

Short Speculation

Traders anticipating lower cattle prices sell futures contracts to profit from downward price movements. This approach benefits from declining market conditions.

Spread Trading

Advanced traders use spread strategies, simultaneously buying and selling related contracts to profit from price relationships. Popular cattle spreads include live cattle versus feeder cattle spreads and calendar spreads between different contract months.

If you wish to understand cattle spreads in more detail, visit https://agoptimus.com/cattle-spreads-for-hedging/

Key Differences Between Hedging and Speculation

Risk Management Objectives: Hedgers reduce existing price risk while speculators assume risk for potential profit.

Market Knowledge: Hedgers typically possess extensive cattle industry knowledge, while speculators may focus purely on price analysis.

Position Duration: Hedgers often hold positions until physical transactions occur, while speculators may trade frequently based on market conditions.

Profit Motivation: Hedgers accept small losses on futures to protect larger physical positions, while speculators seek direct profits from futures price movements.

*The numbers above are an estimate based on our research. Figures are an estimate.

6. Step-by-Step Guide to Trading Cattle Futures

Successfully trading cattle futures requires careful preparation and systematic execution. Follow these steps to begin your cattle futures trading journey.

Step 1: Choose the Right Futures Broker

Selecting an appropriate broker is crucial for cattle futures trading success. Look for commodity brokers offering competitive commission rates, reliable execution, and comprehensive research tools. Top futures brokers typically provide access to cattle market reports, technical analysis software, and real-time price data.

Consider contacting brokers with agricultural commodity specialization, as they often provide superior cattle market insights and customer support.

Step 2: Open and Fund Your Trading Account

Complete the required account opening documentation, including futures trading risk disclosures. Cattle futures require margin deposits, so ensure adequate account funding. Initial margin requirements vary by contract and market conditions, typically ranging from $1,000 to $3,000 per contract.

Most brokers require minimum account balances for futures trading, often $5,000 to $10,000. (Margins and brokers’ requirements are subject to change.)

Step 3: Develop Your Cattle Trading Plan

Create a comprehensive trading plan addressing your investment objectives, risk tolerance, and market approach. Define whether you’re hedging cattle price risk or speculating on price movements. Establish position sizing rules, profit targets, and stop-loss levels before placing trades.

Consider seasonal cattle market patterns, fundamental analysis methods, and technical indicators that align with your trading style. Document your plan in writing to maintain discipline during volatile market conditions.

Step 4: Analyze Cattle Market Fundamentals

Stay informed about cattle industry developments through USDA reports, market newsletters, and industry publications. Key reports include the Cattle on Feed Report, Cold Storage Report, and Weekly Export Sales data.

Monitor feed grain prices, weather conditions in major cattle-producing regions, and economic indicators affecting beef demand. Understanding these fundamentals provides context for price movements and trading opportunities.

Step 5: Execute Your Trading Strategy

Place orders through your broker’s trading platform, specifying contract months, quantity, and order types. Use appropriate order types such as market orders for immediate execution or limit orders for specific price levels.

Consider using stop-loss orders to manage risk and protect profits. Monitor positions closely, especially around report releases and market-moving events.

Step 6: Monitor and Manage Your Positions

Actively manage open positions by monitoring market developments and adjusting strategies as needed. Stay informed about cattle industry news, weather updates, and economic changes that might affect your positions.

Consider rolling positions to different contract months as expiration approaches. Close positions before delivery unless you intend to make or take physical delivery of cattle.

7. Cattle Futures Trading Strategies

Seasonal Cattle Price Patterns for Hedging and Inventory Management

Cattle markets display seasonal price patterns based on production cycles and marketing habits. Understanding these patterns enables ranchers to make better hedging and inventory management decisions. However, while being aware of these patterns is important, the market is not always predictable and doesn’t operate according to linear logic. Always remain flexible as seasonal trends may not occur as expected.

Spring Price Rally

Cattle prices often strengthen during spring months as winter feed costs end and cattle come off feed. This seasonal pattern creates hedging opportunities for ranchers planning fall sales. Consider selling futures contracts from February through May when prices are seasonally strong to lock in favorable prices for cattle that will be ready in 6-9 months.

