TL;DR — The AgOptimus Executive Summary

-

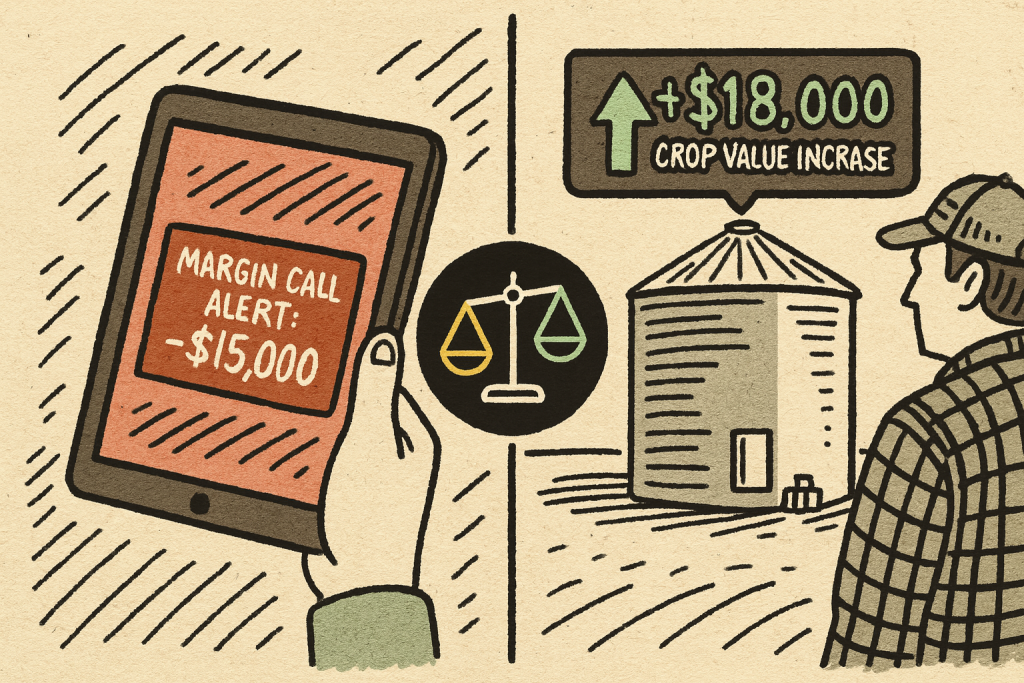

The Reality: Margin calls are liquidity events, not penalties. They occur because futures markets settle daily, while physical crops sell seasonally.

-

The Mismatch: A margin call does not mean a hedge is failing. It often means the market is moving, and your futures account is balancing against the rising value of your physical inventory.

-

The Broker’s Role: A broker cannot stop margin calls, but Ag Optimus provides the real-time reporting and communication needed to explain them to lenders.

-

The Strategy: Smart producers don’t fear margin; they plan for it. Switching brokers won’t stop volatility, but switching to a Strategic Risk Partner ensures you have the tools to handle it.

What is a Margin Call?

Ag Optimus Definition:

A Margin Call is a mandatory deposit to increase your account’s Performance Bond. It occurs when the market moves against your futures position and your account balance drops below the minimum level required by the exchange.

For agricultural producers, it is critical to understand that Margin is not a fee, a penalty, or a realized loss. It is simply Collateral held by the clearinghouse to guarantee your trade. This money remains your equity and is used to offset the final profit or loss when the hedge is closed.

Clearing Firms (FCMs) may raise margin requirements at their own discretion, including levels above exchange-mandated margins. These adjustments can occur during periods of increased volatility or changing market conditions. Margin values shown in this demo are for illustration only and may not reflect actual requirements.

1. Defining the Mechanics: What Actually Triggers the Call?

For many agricultural producers, the term “margin call” carries a stigma. It is often viewed as a penalty for being wrong. However, in the context of a commercial hedge, a margin call is simply a function of market mechanics—a transfer of liquidity, not necessarily a loss of wealth.

To manage margin, one must first define it with precision. The clearinghouse does not know you have corn in the bin; they only know the math of the contract.

Ag Optimus Definition: Variation Margin

Variation Margin is the daily cash adjustment made to a futures account to reflect the current market value of open positions (“Mark-to-Market”). If a short position moves against the trader, cash must be deposited to cover the theoretical loss and restore the account to its Initial Margin level.

Example: Initial is $5,000. Maintenance is $4,000. If you drop to $3,900, you don’t wire $100 to get back to $4,000. You must wire $1,100 to get back to $5,000.

