Author: Author: Nathan Harris, Ag Optimus, Akron, IA Branch

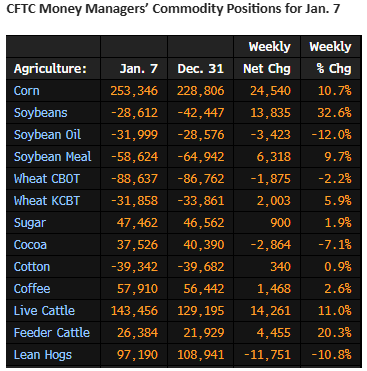

COT data was released after yesterday’s close, showing money flow by reportable traders as of last Tuesday (1/7).

The table below provides a look at “Managed Money” positions. These funds have a tendency to drive the market as their trade flow can overwhelm the small spec/hedge crowd.

Some key notes–

MM was shown net long 253k corn and short 28k beans as of Tuesday, BUT major buying has taken place since then. The USDA report provided us with some fireworks, and funds have reacted to lower 2024 yields by buying the market in a big way.

The livestock markets have been a managed money playground over the last few months. Last week they continued to push the cattle complex, taking their LC position to a net long 143k, and FC to long 26k (a new record by over 4k). In the hog market we’ve seen them start to pull back their long exposure as net sellers of 11k last week. Their net long in hogs is still 97k.

Funds can be the farmers worst enemy, or best friend! Their buying of Ag markets in late 2024 has given producers a shot in the arm. A good friend of mine likes to say, “you’ve gotta sell your peanuts when the circus is in town”. When the buy side money flow stops, so too will the rally in flat price. Be prepared!

Have a great day!

Nathan

Source: ADMIS