TL;DR — The Quick Read: LRP vs Selling Futures

-

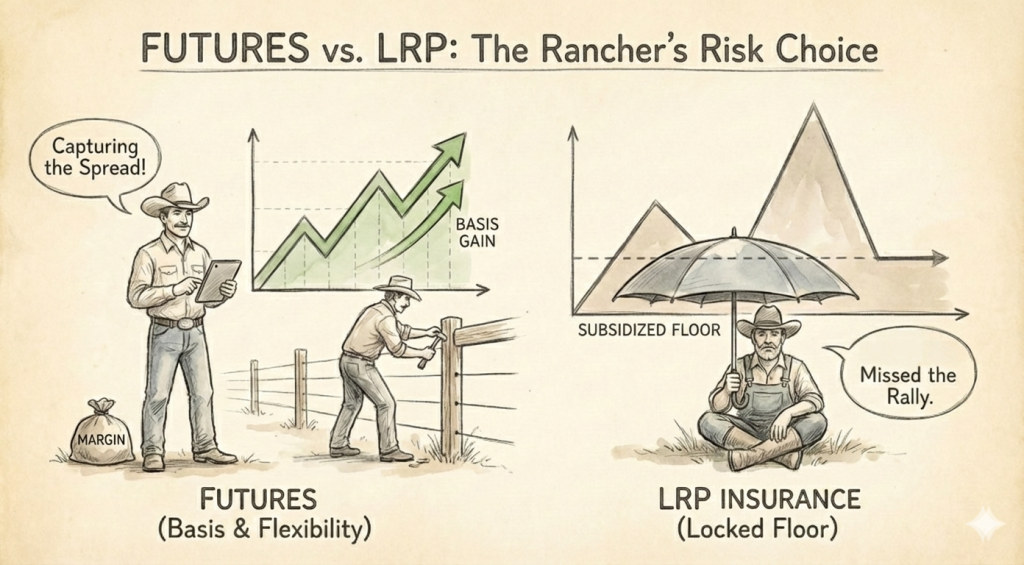

The Decision: You need to protect your cattle’s price. The two primary tools available are Selling Futures and Livestock Risk Protection (LRP).

-

The Difference: Futures contracts are capital-intensive tools that require margin liquidity to maintain the position. LRP is an insurance product that requires a premium payment but does not require daily margin adjustments.

-

The Verdict: Futures offer precision for large feeders managing basis. LRP offers a simplified cash-flow structure for producers who prefer to avoid variable capital requirements.

The Basics: Defining the Tools

Before we compare them, let’s define exactly what we are trading.

-

What is Livestock Risk Protection (LRP)? LRP is a federally subsidized insurance policy designed to insure against a decline in market prices. You pay a premium to set a “floor price” for a percentage of your cattle. If the USDA 5-area weighted average price drops below your floor at the end of the coverage term, you get paid the difference. It works like a put option but is purchased through an LRP agent.

-

What are Live/Feeder Cattle Futures? A Futures Contract is a standardized agreement traded on the Chicago Mercantile Exchange (CME). When you “sell” a futures contract, you are locking in a sale price for a specific weight (e.g., 50,000 lbs) for a future month. This creates a binding financial obligation that tracks the market dollar-for-dollar.

-

The Rancher’s Decision-LRP vs. Selling Futures

When cattle prices are profitable, the logical step is to protect that revenue. However, the method you choose to protect that price has a significant impact on your operation’s cash flow.

Ten years ago, the primary tool was the Futures Market. Today, producers also have access to Livestock Risk Protection (LRP).

At AgOptimus, we specialize in Futures and Options. However, we believe a strong marketing plan requires understanding the structural differences between brokerage accounts and insurance policies. Here is an objective breakdown of how they compare.

Tool 1: Selling Futures (Exchange-Traded)

The Mechanism: You open a brokerage account and sell a Feeder Cattle contract (50,000 lbs) for a specific month (e.g., October). This creates a financial obligation to deliver that value.

-

Precision: It provides a 1-to-1 hedge. If the market drops, the gain in your futures account offsets the loss in the cash market.

-

Sizing: Contracts are standardized (50,000 lbs). This requires you to match your herd weight to the contract size as closely as possible to avoid being over- or under-hedged.

-

Capital Requirement (Margin): Futures trading requires a “performance bond” known as margin. If the market moves against your position (prices rise), you are required to post Variation Margin to maintain the position. This requires having liquid capital or an operating line available to meet these margin calls immediately.

Tool 2: LRP Insurance (USDA Subsidized)

The Mechanism: You purchase an insurance policy from a licensed crop insurance agent that establishes a “Floor Price” for a percentage of your cattle at a specific end date.

-

Structure: LRP functions similarly to a Put Option. You pay a premium to establish a floor. If the market settles below that floor, the policy pays an indemnity.

-

Sizing: It is customizable. You can insure specific head counts (e.g., 12 head or 5,000 head), allowing for precise matching of your actual production.

