.

Author: Nathan Harris, Ag Optimus, Akron, IA Branch

Attached is Friday’s COT data release—no surprise—more liquidation in the grain complex.

🌽 Grains: Funds Liquidate More Corn Longs

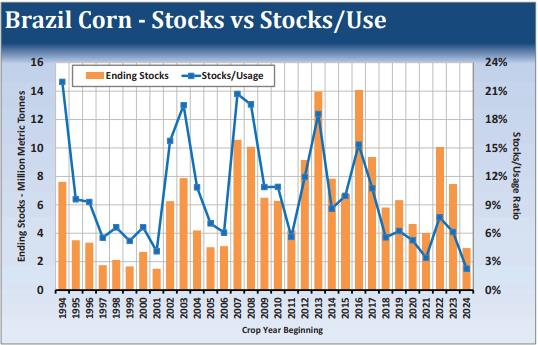

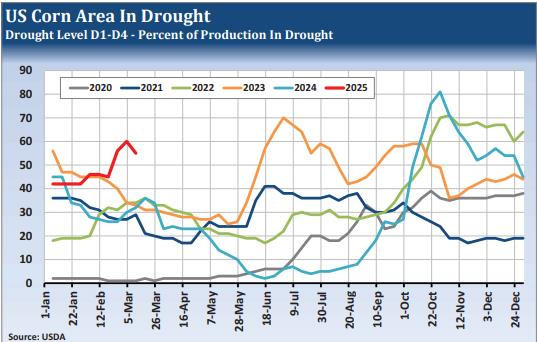

Funds have rushed to the exits on another 73k corn longs, bringing their net position down to just 146k long. This comes right before a critical growing season, as global corn supplies tighten and much of the Corn Belt enters spring with a moisture deficit. The images below are enough to keep me from turning bearish just yet. Buckle up!

🌱 Soybeans look like a sleeper. Funds hold a modest 15k net short, a position worth watching.

🐄 Livestock: Confidence in Cattle, Shaky in Hogs

We saw more excitement in the livestock markets, though managed money movement remained limited.

- Funds still hold a record 30k net long in feeder cattle

- Live cattle remain strong with a sizeable 112k net long

- Cash markets continue to support the bullish trend

🐖 Hogs: A Lesson in Market Perception

I’d encourage cattle bulls to look at the hog chart. The funds’ position in hogs has been cut by more than half over the past two months, now sitting at just 55k net longs.

Did the fundamental supply/demand picture change drastically? Not really. But perception did.

⚠️ Tariffs—or even their threat—have shaken the market. With funds now at 55k net long, they’re far less of a downside risk. A recovery could unfold into spring and summer.

Have a great week!

Nathan

Images: ADMIS

Have questions about your marketing strategy? Call Nathan today! 📞 712-435-7879