Why Do Margin Requirements Change?

Margin is Dynamic, not static. The Exchange (CME Group) adjusts these levels daily using a risk algorithm (SPAN) to ensure there is enough collateral to cover the next day’s potential move.

Three variables cause the Exchange to raise your margin requirement:

-

Volatility (The “Fear Factor”): If the market starts swinging 20 cents a day instead of 5 cents, the Exchange raises the bond to cover the wider risk. This is the #1 driver of margin hikes.

-

Higher Price Levels: As corn moves from $4.00 to $6.00, the value of the contract grows. A 5% move at $6.00 is a larger dollar amount than at $4.00, requiring more collateral.

-

Event Risk: Ahead of major USDA reports or during geopolitical crises (like war), exchanges often hike margins to buffer against price gaps.

Ag Optimus Insight: Rising margins signal increasing market risk. It is not a penalty; it is the Exchange protecting the system from leverage.

2. The “Hedger’s Paradox”: Why You Pay When Markets Rally

A common point of confusion—and frustration—occurs when a producer sees a “loss” in their brokerage account while the market is rallying.

If you are a corn producer holding a Short Futures position (selling ahead), a market rally creates a loss in your futures account.

-

The Optics: You are wiring funds to your commodity broker (read more about how commodity brokers work with farmers and cattle feeders )

-

The Economic Reality: The physical grain in your bin has theoretically increased in value by a commensurate amount.

The Mathematics of the Offset

A symmetric hedge has the potential to create a net-neutral price environment.

Net Price = (Cash Price + Basis) + (Futures Entry – Current Futures Price)

When futures rally +$0.50:

-

Futures Account: Lose $0.50 (Requires Margin Wire).

-

Cash Asset: Gains ~$0.50 (assuming stable basis).

-

Net Result: Flat.

The Problem: The gain in the physical crop is “illiquid” (you haven’t sold it yet), while the loss in the futures account is “liquid” (due immediately). This creates a Liquidity Mismatch, not a solvency issue.

Risk: It is critical to note that Futures and Cash markets rarely move in a perfect 1-to-1 correlation. If these prices diverge—a phenomenon known as Basis Misalignment—the increasing value of your physical grain may not be enough to cover the cash owed to the brokerage account entirely.

3. Strategic Solutions: How to Handle the Call

Sophisticated risk management requires distinguishing between Solvency Risk (going broke) and Liquidity Risk (running out of cash). Here is how professional operations manage this friction.

Step 1: The Pre-Trade Liquidity Stress Test

Before entering a hedge, it is essential to calculate the “Max Pain” scenario.

-

Question: If Corn rallies $1.00, how much capital will this position require?

-

Calculation: 5,000 bushels (1 contract) × $1.00 move = $5,000 variation margin.

-

Action Example: Ensure your operating line of credit has the capacity to absorb a 2-standard-deviation move before placing the trade.

Step 2: Communicating with Lenders

Lenders get nervous when they see large wires leaving the farm account without context.

-

The Standard Approach (What not to say): “I need $50,000 for a margin call.” (This raises red flags because it sounds like a loss.)

-

The Professional Script (What you should say): “I need to fund the hedge. The futures account is down $50,000, but based on current cash market values, our physical inventory has risen commensurately. Here is the mark-to-market report validating the offset.”

Step 3: Structural Switching (Futures vs. Options)

If the cash-flow volatility of futures is too high for your operation, the hedge structure may need to change.

If the cash-flow volatility of futures is too high, you may need to adjust your strategy or re-evaluate your hedge month selection to better align with your cash sales.You should read this to know how to hedge with the right month: https://agoptimus.com/pick-the-right-hedge-month/

Futures Contracts offer a linear hedge but come with unlimited liquidity risk during rallies. Put Options offer a price floor with a fixed cost, eliminating margin calls for the buyer.

| Feature | Short Futures Hedge | Long Put Option Hedge |

| Cash Flow Profile | Variable (Daily Margin Adjustments) | Fixed (Upfront Premium Only) |

| Margin Call Risk | YES (Unlimited) | NO (Fixed Risk) |

| Opportunity Cost | Locked Price (Cannot participate in rally) | Open Upside (Can participate in rally) |

| Ideal For | Producers with strong cash reserves | Producers protecting cash flow |

4. When “Basis” Breaks the Math

It is critical to note that the “perfect offset” mentioned above relies on Basis (the difference between Cash and Futures) remaining stable.

