Introduction

Feeder cattle futures versus live cattle futures represent two distinct futures contracts that serve different stages of the beef production cycle, with each offering unique opportunities for hedging price risk and managing cattle operations. Understanding the key differences between these cattle futures contracts is essential for making informed trading and risk management decisions in the livestock markets.

The choice between feeder cattle and live cattle futures directly impacts your hedging effectiveness, profit potential, and overall risk exposure when managing cattle operations or trading commodities.

What This Guide Covers

This comprehensive comparison examines contract specifications, trading strategies, risk management applications, and practical guidance for determining when to use each futures contract. We focus specifically on CME Group-traded contracts and their real-world applications rather than general livestock market theory.

Who This Is For

This guide is designed for cattle producers, meat packers, livestock traders, agricultural investors, and risk managers operating within the beef supply chain. Whether you’re a cow-calf producer hedging feeder cattle sales or a feedlot operator managing both input costs and finished cattle prices, you’ll find specific strategies tailored to your position in the cattle market.

Why This Matters

These futures markets enable participants to lock in prices months in advance, protecting against adverse price movements that can significantly impact profitability. With cattle representing billions of dollars in annual agricultural production across America, understanding which futures contract aligns with your operations determines whether your hedging strategy succeeds or fails.

What You’ll Learn:

- Contract specifications and trading mechanics for both futures markets

- Key pricing relationships and fundamental drivers affecting each market

- Hedging strategies matched to different cattle production stages

- Trading approaches for capturing profit opportunities in cattle futures

Understanding Cattle Futures Contracts

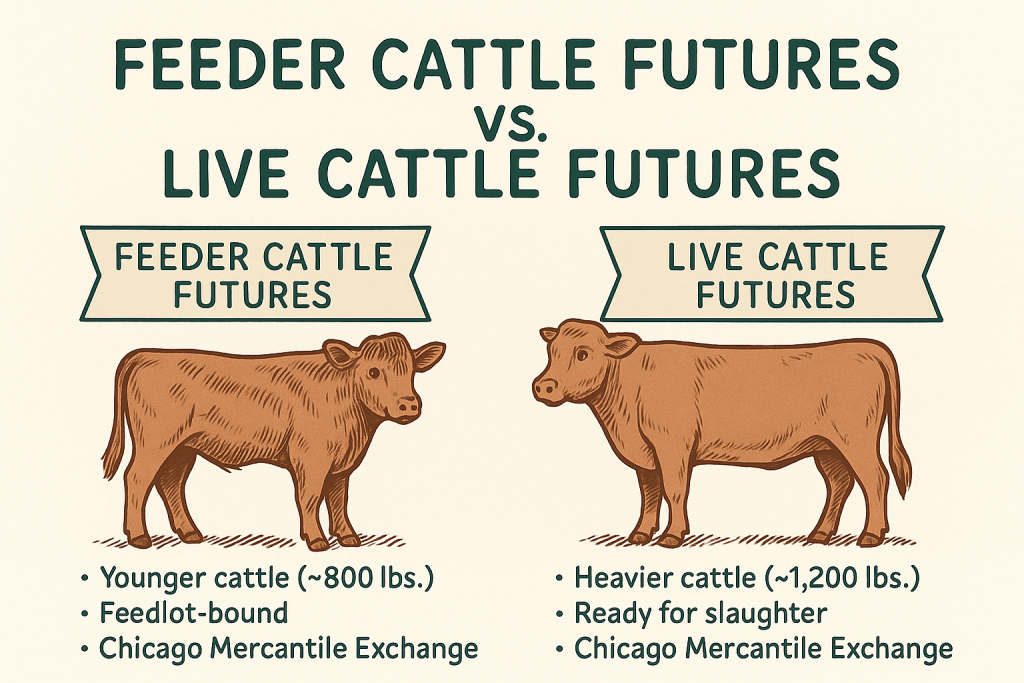

Cattle futures contracts provide standardized agreements to buy or sell cattle at predetermined prices on specific future dates, with feeder cattle futures covering young cattle destined for feedlots, while live cattle futures represent finished cattle ready for slaughter.

