Simple steps to increase your farm operating line of credit

Why Your Bank Limits Your Farm Loan

Before harvest or sale, you still need cash for seed, feed, or equipment repairs.

Banks will lend, but they worry:

“If corn, soybeans, or cattle prices drop, the grain or herd might be worth less than the loan.”

Because of that risk, lenders set a borrowing base—the maximum you can borrow—usually less than the full market value of your crop or livestock.

Example: Corn Without a Price Lock

- 10,000 bushels of corn

- Local cash price: $4.00/bu → $40,000 total value

- Bank lends about 60% → $24,000 operating credit

That “haircut” protects the bank if prices fall.

How Hedging or Forward Contracts Work

Hedging simply means locking in a selling price ahead of time.

Two common tools:

- Forward contract – Sign an agreement with a grain elevator or packer to sell at a set price.

- Futures contract – Work with a licensed futures broker to sell a paper contract that locks in the price on a commodity exchange.

Either way, you haven’t delivered yet—you’ve just guaranteed a minimum price.

How a Price Lock Increases Your Borrowing Base

Once you lock in the price:

- The bank knows your corn or cattle are worth at least that agreed price.

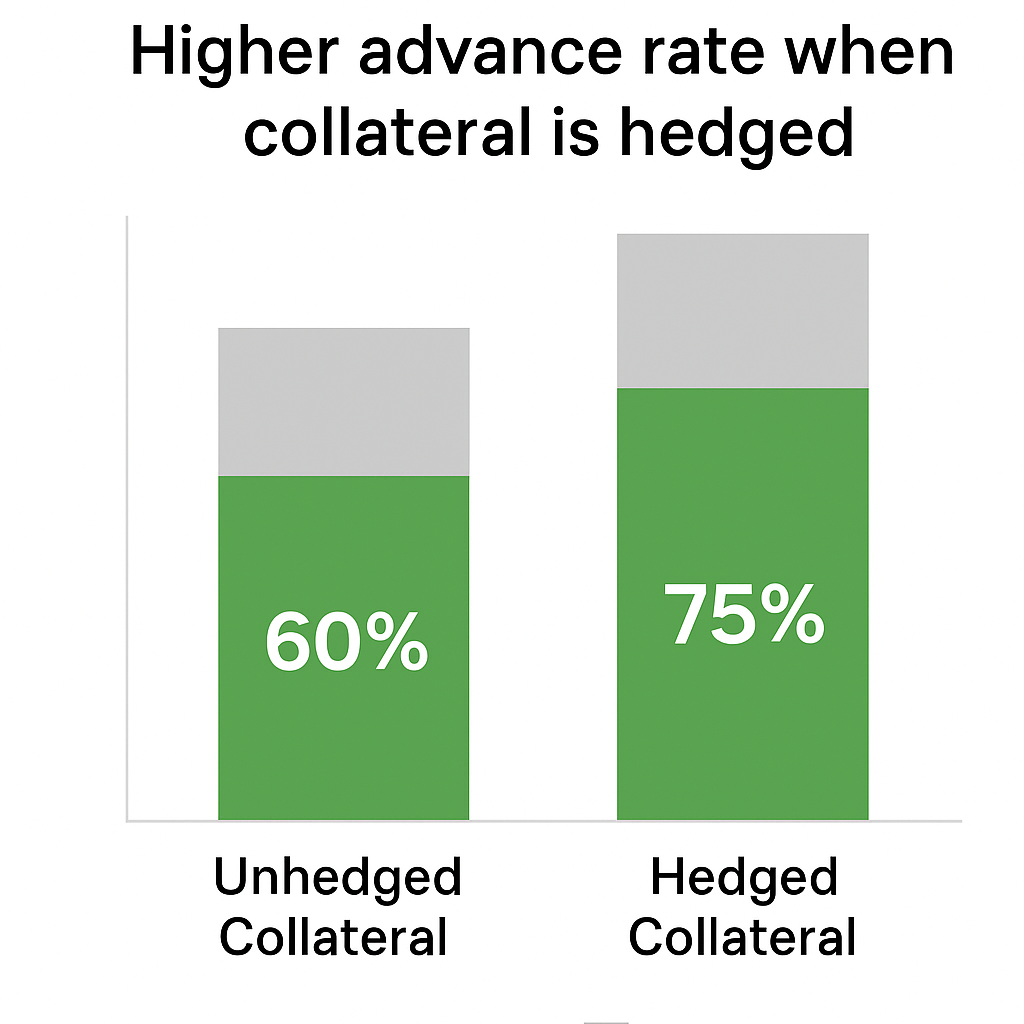

- With less risk, the lender can raise the advance rate—often from 60% up to 70–75%.

Example:

Locked-in price: $4.00

$40,000 × 75% = $30,000 line of credit

That’s $6,000 more borrowing power than without a hedge.

Bankers and Futures Brokers Work Together

To count your hedge, the bank usually asks you to:

- Provide broker statements or a copy of your Futures contract,

- Sign a simple form so the banker can see hedge reports,

- Keep a small cash cushion for margin calls if using futures.

The banker wants a safer loan.

The broker wants you to manage price risk.

Working together protects your farm and lets you borrow more.

Hedging Is Risk Protection, Not Gambling

Many farmers think futures are risky speculation.

When used to hedge, it’s actually the opposite of gambling:

You’re potentially protecting your income and ensuring you can pay your bills even if markets fall.

Quick Takeaways for Farmers

- Borrowing base – the limit your bank will lend, based on crop or livestock value.

- Hedging or forward contracting – locks in a price and reduces lender risk.

- Result – often a larger farm operating loan and steadier cash flow.

This article is for general education only. Farmers should consult their banker and a licensed futures broker before making financial decisions. Every bank sets its own lending standards, and approval is never guaranteed, even if a hedge or forward contract is in place.

Ready to Explore Your Options?

Whether you’re raising corn, soybeans, or cattle, Ag Optimus can walk you through hedging basics and help you talk with your banker about borrowing capacity.

👉 Call toll-free at (800) 944-3850 or (712) 545-0182 to start a no-obligation conversation about protecting prices and strengthening your next operating loan application. For more information, contact us at https://agoptimus.com/contact-us/

Frequently Asked Questions (FAQ)

1. What is a borrowing base?

It’s the amount of money a bank is willing to lend you, based on the value of what you grow or raise—like grain in the bin or cattle in the lot. Banks usually lend only a percentage of that value to protect themselves if prices drop.

2. How does hedging help me get a bigger operating loan?

By locking in a selling price through a forward contract or a futures hedge, you show the bank that your crop or herd will be worth at least that amount. Less risk for the bank often means they can lend you a larger percentage of your inventory’s value.

3. Is using futures the same as gambling?

No. When you hedge, you’re not trying to “beat the market.” You’re setting a price floor so you know you can cover your costs, even if prices fall.

4. Will the bank automatically give me more money if I hedge?

Not necessarily. Each bank has its own lending rules. Hedging can strengthen your loan request, but loan approval and the size of the line are never guaranteed.

5. Do I need to work with a futures broker to hedge?

Yes, if you use exchange-traded futures or options, you’ll need a licensed futures broker. If you prefer, you can also use a forward contract with a local elevator or packer to lock in prices without using the futures market directly.