Overnight prices turn lower led by wheat and Jan beans as they begin to enter a liquidation period. Soyoil futures once again prove that big breaks are buying opportunities. Traders continue to watch for any EPA biofuel announcement, which has been delayed for about a year.

Demand did surface on the large break last week. Export inspections for beans yesterday were very good compared to corn or wheat. Bean inspections year-to date total 23.569 mmt which is still 21% behind yr ago. China loaded out 54 tmt fro the gulf. Corn inspections were in the neutral column, with exporters shipping 758K vs. 805K prior wk. Year-to-date corn shipments are 9.379 mln mt vs. 11.169 mmt yr ago. Wheat on the other hand is finding global interest, though US origin is not the top choice.

Concerns abound over wheat supplies, and countries seem to be buying with some urgency. Wheat continues to find buying interest on any number of inputs including tensions between Ukraine/Russia, and drier weather in SA.

On the political front, the US is doing some saber-rattling of its own, following through on threats to “diplomatically boycott” the Beijing winter olympics over human right abuses in Xinjiang. Though athletes can compete, the US will not be in attendance with any political representatives. It is said that China is not pleased with this scenario. Biden and Putin will hold a conference call today to discuss many topics which includes Russia sitting on Ukraine sidelines.

WEATHER – SA features a dry pattern over the next 10 days for southern Brazil, Paraguay, and Uruguay. These areas are going to need more rains in the last part of December given dryness concerns today.

ANNOUNCEMENTS

Brazil’s AgRural estimated Brazil planting at 94% complete vs. 90% wk ago, with concerns over dryness.

China’s bean imports rose sharply in Nov. as more shipments from the US arrived, as reported by customs data. China purchased 8.6 mln tonnes in Nov. which was 68% higher than Oct. at 5.1 mln tonnes. China purchased 87.7 mln tonnes of beans for the first 11 months of the year, which was down 5.5% vs. yr ago.

China customs reported that they imported a total of 673,000 mt of veg oil, up 9.8% vs. Oct.

DELIVERIES

soyoil: 80

corn: 2

Calls are as follows:

beans: steady

meal: 1.20-1.50 lower

soyoil: 50-60 pts higher

corn: 1-2 lower

wheat: 3-4 lower

Outside markets have crude at $71.93/barrel and the US dollar rising to 96.43. Stocks are up over 320 pts.

Tech talk:

Soy: Jan beans are in consolidation mode though traders are starting to roll or liquidate these futures. Prices now are back below the 200 day moving average of $12.61 with not much support until we reach $12.50. Overall trading range is nicely defined from $12.20 to $12.70. Look for more pressure to likely surface. Jan meal consolidates from $350.00-$360.00, but is now open to further losses heading to double lows of $348.00 and the 100 day moving average of $344.00. Would look to likely head there on profit-taking. Jan soyoil rebounds nicely with nice upside follow-through. Lower support returns to 57c with prices likely to test 5950c or higher.

Grains: March corn remains well bid reaching a new recovery high this AM at $5.87 1/4. Double lows provide support at $5.75, and the uptrend continues stronger with an ADX of 24. PUllbacks will be buying opportunities as prices turn slightly higher. There is not much back resistance to stop the market from reaching previous range highs at $5.93. However, March wheat could be the spoiler for the day as it appears to be forming a possible top. Trendline support crosses at $7.90 and it is major support now. Any close under $7.80 would open the door to a much larger sell-off, and a major correction towards $7.50-$7.60. The ADX has turned lower to 27 from values in the 30’s as chartists notice the vulnerability. Lower volumes on the drop towards $8.00 is bearish. Like the Kansas City wheat chart, this one may not be a full-out head and shoulders top, but in the process is enough to invite profit-taking if long.