The cattle production cycle typically spans 12-18 months from weaned calf to finished beef, with futures contracts allowing market participants to manage price risk at different stages of this process. Feeder cattle contracts focus on animals weighing 650-849 pounds that require additional feeding to reach slaughter weight, while live cattle contracts cover mature animals weighing 1,200-1,400 pounds ready for processing.

Both futures markets trade on the CME Group exchange and serve complementary roles in the beef supply chain, enabling producers, feeders, and processors to hedge price risk according to their specific operational needs. USDA grading requirements for these contracts are set by the department responsible for livestock grading and classification, ensuring standardized quality and consistency in trading.

Feeder Cattle Futures Fundamentals

Feeder cattle futures contracts represent 50,000 pounds of young cattle, typically equivalent to 65-75 head depending on individual animal weights. These contracts trade for delivery months of January, March, April, May, August, September, October, and November, with each contract month corresponding to typical marketing patterns for feeder cattle. Trading for feeder cattle futures typically opens on Monday, aligning with the start of the trading week.

The minimum price movement (tick size) is $0.025 per pound, or $12.50 per contract. Unlike live cattle futures, feeder cattle contracts are cash settled against the CME Feeder Cattle Index rather than requiring physical delivery of actual cattle.

USDA grading requirements specify medium- and large-frame steers weighing 650-849 pounds, ensuring contract standardization while reflecting typical feeder cattle marketed through auction barns and direct sales.

Live Cattle Futures Fundamentals

Live cattle futures contracts cover 40,000 pounds of finished cattle, approximately 30-35 head of mature animals ready for slaughter. Trading months include February, April, June, August, October, and December, aligning with seasonal slaughter patterns and beef demand cycles.

The minimum tick size equals $0.025 per pound, or 2.5 cents per pound, representing $10 per contract movement. Live cattle futures allow for physical delivery, meaning contract holders may receive or deliver actual cattle meeting USDA Choice or Select grade requirements at approved delivery locations.

Contract specifications require steers and heifers weighing between 1,200-1,400 pounds, matching typical finished cattle weights that maximize processing efficiency for beef packers.

Transition: These fundamental differences in contract design reflect the distinct roles each futures market plays in cattle price discovery and risk management.

The Role of the Futures Market

The futures market is the backbone of price discovery and risk management for live cattle futures, providing a transparent and efficient platform for trading futures contracts tied to cattle prices. At the heart of this market is the CME Group, where live cattle futures and feeder cattle futures are actively traded by a diverse range of participants—including, but not limited to producers, feedlot operators, meat packers, exporters, and importers.

By trading live cattle futures contracts, producers and feedlot operators can hedge against unpredictable cash-market price swings, locking in prices for future sales and purchases. This ability to manage price risk is crucial for maintaining stable revenues and protecting profit margins, especially in a market as volatile as the cattle market. For example, a feedlot operator can sell live cattle futures to secure a favorable sale price months before the actual sale, while a meat packer might buy futures contracts to guard against rising cattle prices that could squeeze processing margins.

The futures market also brings liquidity and transparency, making it easier for buyers and sellers to enter and exit positions at competitive prices. High trading volume and open interest in live cattle futures ensure that market participants can transact efficiently, even during periods of heightened volatility.

Beyond live cattle, the futures market supports trading in other commodities closely linked to the cattle industry, such as feeder cattle, corn, and soybean meal. These related markets allow producers and traders to manage not only cattle price risk but also the cost of feed and other inputs, further stabilizing their operations. For instance, a cattle producer might use corn futures to hedge against rising feed costs while simultaneously managing cattle price exposure with live cattle futures.

The CME Group enhances this ecosystem by offering robust trading platforms, real-time market data, and educational resources tailored to the needs of cattle futures traders. Certain advanced tools and data downloads are available exclusively to registered users on the CME Group site. Additionally, the futures market is overseen by government agencies, which help ensure fair trading practices and protect the interests of both producers and consumers.

