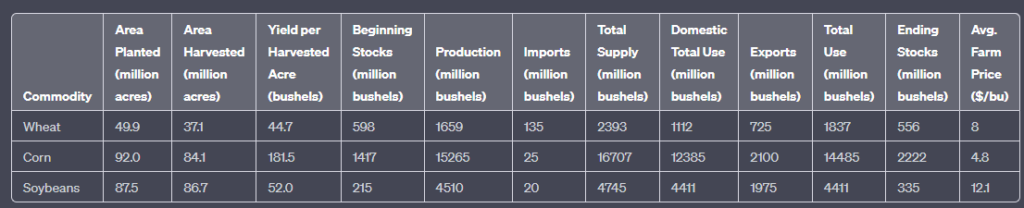

Corn

Production: Corn production for the 2023/24 season is projected to increase from 13,730 million bushels in 2022/23 to 15,265 million bushels.

Exports: Corn exports are expected to increase from 1,775 million bushels in 2022/23 to 2,100 million bushels in 2023/24.

Consumption: Domestic total use is projected to increase from 11,955 million bushels in 2022/23 to 12,385 million bushels in 2023/24.

Ending Stocks: Ending stocks for 2023/24 are projected to increase substantially from 1,417 million bushels in 2022/23 to 2,222 million bushels.

Wheat

Production: For the 2023/24 season, wheat production is projected at 1,659 million bushels, up slightly from 1,650 million bushels in 2022/23.

Exports: Wheat exports are expected to decrease from 775 million bushels in 2022/23 to 725 million bushels in 2023/24.

Consumption: Domestic total use is projected to increase slightly from 1,100 million bushels in 2022/23 to 1,112 million bushels in 2023/24.

Ending Stocks: Ending stocks for 2023/24 are projected to decrease from 598 million bushels in 2022/23 to 556 million bushels.

Soybeans

Production: Soybean production for the 2023/24 season is projected to increase from 4,276 million bushels in 2022/23 to 4,510 million bushels.

Exports: Soybean exports are projected to decrease from 2,015 million bushels in 2022/23 to 1,975 million bushels in 2023/24.

Consumption: Domestic total use is projected to increase slightly from 4,355 million bushels in 2022/23 to 4,411 million bushels in 2023/24.

Ending Stocks: Ending stocks for 2023/24 are projected to increase from 215 million bushels in 2022/23 to 335 million bushels

Disclaimer:

The risk of loss in Commodity Interest trading is substantial. Past performance is not indicative of future results. Any content presented should be viewed as a solicitation and an inducement to conduct business with AgOptimus. Market information presented is believed to be accurate as of the time of publication. Trading and investment decisions should be made at your own risk and only with risk capital. Be advised the views and opinions expressed herein do not necessarily reflect the current views or positions of AgOptimus and are subject to change at any time.

The information contained herein has been primarily derived from the World Agricultural Supply and Demand Estimates (WASDE) report, available at the following URL: https://www.usda.gov/oce/commodity/wasde. To ensure the highest level of accuracy and comprehensiveness, we strongly encourage readers to directly refer to the original report.