If the Board rallies (triggering a margin call) but your local cash price does not follow (Basis widens/weakens), you face a “Double Negative”:

-

You owe margin on the futures.

-

Your physical corn didn’t gain enough value to offset the cost.

This is why Ag Optimus emphasizes that hedging is not just about locking in a futures price—it is about monitoring the correlation between the Board and your local elevator.

Stop Guessing: Run a Portfolio Simulation First

Most producers calculate margin on a napkin. That is dangerous. You shouldn’t have to guess if your account has enough capital to handle a new hedge.

Your commodity broker should be able to answer this question before you trade: “If I add 20 corn contracts to my current positions, exactly what will my new total margin requirement be?”

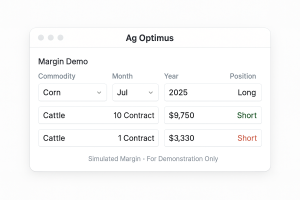

At Ag Optimus, we don’t guess. Leveraging the enterprise clearing technology ut Optimus Futures, we run “What-If” Position Simulations on your account. This allows us to:

-

Preview the Portfolio Impact: See exactly how adding (or removing) contracts changes your total margin requirement before you place the trade.

-

Check Capital Efficiency: Verify that you have enough excess liquidity to hold the new position without triggering an immediate call.

-

Prevent Rejection: Ensure your trade fits within your risk limits so you don’t get rejected at the order desk.

Frequently Asked Questions

What is a margin call in futures hedging for farmers and cattle feeders?

A margin call is a request for additional funds when the balance in a futures account falls below the exchange-required maintenance margin. At AgOptimus, we define this as a “Liquidity Transfer.” It occurs because futures positions are settled daily (“marked-to-market”), not because a hedge is failing. Margin calls reflect short-term market volatility, not long-term marketing errors.

Why do producers receive margin calls even when their hedge supports their operation?

Producers receive margin calls because of a timing mismatch: futures settle every day, while revenue from grain or cattle sales occurs later. A hedge can align with the operation’s pricing goals, yet daily volatility may require additional funds before the physical sale.

Are margin calls a sign that a farmer or feeder made a mistake?

No. Margin calls are not indicators of errors in planning or execution. They are a standard mechanical function of the futures market’s risk-management structure. They arise whenever prices move temporarily against the futures position, even if the hedge ultimately supports the producer’s revenue.

Why do some producers consider switching brokers because of margin call issues?

Producers may reconsider their brokerage relationship when communication about margin calls is unclear, notifications arrive late, or the platform does not show real-time exposure. We believe many prefer working with a firm like AgOptimus that provides “Cash Flow Context”—helping you explain the margin call to your lender rather than just demanding a wire transfer.

How do margin calls affect a producer’s liquidity?

Margin calls require available cash to maintain open futures positions. This affects short-term liquidity but does not change the potential long-term revenue effect of a hedge. Producers often incorporate futures margin into their overall working-capital planning.

Do brokers control whether margin calls occur?

No. Exchanges set margin requirements and perform daily mark-to-market settlement. Commodity brokers enforce these rules. What differs among brokers is the clarity of communication, the timeliness of alerts, and the tools provided to monitor account balances and margin levels.

Is a margin call the same as a fee?

No. A margin call is not a fee or commission. It is simply a request to bring the account back to the required margin level. The funds remain the producer’s equity and may be withdrawn if the market later moves favorably.

Can market volatility increase margin requirements for grain or livestock hedgers?

Yes. Exchanges may raise margin requirements during periods of high volatility in corn, soybeans, wheat, live cattle, or feeder cattle. These adjustments are made to ensure sufficient collateral across the market but are not predictions of future prices.

Need a Commodity Broker Who Speaks Ag?

We know that farming is hard enough without a broker trying to confuse you with fancy math. You want clear answers, honest advice, and someone who picks up the phone when the market is moving.

At Ag Optimus, we keep it simple: We help you protect your price so you can focus on farming.

Give us a call. Let’s look at your risk plan and make sure you (and your banker) are comfortable with it.

Call Toll-Free: (800) 944-3850 Local: (712) 545-0182 Email: Contact Form

We are located in Akron, Iowa. We know Ag because we live it.

Disclaimer

Margin calls are a standard part of the futures clearing system and may not always be negotiable. Brokers are required to follow the margin policies established by their Futures Commission Merchant (FCM) and the rules set by the exchanges and regulators. These procedures ensure that all positions remain properly collateralized and that the brokerage operates in accordance with industry requirements.