In summary, the futures market is essential for anyone involved in the cattle industry, providing the tools and infrastructure needed to manage price risk, discover fair market prices, and trade efficiently across a range of related commodities.

Key Differences Between Feeder and Live Cattle Futures

Understanding these differences enables traders and producers to select the appropriate futures contract based on their position in the cattle supply chain and specific risk management objectives.

Contract Specifications Comparison

| Feature | Feeder Cattle Futures | Live Cattle Futures |

|---|---|---|

| Contract Size | 50,000 pounds (65-75 head) | 40,000 pounds (30-35 head) |

| Animal Weight | 650-849 pounds | 1,200-1,400 pounds |

| Trading Months | Jan, Mar, Apr, May, Aug, Sep, Oct, Nov | Feb, Apr, Jun, Aug, Oct, Dec |

| Tick Value | $12.50 per contract | $10.00 per contract |

| Settlement | Cash settled to CME Index | Physical delivery available |

| Primary Commercial Users | Cow-calf producers, stocker operators | Feedlots, beef packers |

Note: All trading hours for these contracts are listed in Central Time (CT).

The different contract sizes reflect typical cattle weights at each production stage, while varying trading months accommodate seasonal marketing patterns. Cash settlement for feeder cattle eliminates delivery logistics, while physical delivery options for live cattle ensure futures prices converge with cash market values.

Price Volatility and Trading Volume

Live cattle futures typically exhibit higher trading volume and open interest compared to feeder cattle futures, with daily volume often exceeding 70,000 contracts versus approximately 15,000 contracts for feeder cattle. This volume difference affects market liquidity and bid-ask spreads, particularly during volatile market conditions. Unlike stocks, where real-time data updates and price feeds are frequent and often timestamped during trading hours, cattle futures data updates may have different timing or frequency, so traders should be aware of these differences when monitoring market activity.

Price volatility patterns differ across contracts: feeder cattle futures can be more sensitive to corn prices and feed costs, while live cattle futures tend to respond more directly to beef demand and changes in processing capacity. Traders often use calculations as part of technical analysis to evaluate market trends and inform trading strategies in live cattle futures.

Fundamental Price Drivers

Feeder cattle prices primarily respond to corn futures prices, pasture conditions, and replacement demand from feedlot operators. When corn prices decline, feeding margins improve, increasing demand for feeder cattle and supporting futures prices. Weather conditions affecting pasture quality also influence feeder cattle values, as drought conditions force earlier marketing of young cattle.

Live cattle futures react to factors affecting beef demand, including consumer spending, export markets, and seasonal consumption patterns. Imports of beef and live cattle also influence supply and, consequently, futures prices. Processing capacity constraints, labor issues, and government regulations that directly affect beef plants all impact live cattle prices. The relationship between these fundamental drivers creates trading opportunities for investors who understand cattle market dynamics.

Transition: These pricing relationships give rise to specific trading strategies and hedging applications for different market participants.

Trading Strategies and Applications

Market participants use cattle futures contracts for hedging price risk, speculative trading, and capturing profit opportunities through spread trading strategies. Futures prices also serve as a reference point for pricing and hedging strategies in the cattle industry.

Hedging Strategies for Producers

Cow-calf producers typically sell feeder cattle futures to hedge against price declines before marketing weaned calves. For example, a producer expecting to sell 500 head of 750-pound calves in October might sell 8 feeder cattle futures contracts (approximately 75 head per contract) to lock in current price levels and protect against adverse price movements.

Feedlot operators face dual price risk, requiring strategies using both contract types. They buy feeder cattle futures to hedge input costs when acquiring young cattle and sell live cattle futures to hedge sale prices for finished animals. This combined approach, known as a cattle feeding margin hedge, helps stabilize profit margins despite price volatility in both markets.

Beef packers primarily use live cattle futures to hedge their largest input cost – live cattle purchases. By buying live cattle futures, packers can lock in purchase prices and protect against sudden price spikes that would squeeze processing margins.

