Author: Nathan Harris, Ag Optimus, Akron, IA Branch

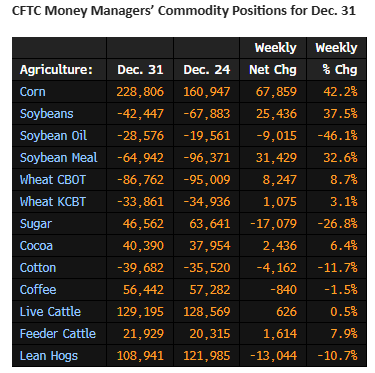

The Commitment of Traders report was released yesterday afternoon, showing positions by reportable traders as of the close last Tuesday (12/31). Below, you’ll find the Managed Money positions and how they changed going into year-end.

Big length in Corn! Funds have done a full 180 since early last fall, now pushing into a net long position of 228k contracts. With a grain report this week, some advisors are warning of the downside risk the fund position may be creating. Watch for a technical signal that may send the managed money crowd to the door. For now, the trend is up. We’re a touch overbought, so a correction could be in the cards short term. Demand has chipped away at a carryout that was once predicted to be burdensome. The current 1.7b bu C/O is seen as supportive to the market.

Short positions in beans, meal, and wheat remain, though funds lightened that stance with a touch.

On the livestock side of things, the record net length in hogs has begun to shrink. We’ve seen this pressure the futures market. Feb hogs are now $10 off their Thanksgiving week highs. I recall the bullish commentary at that time telling us “hog numbers are much tighter than expected”. Remember- buy the rumor, sell the fact. The funds pushed into a long position that was too big. Price is suffering from their liquidation now.

Speaking of record long fund positions… MM$ is now net long 22k feeders and likely closer to 25k now after massive buying this first week of 2025. Same fundamental story- tight numbers and strong cash. When will the fact need to be sold? Friday’s reversal down was a warning sign, but we’ve seen no change in trend to this point. Similar bullish sentiment exists in live cattle with funds net long 129k.

USDA report on Friday. Give us a call to discuss average estimates and a plan of attack!

Have a great day!

Nathan

Source: ADMIS