Author: Nathan Harris, Ag Optimus, Akron, IA Branch

Good morning,

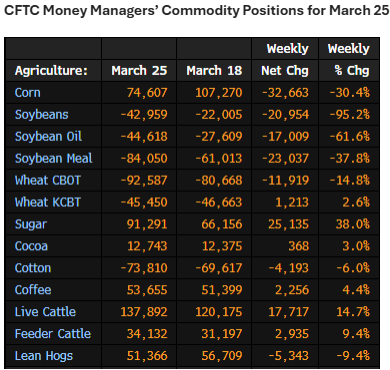

The COT data released Friday reflects reportable trader positions as of March 25th. Once again, it’s clear: money flow is king!(opinion)

📉 Grains: Funds Selling Across the Board

The table below shows Managed Money movement for the week ending March 25th.

✅ Funds were sellers of all CBOT grain/oilseed products

✅ Buyers of the cattle complex

- Corn: Funds are starting the growing season relatively neutral at 74k net long

- Soybeans: Funds hold a 42k net short, but we’ve seen some short covering since Tuesday

💡 In my opinion, beans are a sleeper. At some point this growing season, I believe funds will get spooked out of their short bias—especially if weather becomes a factor.

🐄 Cattle: Funds Still Charging In

The fund position in cattle continues to defy gravity:

- Feeder Cattle: Managed Money pushed to a new record 34k net long

- In our view, strong cash feeder prices support the move—but we believe caution is warranted. The door could get tight when funds decide to exit.

- Live Cattle: Funds held 137k net longs as of the report, and added significantly midweek. My estimate: 145k+ net long as of now.

⚠️ Positions are hefty, and timing is everything in these kinds of trades.

🐖 Hogs: Tariffs Cloud the Outlook

March was choppy, and the funds remain indecisive.

- The Quarterly Hogs & Pigs report showed less supply than expected

- But traders remain cautious due to tariff risks

💬 Some are calling this “liberation week”—we may finally get clarity on tariff implications.

- MM$ (managed Money) once held a record net long hog position in 2025

- Now reduced to a more manageable 51k net long as of March 25

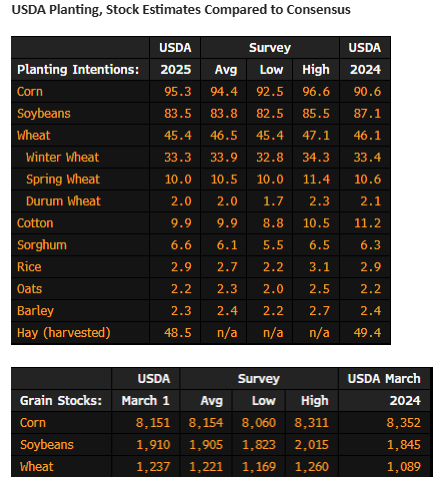

📊 USDA Report Recap – March 31st

Monday’s report was tame compared to past March 31 fireworks:

- Corn:

- Market absorbed the 95m+ acreage number well

- Reversed higher, supported by strong demand

- Notably, domestic corn usage was the largest in 20 years 🌽

- Wheat:

- Strong gains followed a drop in acreage expectations

- Total wheat acreage: 45.4m, second smallest since 1919!

- Funds remain short—this feels like a “fade them and out-wait them” kind of setup

- Soybeans:

- 83.5m acres—small enough to give us hope

- Any adverse growing season weather could send this market back into the teens

- I still think beans are a sleeper

- Consider upside calls for re-ownership of old crop

- Or “courage calls” for future coverage on new crop sales

Images: ADMIS

⚠️ Macro Watch: Tariffs in the Spotlight

Keep your head on a swivel. Tariffs are sure to dominate headlines the rest of the week, with Trump promising major announcements tomorrow.

Have a great day!

— Nathan

Have questions about your marketing strategy? Call Nathan today! 📞 712-435-7879