This week marks the unofficial start of holiday season with Thanksgiving on Thursday and before we know it, we will be ringing in the new year. As we enter into this holiday season there is a lot of discussion around the cost of everything from food to fuel.

Unless you have no access to social media it would not take long to find someone commenting on the higher price of gas over the past year, or let us not forget the infamous I did thatJoe Biden stickers pointing at the cost of a gallon of gas.

In an attempt to pacify the mess that we are in the current administration announced this morning that they were going to release 50 million barrels form the U.S. Strategic Petroleum Reserve SPR.

So, what does this mean? First lets take a look at the market reaction. While most of us were sleeping at 5:21 this morning JAN Crude Oil was trading at 76.02. Somewhere around the 6 oclock hour the White House released a statement about their intended action. JAN Crude made a low of 75.70 after the release. At the time of writing this article (10:58) Crude was trading at 78.27. (All Times Central).

From a longer-term perspective will 50 million barrels really make a difference? According to CEIC the United States consumes 17,177.648 Barrel/Day in DEC of 2020 (1). So 50 million barrels wont quite make it three days. Little more then putting a band aide on a broken leg in my opinion.

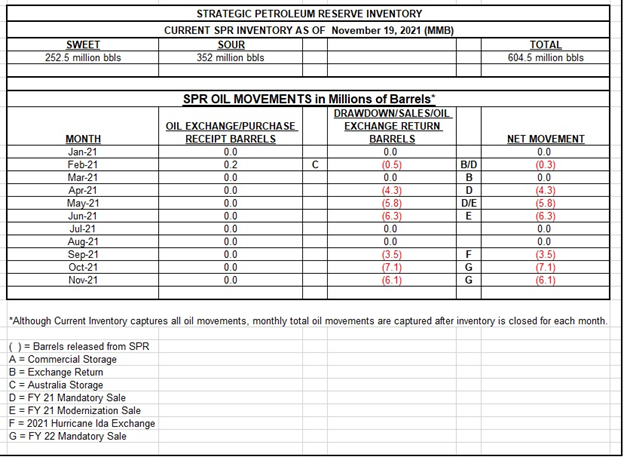

Additionally, this is not the first time that we have tapped into the Strategic Petroleum Reserve in 2021. Even though this release is by far and away the largest release through November of 2021 the United States has released 33.4 Million Barrels from the SPR. See table Below (2).

There are a number of ways that this action can be interpreted. Some are suggesting that this is a political move because the administration woke up and saw the plummeting polls. While others will look at this as a legitimate attempt to fix our festering energy problem.

This blog intends not to be political, and there are enough talking heads and bloggers out there that will put that spin on things. But Gas prices have a tangible impact on our day-to-day lives, operations, and savings.

My biggest takeaway from this action is the fact that we have an even bigger problem on the horizon and the government is beginning to come to that realization. If we dont find a way to solve this issue it will become a full-blown crisis before we know it, and the inflation that we have experienced thus far will seem minuscule in 2022.

(1) https://www.ceicdata.com/en/indicator/united-states/oil-consumption

(2) https://www.spr.doe.gov/dir/images/img2.jpg

Looking to Trade or Hedge Commodities? Please reach out and let’s chat…

David Ericson

712.435.7402

Receive Relevant and Timely Grain Market Reports that Matter!

Get updated twice a week with concise, direct information that you can use in grain trading, marketing, and farm management

Better yet, become a customer and get DAILY updates, fundamental, and technical, sent straight to your Inbox! Contact Us now to get started.

RISK DISCLAIMER: Trading in commodity interest products such as futures, options and otc swaps entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. The placement of contingent orders by you or broker, or trading advisor, such as a stop-lossor stop-limitorder, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Long options strategies could lose their entire premium plus transactional costs. Short options strategies entail unlimited risk of loss plus transactional costs. The information presented represents the opinion of Ag Optimus. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Futures prices factor in the seasonal aspects of supply and demand. This communication may cite historic data and should not be taken to mean certain trades can produce dramatic profits year in and year out. This information does not imply customers have or will experience profits based on seasonal trades or trade data. All information, communications, publications, and reports, including this specific material, used and distributed by Optimus Futures, LLC (“Optimus”) shall be construed as, or is in the nature of, a solicitation for entering into a derivatives transaction. Optimus does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This email may include information produced by third parties. Material not labelled Optimus Futures should be considered to be third-party, and is provided for informational purposes only. Third-party material is from sources believed to be reliable, but its accuracy is not guaranteed by Optimus Futures. Optimus Ag and Ag Optimus are registered dbas of Optimus Futures LLC [NFA ID 0481133] CONFIDENTIALITY NOTICE: Privileged/Confidential information may be contained in this message. If you are not the intended recipient, please notify the sender immediately and you must not use the message for any purpose nor disclose it to anyone. Communications on all mediums may be recorded.