Market Update: Massive Fund Liquidation Hits Ag Commodities – March 4 COT Report

📊 COT Report: Fund Selling Dominates the Market

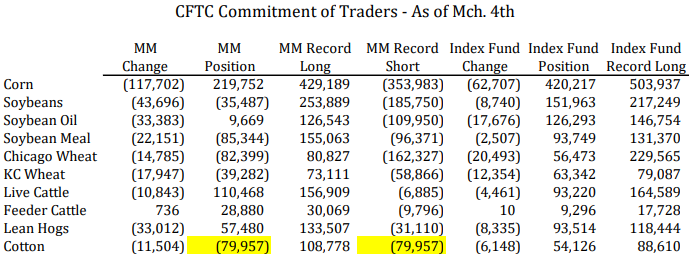

- Friday’s Commitment of Traders (COT) report confirmed widespread fund liquidation across major ag commodities.

- Managed Money Sell-Off Totals (Week Ending March 4):

🔻 Corn: -117k contracts

🔻 Soybeans: -43k contracts

🔻 Live Cattle: -10k contracts

🔻 Lean Hogs: -33k contracts

🌍 Trade War Uncertainty Driving Risk-Off Attitude

- Fund managers are pulling back due to ongoing trade war concerns.

- New twist: China imposed 100% tariffs on Canada last Friday, raising fears of potential U.S. trade retaliation.

- Key Question: Will China target U.S. ag products with similar tariffs?

- Market Impact: Uncertainty is fueling liquidation in grain and livestock markets.

📉 Have Markets Stabilized After Heavy Selling?

- Fund selling has slowed since the middle of last week, and grains & livestock have found footing.

- Market Positioning:

✅ Funds are now in a “cleaner” position after being overloaded recently.

✅ Traders are less extreme in their positioning, allowing for more balanced price action. - Next Market Focus:

🔹 Growing season conditions

🔹 Planted acreage expectations

📊 WASDE Report – March 5 Expectations

- USDA’s WASDE report is released tomorrow at 11 AM (CST).

- Market Estimates:

📌 Corn Carryout: 1.51 billion bushels

📌 Soybean Carryout: 379 million bushels

📢 Final Thoughts: What to Watch This Week

✔ Corn & Soybeans: Will funds return after selling pressure eases?

✔ Trade War Uncertainty: Any updates on China’s tariffs could impact markets.

✔ Livestock Markets: Have funds finished liquidating, or is more selling ahead?

✔ WASDE Report Impact: Will USDA’s numbers match expectations or surprise traders?

💬 Have questions about market positioning? Call Nathtan 📞 712-435-7879