Spread Trading Opportunities

The feeder-to-live cattle spread represents the gross margin for feeding cattle, creating trading opportunities when this spread moves outside historical ranges. Technical analysis of moving averages and chart patterns helps identify entry and exit points for spread positions.

Calendar spreads within each contract type capture seasonal price patterns and storage costs. October feeder cattle futures often trade at premiums to December contracts, reflecting typical calf marketing seasons. Traders can profit by selling October and buying December when this spread exceeds historical norms. In addition to cattle spreads, traders may also consider spreads involving grains, such as corn and other feed commodities, to manage risk and capture arbitrage opportunities.

Successful spread trading requires understanding seasonal patterns, monitoring open interest levels, and managing margin requirements for multiple contract positions.

Speculative Trading Approaches

Day traders often prefer live cattle futures due to higher volume and tighter bid-ask spreads, while position traders may find better opportunities in feeder cattle during periods of corn price volatility.

Fundamental analysis focuses on USDA cattle reports published each Friday, export data, and relationships among grain prices. Traders should monitor weekly cattle placement numbers and monthly cattle inventory reports to anticipate price movements.

Position sizing must account for contract value differences and volatility patterns, with feeder cattle requiring slightly larger margins due to lower trading volume and wider spreads.

Transition: Despite these opportunities, cattle futures trading presents specific challenges requiring careful risk management.

Technical Analysis for Cattle Trading

Technical analysis is a cornerstone of successful trading in the live cattle futures market, offering traders a systematic approach to analyzing price movements and identifying trading opportunities. By studying historical price data and chart patterns, traders can anticipate potential market trends and make more informed decisions about when to buy or sell live cattle futures contracts.

One of the primary tools in technical analysis is the use of charts, which visually display price action over various timeframes. Traders often rely on technical indicators such as moving averages to smooth out price fluctuations and highlight the underlying trend. For example, a simple moving average can help identify whether the market is in an uptrend or a downtrend, guiding entry and exit decisions.

Other popular technical indicators in live cattle futures trading include the Relative Strength Index (RSI), which measures the speed and change of price movements to identify overbought or oversold conditions, and the Moving Average Convergence Divergence (MACD), which signals potential trend reversals. Bollinger Bands are also widely used to gauge market volatility and spot breakout opportunities.

Technical analysis is not limited to live cattle futures alone. Traders often apply these techniques to related commodities such as feeder cattle and corn, using inter-market analysis to gain a broader perspective on price relationships and market sentiment. For instance, a breakout in corn futures might signal upcoming changes in feed costs, which could, in turn, impact live cattle prices.

Support and resistance levels, identified through technical analysis, help traders pinpoint optimal entry and exit points, manage risk, and set stop-loss orders. By combining technical analysis with fundamental analysis—such as monitoring USDA reports, supply data, and market news—traders can develop a comprehensive strategy for navigating the futures market.

The CME Group supports technical traders by providing a suite of analytical tools, including interactive charts, technical indicators, and real-time market data. Traders can navigate the trading platform’s pages to access specific data tables, charts, and technical indicators. These pages often allow users to sort, update, and download market data, making it easier to customize their technical analysis workflow. These resources empower traders to conduct in-depth technical analysis and stay ahead of market trends.

Incorporating technical analysis into your trading approach can enhance your ability to manage price risk, capitalize on market movements, and achieve greater consistency in live cattle futures trading.

Common Challenges and Solutions

Successful cattle futures trading, in our opinion, requires understanding and managing several key challenges that can impact trading performance and hedging effectiveness.

Challenge 1: Choosing the Right Contract for Hedging

Solution: Match your futures contract selection to your specific position in the cattle supply chain and marketing timeline.

Cow-calf producers should use feeder cattle futures when hedging weaned calf sales, while feedlot operators need live cattle futures for finished cattle hedging. The timing of your cattle marketing determines which delivery month provides the best hedge effectiveness.

