Author: Nathan Harris, Ag Optimus, Akron, IA Branch

🌐 Markets in Panic Mode

Last week ended in a washout across nearly all financial markets.

The trigger? Tariffs.

President Trump is taking a hardline stance globally, prompting fears of retaliation and uncertainty—typically a bearish cocktail.

✅ Some countries (South Korea, India, Vietnam, Argentina) are extending olive branches.

🧊 Cooler heads may prevail by mid-week.

⚠️ Until then, expect heightened volatility.

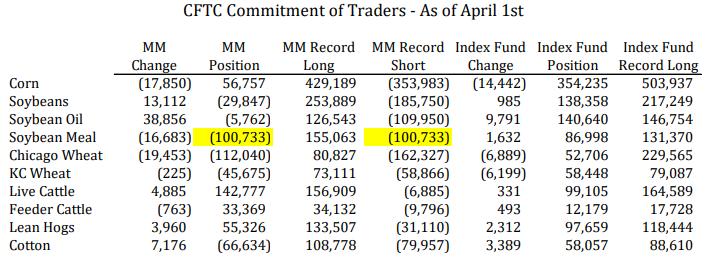

🐄 Cattle: Watching Fund Exposure as Markets React

- Live Cattle: Funds net long 142k (near record)

- Feeders: Funds net long 33k (also elevated)

- Both markets sit near all-time highs

⚠️ This setup is vulnerable—especially in the current macro environment.

🦢 With equities selling off, we may face a “black swan” scenario sparked by tariffs.(opinion)

📉 Thursday & Friday price action broke key supports.

Remain aware of the possibility of fund liquidation and price pressure

💡 Use options to manage exposure.

🐖 Hogs: Limit Down, But Possibly Undervalued

- Heavy selling after China threatened retaliation

- Mexico relations improving, offering some relief

- Despite the pressure, hogs may attract value buyers (opinion)

➡️ Cheaper protein = consumer shift = demand support

Image: ADMIS

🌾 Grains: Bearish Fund Positions, But Corn Stands Out

- Funds hold short positions in:

- Beans

- Wheat

- Cotton

- Corn: Neutral positioning

✅ Friday’s corn action, in our opinion, showed solid resilience.

📊 Domestic demand may be the key driver as the export outlook remains murky

🌱 As planting season begins, weather will matter

➡️ Adverse conditions could flip the script and bring funds back long (opinion)

Bottom Line:

Options are your best friend in this kind of market. (opinion)

Tariffs are the headline risk, but weather, demand, and fund flows will drive direction.

Stay nimble.

Have a Great week!

Nathan

Have questions about your marketing strategy? Call Nathan today! 📞 712-435-7879