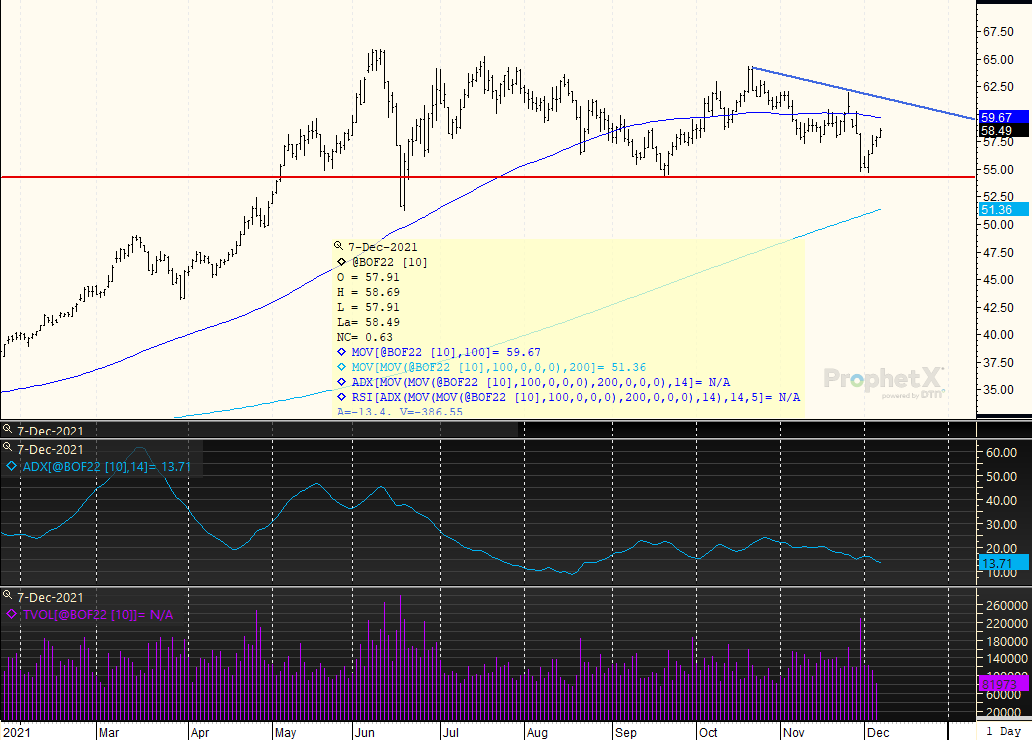

JANUARY SOYOIL: Big picture trade features continued recovery off the low of 55c. Trend continues higher as prices rise above 58c and head towards the 100 day moving average at 5950c. Would look for continued recovery though the ADX is weak at 13 signaling the resumption of a large sideways range. Still, there is good upside follow-through this AM, and major trendline resistance does not surface until we reach 6150c. With room to move, (no upside resistance), look for pullbacks to hold and for the lower end of the trading range to likely return to 57c vs. 55c on the break for a 57c-62c value range.

Receive Relevant and Timely Grain Market Reports that Matter!

Get updated twice a week with concise, direct information that you can use in grain trading, marketing, and farm management

Better yet, become a customer and get DAILY updates, fundamental, and technical, sent straight to your Inbox! Contact Us now to get started.

RISK DISCLAIMER: Trading in commodity interest products such as futures, options and otc swaps entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. The placement of contingent orders by you or broker, or trading advisor, such as a stop-lossor stop-limitorder, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Long options strategies could lose their entire premium plus transactional costs. Short options strategies entail unlimited risk of loss plus transactional costs. The information presented represents the opinion of Ag Optimus. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Futures prices factor in the seasonal aspects of supply and demand. This communication may cite historic data and should not be taken to mean certain trades can produce dramatic profits year in and year out. This information does not imply customers have or will experience profits based on seasonal trades or trade data. All information, communications, publications, and reports, including this specific material, used and distributed by Optimus Futures, LLC (“Optimus”) shall be construed as, or is in the nature of, a solicitation for entering into a derivatives transaction. Optimus does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This email may include information produced by third parties. Material not labelled Optimus Futures should be considered to be third-party, and is provided for informational purposes only. Third-party material is from sources believed to be reliable, but its accuracy is not guaranteed by Optimus Futures. Optimus Ag and Ag Optimus are registered dbas of Optimus Futures LLC [NFA ID 0481133] CONFIDENTIALITY NOTICE: Privileged/Confidential information may be contained in this message. If you are not the intended recipient, please notify the sender immediately and you must not use the message for any purpose nor disclose it to anyone. Communications on all mediums may be recorded.