Good morning,

Markets opened quietly to start the week: equities and energies steady, grains slightly lower.

🌍 Global Politics & Market Mood

- Trump and Putin met on Friday in Alaska, discussing trade and the Ukraine conflict.

- Today, Zelensky and EU leaders visit Washington, D.C.

- Trump continues to push trade and peace negotiations, and so far, equities like the direction.

🌱 Crop Tour Begins

The Pro Farmer Crop Tour kicks off this morning:

- Western leg: South Dakota & Nebraska

- Eastern leg: Ohio & Indiana

Follow updates on X with #pftour25.

The USDA has set an ambitious yield target, but I feel the odds favor lower production by the final January number. Corn’s resilience last week—closing steady despite a very bearish number—suggests the market may agree.

💬 The best cure for low prices is low prices?!

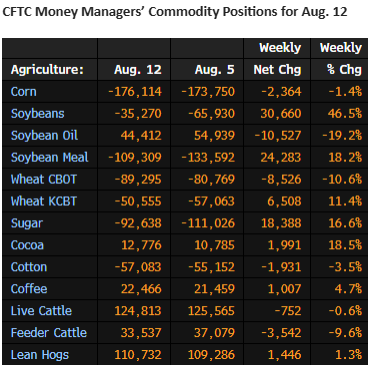

📊 Commitment of Traders – Managed Money

Funds remain bearish on grains, though we saw major short covering in soybeans following last week’s report.

- Corn & Wheat: Still bearish bias

- Soybeans: Heavy short covering

🐂 Livestock: Trend Still Up

- Live Cattle: Long 124k

- Feeder Cattle: Long 33k (down 3,500 contracts, mostly on 8/8’s limit down session)

- Lean Hogs: Long 110k

Cattle remain above key moving averages, potentially supporting the uptrend.

Hogs, however, are showing cracks—December needs to reclaim $84 to keep momentum alive (opinion).

Source: ADMIS

Have a great week!

Nathan

Have questions about your marketing strategy? Call Nathan today! 📞 712-435-7879