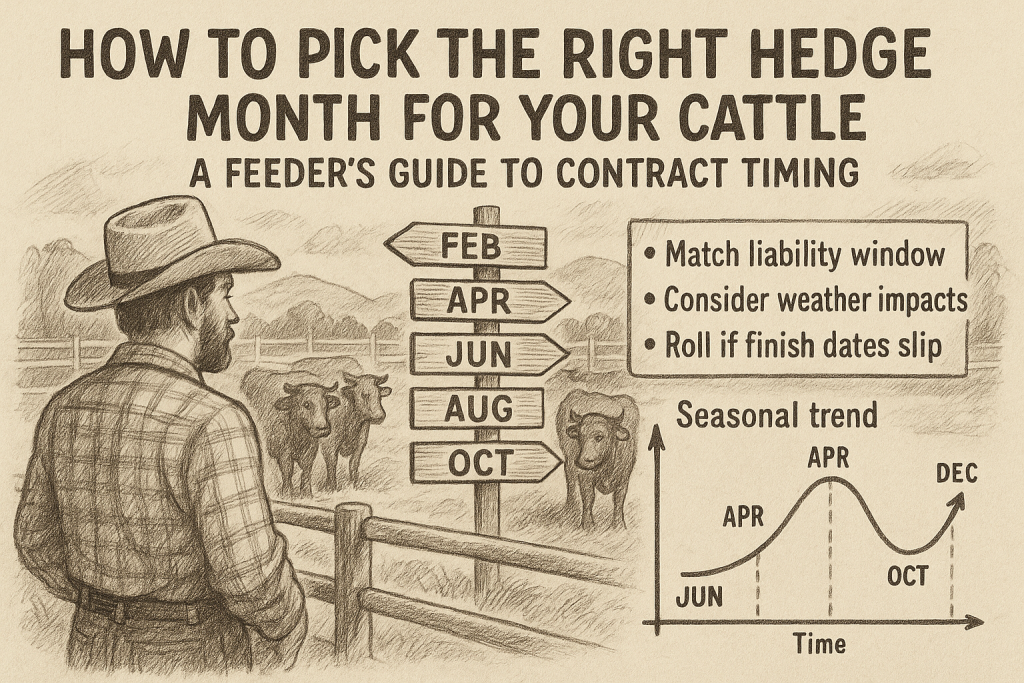

TL;DR — How to Pick the Right Hedge Month for Your Cattle

- Match your hedge month to when cattle will likely finish, not when the board looks best today.

- Weather, health, and feed performance influence finish dates — build flexibility into your plan.

- If cattle slip or gain faster than expected, roll the hedge to the correct contract month.

- Seasonal tendencies matter: spring contracts often carry strength; summer contracts can weaken.

- Don’t hedge based solely on the cheapest premium — hedge based on your liability window.

- Track the historical basis for your region; it impacts which month best aligns with cash expectations.

- If unsure, layer hedges gradually instead of committing all at once.

- Futures lock price; options provide insurance; spreads help manage timing mismatches.

- Picking the wrong month increases basis risk; picking the right month can help stabilize margins.

- A good hedge month keeps you aligned with the cattle — not the headlines.

The first step in hedging cattle with futures is choosing the contract month that lines up with when your cattle will be marketed. But cattle contracts don’t trade every month, which means the month you sell cattle and the month available on the board won’t always match up.

For example, there is no January Live Cattle contract. If your finish window or fat-cattle delivery falls in January, the CME specs say you hedge with the next nearby month that expires after your cattle are marketed, not before.

So for January marketings, feeders and ranchers typically hedge with the February Live Cattle contract. The same logic applies for other gaps in contract listings: choose the next contract that captures the price risk for when your cattle will actually move.

This ensures your hedge stays aligned with your real-world marketing schedule and avoids unnecessary basis risk from using a contract that expires too early.

Why Contract Timing Matters

When you sell a futures contract, you’re making a statement about when your cattle will finish. If that timing doesn’t match reality, you’re exposed to:

- basis swings*

- contract-month volatility

- premium/discount distortions

- costly rolls

- mismatched packer dates

- hedge coverage that doesn’t actually cover

A hedge placed in the wrong month may protect the wrong price.

*To read more about cattle basis, visit: https://agoptimus.com/cattle-basis-explained-to-cattle-feeders/

How Cattle Hedge Months Work

Live Cattle contracts settle every other month:

Feb • Apr • Jun • Aug • Oct • Dec

These months are tied to seasonal slaughter patterns, packer schedules, weather impacts on gain, and historical trends in cattle performance. This is why there are no LC contracts for January, March, May, July, September, or November—the seasonal flow already has built-in assumptions.