Summer Feeding Season

During summer months, monitor feed costs and pasture conditions closely for inventory planning. Drought conditions may drive prices higher, creating good hedging opportunities for current inventory. Favorable weather and lower feed costs may pressure prices, making it wise to delay hedging decisions until a clearer price direction emerges.

Fall Marketing Pressure

Increased cattle marketing during fall months often pressures prices lower due to seasonal supply increases. Ranchers should consider forward pricing cattle during earlier seasonal highs rather than waiting for fall delivery. This seasonal tendency makes fall an ideal time to hedge spring cattle or manage existing inventory by accelerating or delaying sales based on current prices versus seasonal norms.

Spread Trading Strategies

Spread trading involves simultaneously buying and selling related futures contracts to profit from price relationships rather than absolute price movements.

Live Cattle vs Feeder Cattle Spread: This spread reflects feeding margins and profitability. Buy live cattle and sell feeder cattle when feeding margins appear attractive. Reverse the position when margins look compressed.

Calendar Spreads: Trade price differences between different contract months. Nearby contracts often trade at premiums or discounts to deferred contracts based on supply and demand expectations.

Inter-Commodity Spreads: Trade cattle futures against feed grain futures to capitalize on cost relationships. Buy cattle and sell corn when feeding margins appear favorable.

Fundamental Analysis Strategy

Base trading decisions on supply and demand factors affecting cattle prices. This approach requires a deep understanding of cattle industry fundamentals.

Cattle Inventory Analysis: Monitor USDA cattle inventory reports to identify supply trends. Declining cattle numbers often support higher prices, while expanding herds may pressure prices lower.

Feed Cost Analysis: Track corn, soybean meal, and hay prices to assess cattle feeding profitability. Rising feed costs may support higher cattle prices, while declining feed costs could pressure cattle values.

Demand Analysis: Monitor beef consumption data, export sales, and economic indicators affecting meat demand. Strong demand fundamentals support higher cattle prices.

If you wish to understand how high cattle prices affect cattle feeders, visit https://agoptimus.com/high-cattle-prices-what-most-ranchers-regret-when-the-market-peaks/

Technical Analysis Strategy

Use price charts, indicators, and patterns to identify trading opportunities based on market psychology and price action.

Trend Following: Identify and trade with established price trends using moving averages and trendlines. This approach works well in trending market conditions.

Support and Resistance: Trade based on key price levels where buying or selling interest emerges. These levels often provide profitable entry and exit points.

Momentum Indicators: Use indicators like RSI and MACD to identify overbought and oversold conditions. These tools help time market entries and exits.

Options-Based Strategies

Cattle options provide flexible strategies for both hedging and speculation with limited risk characteristics.

Protective Puts: Cattle owners can buy put options to establish minimum selling prices while maintaining upside potential. This strategy costs a premium but provides insurance against price declines.

Covered Calls: Cattle owners can sell call options against physical positions to generate additional income. This strategy works well in sideways or slightly declining markets.

Straddles and Strangles: Volatility traders can use these strategies to profit from large price movements in either direction. These work well around report releases and market events.

If you wish to understand how volatility affects options in cattle, visit https://agoptimus.com/understanding-option-volatility-for-cattle-feeders-why-high-markets-are-the-best-time-to-buy-puts/

8. Risk Management in Cattle Futures Trading

Effective risk management is essential for long-term success in cattle futures trading. Implement comprehensive risk controls to protect capital and maximize opportunities.

Risk Management for Speculators

Speculative cattle futures trading requires disciplined risk management to protect against adverse price movements.

Position Sizing: Consider risking no more than 1-2% of total account capital on any single hedge. This approach allows survival through inevitable adverse price movements while preserving capital for future hedging opportunities. However, the percentage risk you may need to accept will also depend on market volatility. During highly volatile periods, you may need to risk more to maintain effective hedge coverage.

Stop-Loss Orders**: Use stop-loss orders to limit losses on individual trades. Set stops based on technical levels or maximum acceptable loss amounts. Honor stop-loss levels regardless of market opinions. The placement of contingent orderssuch as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.

Diversification: Spread risk across different contract months, related commodities, and trading strategies. Avoid concentrating too much capital in highly correlated positions.

