Good Morning,

Overnight, soybeans rallied 18 cents after President Trump urged China to buy U.S. beans ahead of upcoming trade negotiation deadlines.

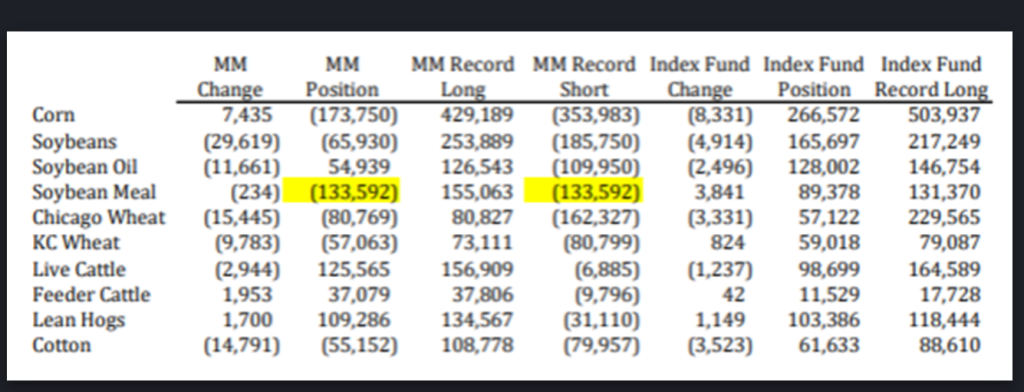

The bounce follows a week of fund selling in soybeans, with managed money now net short 65k contracts—alongside a net short of 173k in corn.

📅 WASDE report due tomorrow.

🌱 Grains

- Soybeans are higher on renewed trade talk momentum

- Funds holding sizable shorts in both beans and corn

- In our view, the WASDE release could be a volatility trigger

🐄 Cattle

Last week was extremely volatile, ending with a risk-off session on Friday.

Still, futures closed higher week-over-week despite a weaker cash market.

- Live cattle: Funds sold 3k contracts, trimming net long to 125k—still 30k shy of record length

- Feeder cattle: In my opinion, net long of 37k could prove bearish later in the year

🐖 Hogs

- Funds added lightly to lean hog positions

- August hogs expire this week

- The October contract still holds an $18 discount

Source: ADMIS

Have a great week!

Have questions about your marketing strategy? Call Nathan today! 📞 712-435-7879

Best,

Nate