Every contract behaves differently:

- February trades winter health risk

- April follows spring gain and stronger beef demand

- June and August price heat stress and volatility

- October reflects fall supply bulges

- December responds to holiday kill schedule changes

This is why matching your cattle to the correct month is crucial in our opinion. Talk to your commodity broker about matching you with the right month.

Matching Your Finish Window to the Correct Hedge Month

The simplest rule of thumb:

Hedge the month your cattle will most likely finish—not the month you wish they would finish.

Finishing weight, health, ration changes, and weather all shift timelines. A slight slip can turn a perfectly chosen month into a mismatched one.

“Which Hedge Month Should I Use?”

| **Expected Market Window | Hedge Month | Why It Fits** |

|---|---|---|

| Late January–February | February LC | Winter shrink, cold-weather gains, slower performance |

| Late March–April | April LC | Transition to spring demand and better performance |

| Late May–June | June LC | Early heat impact, increased volatility |

| Late July–August | August LC | Hot-weather performance pressure |

| Late September–October | October LC | Fall runs, seasonally weaker basis |

| Late November–December | December LC | Holiday kill patterns, premium quality demand |

Why Picking the Wrong Month Turns Your Hedge Into a Spread

A common mistake:

Hedging with a month that has a “better price” rather than the month that matches your cattle.

Example:

Your cattle finish in April.

April LC is $183.

February LC is $186.

So you hedge February because it’s higher.

But…

- February basis is different

- February volatility is different

- February delivery windows don’t align with spring-finished cattle

What you really did was trade a Feb/Apr spread, not hedge your cattle.

Finishing Weight, Health, and Why They Matter for Timing

Feeders can’t hedge cattle; they can’t finish on time.

Your timeline depends on:

- average daily gain (ADG)

- ration energy

- pen density

- breed type

- weather

- respiratory or metabolic health problems

If cattle slip two to four weeks:

- Your hedge month no longer matches

- You take a timing risk

- Your basis may behave differently

- You may be forced to roll

Health → gain consistency → correct hedge placement.

To read more about cattle health, visit: https://agoptimus.com/how-healthy-cattle-create-marketing-certainty/

How Weather Impacts Each Contract Month

February LC — winter performance risk

April LC — spring demand, improved gains

June LC — heat volatility begins

August LC — highest performance variability

October LC — fall supply pressure

December LC — holiday procurement patterns

Each month prices a different set of biological and seasonal realities.

When Should You Roll a Hedge?

You roll when:

- cattle slip into a later finish

- packers push dates back

- weather alters feeding performance

- spreads narrow and the roll is cheap

You do not roll when:

- Your cattle are still on schedule

- spreads are wide and costly

- you’re rolling “because you always do”

Rolling is a tool—not a habit.

Basis Behavior Changes by Contract Month

Different months have different basis patterns.

Examples:

- February basis tends to be stronger (lower supply, premium-quality cattle)

- June and August basis can swing wildly

- October basis is often seasonally weak

Choosing the wrong month can create basis surprises.

How Months Track Seasonally

LC Seasonal Tendencies (Stylized)

Price

^

High | Apr LC

| /

| Feb LC

| /\ /

| / \ / Jun LC

| / \/ /\

| / \ / \ Aug LC

| / \ / \/

Low |/ \/ Oct LC

+----------------------------------> Time

Notes:

• Feb often trades winter premiums.

• Apr rises with spring beef demand.

• Jun/Aug carry heat volatility.

• Oct weakens with fall supply.

*Past performance is not indicative of future results; Futures prices factor in the seasonal aspects of supply and demand

Real-World Examples

Example 1

Placed: November

Finish: Late April

Correct month: April LC

Reason: Spring demand, predictable gains, weather alignment.

Example 2

Placed: March

Finish: Late August

Correct month: August LC

Reason: Heat risk and summer volatility match the August contract.

Example 3

Cattle slip due to respiratory issues

Roll: June → August

Reason: Timeline moved; hedge must follow.

FAQ: Picking the Right Cattle Hedge Month

What’s the #1 factor for choosing a hedge month?

Your actual finish window, not placement.

Can I hedge a month early to get a better price?

You can—but you’re trading a spread, not hedging cattle.

Do different months have different behavioral bases?

Yes. Basis is seasonal and heavily contract-specific.

When should I roll my cattle hedge?

When finish dates shift, or the spread favors rolling.

Does cattle health matter?

Yes. Sick or inconsistent cattle break hedge timing.

Talk With Commodity Brokers Who Understand Feedlot Timing

If you want help matching your cattle’s real finish window to the right futures month, we can walk through it with you.

Our brokers at Ag Optimus work with cattle feeders everyday—ration changes, health runs, packer bids, grid differences, all of it.

📞 (800) 944-3850

📞 (712) 545-0182

🌐 www.agoptimus.com