Market Monitoring: Stay informed about cattle industry developments, weather conditions, and economic factors affecting livestock markets. Knowledge helps anticipate potential risks and opportunities.

Options Hedging: Consider using cattle options to hedge futures positions when market uncertainty increases. Long Options provide risk limitation with unlimited profit potential. This is specific to long Call and Short options.

Risk Management for Cattle Industry Participants

Cattle producers and processors require comprehensive hedging programs to manage price risk effectively.

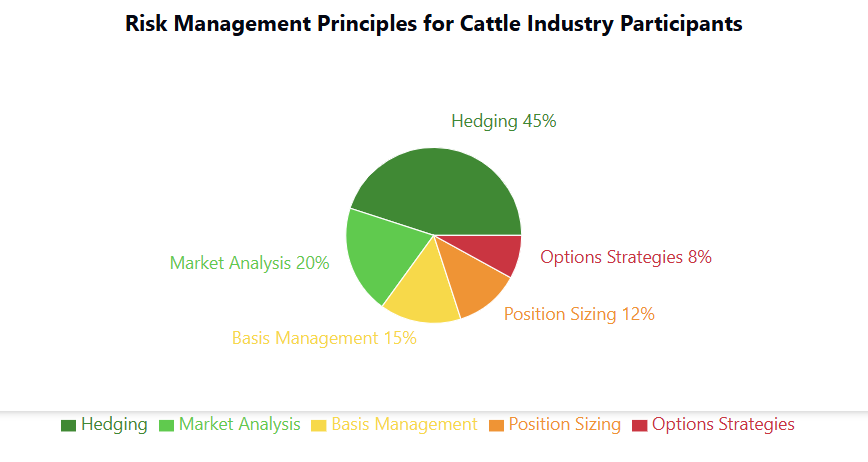

Hedging Strategy (45%): Developing and implementing appropriate hedging strategies represents the critical risk management component. Cattle industry participants must match hedge positions to physical cattle exposure while timing hedges appropriately.

Market Analysis (20%): Understanding market fundamentals, seasonal patterns, and price trends enables better hedging decisions. Regular analysis helps optimize hedge timing and strategy selection.

Basis Management (15%): Monitoring local cash prices versus futures prices is crucial for hedging effectiveness. Understanding basis patterns helps determine whether futures or forward contracts provide better risk management.

Position Sizing (12%): Matching hedge positions to actual cattle inventory or needs prevents over-hedging or under-hedging. Proper sizing ensures hedges provide the intended risk protection.

Options Strategies (8%): Using Long cattle options provides flexible risk management tools that maintain upside potential while providing downside protection. Options cost a premium but offer valuable insurance characteristics.

These percentages reflect the relative importance of each risk management component for cattle industry participants. The emphasis on hedging reflects the primary goal of price risk reduction rather than profit generation.

9. Frequently Asked Questions (FAQs)

What is the minimum amount needed to trade cattle futures?

The minimum amount to trade cattle futures depends on margin requirements and broker minimums. Typically, you need $1,500-$3,000 per contract for initial margin, plus additional funds for maintenance margin and risk management. Most commodity brokers require minimum account balances of $5,000-$10,000 for futures trading. (Margins and brokers’ requirements are subject to change.)

How much can you make trading cattle futures?

Profit potential in cattle futures trading varies significantly based on market conditions, trading skills, and risk management. Successful traders may earn 10-30% annually, while inexperienced traders often lose money. Each 1-cent move in cattle futures equals $400 per contract, creating substantial profit and loss potential.

What time do cattle futures trade?

Cattle Futures trade from 8:30 AM to 1:05 PM CT.

Which cattle futures contract should I trade?

Choose between live cattle (LE) and feeder cattle (GF) based on your market knowledge and trading objectives. Live cattle futures offer higher liquidity and tighter spreads, making them suitable for most traders. Feeder cattle may provide opportunities for those who understand the feeding industry.

How do cattle futures prices relate to beef prices in grocery stores?

Cattle futures prices reflect wholesale cattle values, not retail beef prices. Many factors affect the farm-to-retail price relationship, including processing costs, transportation, marketing margins, and retail competition. Cattle futures provide the foundation for beef pricing, but don’t directly determine consumer prices.

