Author: Nathan Harris, Ag Optimus, Akron, IA Branch

Quick Recap:

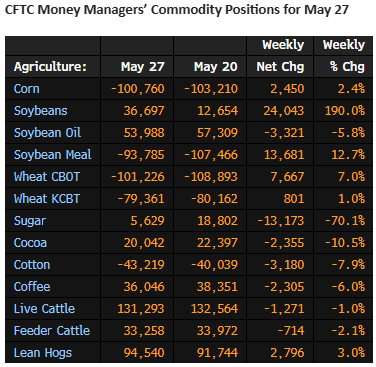

- COT data shows minimal managed money movement last week

- Wheat gains fueled by geopolitical and weather headlines

- From our perspective, the setup in wheat could lead to short-covering pressure on the funds.

CFTC Positioning | Fund Flows | Ukraine Conflict | Weather Watch

COT Report – Released Friday, May 31

The CFTC released Commitment of Traders (COT) data on Friday, showing Managed Money positions as of Tuesday, May 28.

Fund activity was limited, with small position changes across the ag complex.

🌾 Wheat: Overnight Leader on Short Covering Risk

Wheat surged 11 cents higher overnight, leading the grain complex.

Why?

- Renewed conflict in Ukraine

- 🌧️ Wet weather forecast for key areas of the U.S. Winter Wheat Belt

💬 With funds still heavily net short, this setup could easily trigger a short-covering rally.

We wouldn’t be surprised to see potential wheat run if these headlines persist.

Images: ADMIS

Have questions about your marketing strategy? Call Nathan today! 📞 712-435-7879