Challenge 2: Managing Basis Risk

Solution: Monitor local cash market prices relative to futures prices and understand historical basis patterns in your region.

Basis risk occurs when the difference between local cash prices and futures prices change unexpectedly. Keep detailed records of basis levels during different seasons and market conditions to improve hedge timing and reduce basis risk exposure.

Challenge 3: Understanding Market Liquidity Differences

Solution: Check daily volume and open interest before entering positions, particularly in deferred contract months or during low-activity periods.

Use limit orders rather than market orders in less liquid contracts to avoid excessive slippage. Monitor trading activity during the morning hours when volume typically peaks, and avoid trading during lunch hours when liquidity often decreases.

Transition: Understanding these challenges can prepare traders to implement effective cattle futures strategies.

Conclusion and Next Steps

Feeder cattle futures serve producers at the front end of cattle production, while live cattle futures support risk management for feedlot operators and beef processors finishing cattle for slaughter. Your position in the cattle supply chain, marketing timeline, and specific risk exposures determine which futures contract provides optimal hedging or trading opportunities.

To Get Started:

- Assess your role in the cattle production cycle and identify your primary price risk exposures

- Open a futures trading account with a registered commodity broker who understands agricultural markets.

- Develop a written trading or hedging plan with specific entry criteria, exit strategies, and risk management rules

Looking for a Commodity Broker that Understands Cattle? Try Ag Optimus.

www.agoptimus.com

Toll Free: (800) 944-3850 Phone: (712) 545-0182

Frequently Asked Questions (FAQ) About Feeder Cattle Futures Versus Live Cattle Futures

What are feeder cattle futures and live cattle futures?

Feeder cattle futures are standardized contracts for buying or selling young cattle weighing between 650-849 pounds, typically destined for feedlots. Live cattle futures represent contracts for finished cattle weighing 1,200-1,400 pounds, ready for slaughter. Both are traded on the CME Group exchange and help manage price risk at different stages of production.

How do feeder cattle futures differ from live cattle futures in terms of settlement?

Feeder cattle futures are cash-settled based on the CME Feeder Cattle Index, meaning no physical delivery of cattle is required. Live cattle futures allow for physical delivery of cattle meeting USDA Choice or Select grade standards, typically involving 40,000 pounds of cattle.

Why is understanding the difference between feeder cattle and live cattle futures important?

Knowing the differences helps producers, traders, and investors select the appropriate contracts to effectively hedge price risk, optimize profit potential, and manage operational risks across the cattle production cycle.

What role does the CME Group play in cattle futures trading?

The CME Group operates the primary exchange for feeder cattle and live cattle futures, providing transparent pricing, liquidity, and trading platforms. It also offers educational resources and market data to support informed trading decisions.

How can technical analysis be applied to live cattle futures trading?

Technical analysis involves studying price charts, moving averages, and indicators such as RSI and MACD to identify trends and trading opportunities. It helps traders anticipate price movements and manage risk in live cattle futures markets.

What is basis risk in cattle futures trading?

Basis risk is the risk that the difference between local cash market prices and futures prices changes unexpectedly, potentially reducing the effectiveness of the hedge. Monitoring historical basis patterns can help manage this risk.

Can cattle futures be used to manage feed cost risks?

Yes, producers often hedge feed costs using related futures contracts such as corn and soybean meal alongside cattle futures to stabilize overall production margins.

What are the common challenges when trading cattle futures?

Challenges include selecting the appropriate hedging contract, managing basis risk, and dealing with varying market liquidity. Understanding these factors and using limit orders in less liquid markets can improve trading outcomes.

How do seasonal patterns affect feeder and live cattle futures?

Seasonal factors influence trading months and price volatility. For example, feeder cattle futures months align with typical calf marketing seasons, while live cattle futures correspond with slaughter and beef demand cycles.

Where can I find reliable data and market updates for cattle futures?

Market data, including prices, volume, and open interest, is available through the CME Group website, financial news platforms, and specialized commodity trading sites. Regular USDA reports also provide valuable market insights.