Can individual investors trade cattle futures?

Yes, individual investors can trade cattle futures through futures brokers. However, cattle futures require significant capital, market knowledge, and risk tolerance. Many individual traders start with smaller agricultural futures or ETFs before advancing to cattle futures.

What reports should cattle futures traders watch?

Key reports include the USDA Cattle on Feed Report (monthly), Cold Storage Report (monthly), Weekly Export Sales, and Cattle Inventory reports (semi-annual). These reports provide crucial supply and demand data affecting cattle futures prices.

How does the weather affect cattle futures prices?

Weather impacts cattle futures through multiple channels. Drought conditions reduce pasture quality and increase feed costs, typically supporting higher prices. Severe winter weather can stress cattle and increase mortality, potentially affecting supply. Favorable weather generally supports stable or lower prices.

What’s the difference between hedging and speculating in cattle futures?

Hedging involves using cattle futures to reduce price risk on physical cattle operations. Hedgers own cattle or will purchase cattle and use futures for risk management. Speculation involves trading cattle futures purely for profit without involvement in the physical cattle business.

Do cattle futures require physical delivery?

Most cattle futures contracts are closed before expiration, avoiding physical delivery. However, cattle Futures can be delivered anytime during the delivery period. Live cattle contracts involve physical delivery, while feeder cattle use cash settlement.

How do feed costs affect cattle futures prices?

Feed represents a major portion of cattle production costs, making grain prices crucial for cattle profitability. Rising corn and soybean meal prices increase cattle feeding costs, potentially supporting higher cattle prices. Declining feed costs may pressure cattle prices lower as production costs decrease.

What trading platforms support cattle futures?

Major futures trading platforms, including Optimus Flow, Optimus Web, and Mobile, support cattle futures trading. Choose platforms offering real-time data, technical analysis tools, and reliable order execution for cattle futures.

Are cattle futures good for beginners?

Cattle futures can be challenging for beginners due to high volatility, significant capital requirements, and complex market fundamentals. New traders should consider paper trading, education programs, and smaller agricultural contracts before advancing to cattle futures.

How seasonal are cattle prices*?

Cattle prices exhibit strong seasonal patterns based on production cycles. Prices often strengthen in spring as cattle come off winter feed, weaken during fall marketing, and show volatility during summer feeding seasons. Understanding seasonality helps trading and hedging decisions. Seasonal patterns are not guaranteed to repeat themselves.

What role do exports play in cattle futures prices?

U.S. beef exports represent a significant portion of domestic production, making export demand important for cattle prices. Strong export sales support higher domestic prices, while weak exports or trade restrictions can pressure prices lower. Currency fluctuations also affect export competitiveness.

10. Start Your Cattle Futures Trading Journey

Now that you understand cattle futures trading fundamentals, contract specifications, and risk management strategies, you’re ready to explore this dynamic livestock market. Whether you’re a cattle producer seeking price protection or an investor pursuing agricultural commodity exposure, cattle futures offer valuable opportunities.

Ready to Trade Cattle Futures?

Our experienced team of livestock commodity specialists and agricultural market analysts provides personalized guidance for cattle futures trading. We help both commercial hedgers and individual traders navigate the complexities of cattle markets.

Call us today at Toll Free: (800) 944-3850

Local: (712) 545-0182to discuss your cattle futures strategy.

Our services include:

- Customized hedging programs for cattle producers and processors

- Technical and fundamental analysis for cattle market timing

- Risk management strategies tailored to your specific needs

- Educational resources for cattle futures trading success

- Market updates and reporting on cattle industry developments

Don’t let cattle price volatility impact your business or investment goals. Whether you’re protecting your cattle operation from adverse price movements or seeking profit opportunities in livestock markets, our team provides the expertise you need.

Contact us now: Toll Free: (800) 944-3850 Phone: (712) 545-0182 to speak with a cattle futures specialist.

Remember, futures trading involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether futures trading is appropriate for your financial situation and risk tolerance. Past performance is not indicative of future results.

*Seasonal patterns in agricultural markets are based on historical observations and may not predict future market behavior. Weather events, policy changes, global supply and demand shifts, and other unforeseen factors can cause actual price movements to differ significantly from historical trends.