Author: Nathan Harris, Ag Optimus, Akron Branch

The CFTC released its Commitment of Traders report yesterday afternoon, showing reportable trader positions as of last Tuesday. More of the same- fund buying in livestock futures, and a general lack of interest in the grains and oilseeds.

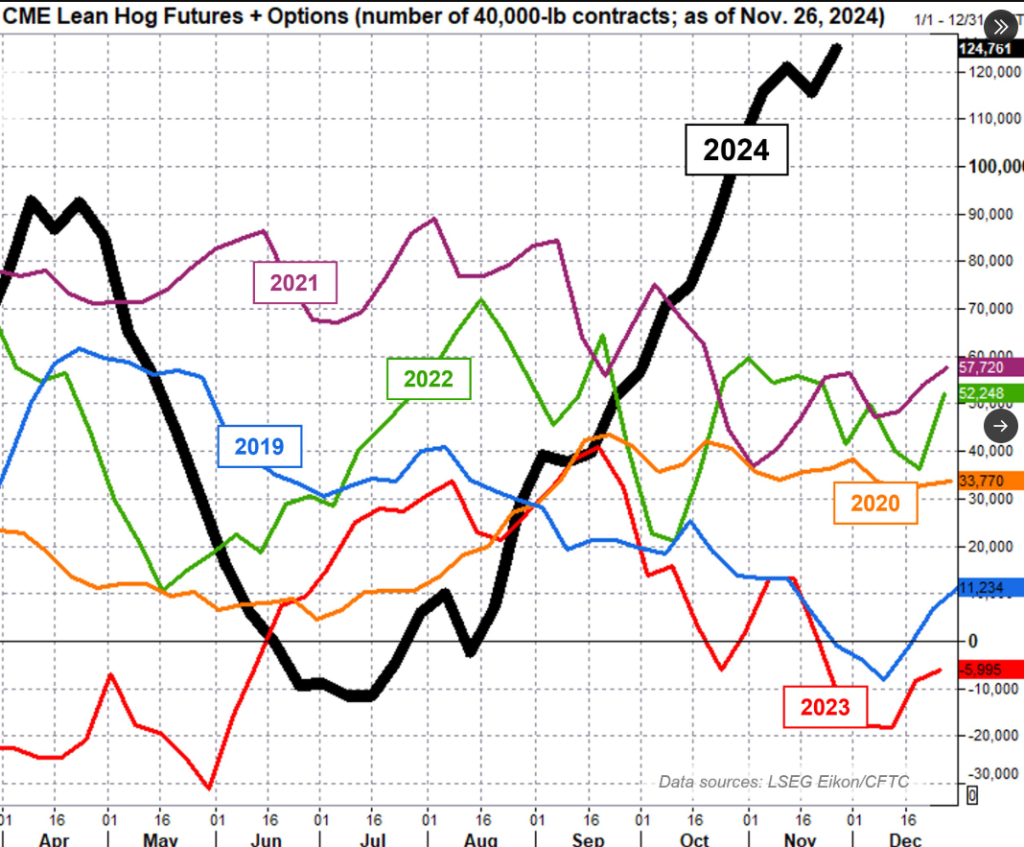

As shown on the table below, managed money has pushed their record net long in the lean hogs to new levels, now holding a net 124k longs in that market. The index funds have also participated, now long 111k. Funds have also continued to support the cattle, taking net longs in feeders to 16,735 and in live cattle to 115,396. These are not records but seem to be tracking that direction.

Source: ADMIS

This chart, posted by Karen Braun on Twitter (@kannbwx) yesterday afternoon, shows the incredible move in the fund positioning in hogs over the last 9 months. It’s no coincidence we were at contract lows in early July, and are making new contract highs now. MONEY FLOW WINS! Saying that, the old rule of thumb of “fade them and out wait them” is a good warning to livestock bulls. When managed money decides to go to the door, the opening may not be big enough! We see good opportunities on the short side of this market, and will act once given the technical signals to execute.

Have a great Tuesday!

Nathan