-

Capital Requirement (Premium): LRP does not have daily margin adjustments. Instead, it has a Premium Cost. This premium is fixed at the time of purchase, providing certainty regarding the expense, though it does not offer the basis potential of a futures contract.

-

Subsidy: The premium is subsidized by the USDA (typically 35% to 55%), which can make the upfront cost lower than comparable exchange-traded options (Source: USDA Risk Management Agency at https://www.rma.usda.gov/livestock-risk-protection).

The Scorecard: LRP vs. Selling Futures-Structural Comparison

| Feature | Selling Futures (AgOptimus) | LRP (Your Insurance Agent) |

| Capital Variable | Variable Margin. Requires liquidity to fund potential market rallies. | Fixed Premium. Cost is known upfront; no variable calls. |

| Upside Participation | No. Selling futures locks in a specific price. | Yes. If the market rallies, you participate in the cash sale. |

| Sizing Flexibility | Standardized. Must trade in 50,000 lb increments. | Customizable. Can trade specific head counts. |

| Cost Structure | Commissions + Exchange Fees + Spread. | Premium Cost (Subsidized). |

| Liquidity Access | High. Positions can be adjusted/closed daily during market hours. | Term. Policies are generally held to the specific end date. |

Scenario Analysis: Managing a Market Rally

Let’s assume you have 60 steers (approx. 33,000 lbs) to sell in October.

The current October board price is $250.00/cwt.

Scenario A: The Futures Hedge

You sell one contract (50,000 lbs). Note that you are technically “over-hedged” by 17,000 lbs.

-

Market Rallies to $270: The short futures position shows a $20/cwt loss. You must post approximately $10,000 in additional margin to hold the position.

-

Operational Impact: You must have this cash available in your operating line. The loss is eventually offset by the higher cash price of your cattle, but the cash flow timing difference must be managed.

Scenario B: The LRP Policy

You write a policy for exactly 60 head (33,000 lbs) with a floor of $250.00.

-

Market Rallies to $270: The policy expires with no value. You owe the premium, but no additional capital is required during the holding period.

-

Operational Impact: You sell your cattle at the higher market price ($270). The cost of the strategy was limited to the premium paid.

Which Tool Fits Your Operation?

Consider Futures (AgOptimus) If:

-

Basis Management: You are looking to lock in the spread between cash and futures.

-

Scale: You have sufficient volume to fill 50,000 lb contracts.

-

Liquidity: You have a solid operating line and understand margin flow.

Consider LRP (Your Insurance Agent) If:

-

Cash Flow Stability: You prefer a known cost (premium) over variable capital requirements (margin).

-

Odd-Lot Sizes: Your herd size does not match the 50,000 lb contract specifications.

-

Upside Goal: You want protection against a crash but wish to retain the ability to sell higher cash if the market rallies.

AgOptimus: Strategic Guidance, Not Product Bias.

As an Independent Introducing Broker, our goal is to help you manage risk effectively.

We recognize that for many cow-calf producers, the structure of LRP may offer a better fit for their capital situation than a futures account. If the math suggests LRP is the better tool for your specific herd, we will recommend you speak with your insurance agent.

However, if your operation requires basis management, large-scale hedging, or advanced option strategies, AgOptimus provides the execution and strategy you need in the futures market.

Unsure which structure fits your balance sheet?

Call AgOptimus for a Strategy Consultation.

We can help you compare the estimated cost of LRP premiums vs. the margin requirements of a futures position.

Phone: (800) 944-3850

Email: support@agoptimus.com

Disclaimer: AgOptimus is a registered Independent Introducing Broker (IIB). Trading futures and options involves substantial risk of loss and is not suitable for all investors. There is always a possibility of margin calls when trading futures. We do not sell insurance products; LRP references are for educational comparison only.

Frequently Asked Questions (FAQ)-LRP vs. Selling Futures

Q: What happens if cattle prices drop below my floor price?

A: With LRP, the policy pays an indemnity for the difference. If you set a $250 floor and the CME Index drops to $240 at the end of the policy, the policy pays you $10/cwt on your insured weight. This offsets the lower cash price you receive at the sale barn.

Q: Is LRP cheaper than Futures Options?

A: Often, yes. Because the USDA pays roughly 35% to 55% of the premium cost (Source: USDA RMA at https://www.rma.usda.gov/livestock-risk-protection), the out-of-pocket cost for LRP is frequently lower than purchasing a comparable Put Option on the exchange.

Q: When is the LRP premium due?

A: LRP premiums are typically due after the policy period ends (often 30-60 days after the end date). This allows you to sell the cattle and collect proceeds before paying the premium, which can be a significant cash flow advantage compared to upfront options costs.

Q: Does LRP replace the need for a broker?

A: For some producers, yes. However, many operations use a “Hybrid” approach—using LRP for their base floor and using a broker (AgOptimus) to sell futures if the market rallies significantly, or to manage feed costs.