Author: Author: Nathan Harris, Ag Optimus, Akron, IA Branch

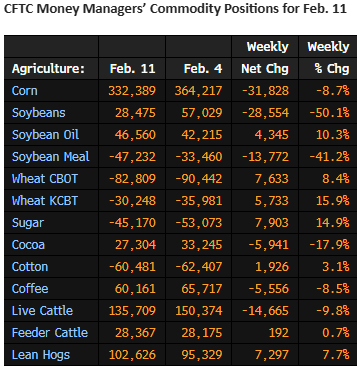

Please see below for COT data from Friday’s release. Managed Money positioning is shown in the table below. These numbers are as of last Tuesday’s close (2/11).

Source: ADMIS

Funds were relatively quiet in the grains last week. Light selling in corn and beans pulled back their net long exposure a touch. Still, the managed money crowd holds a 332k net long in corn.

On the livestock side, we saw funds sell out of a portion of their length in live cattle, taking off 14k of their net longs. Surprisingly, no liquidation is shown in feeders. The 28k net long exposure in that market is a record. In my opinion, the funds like the fundamental story in the meats, with tight supply and strong demand persisting. Still, I find the overall bullishness in these “small” markets to be a big risk moving forward. The door, particularly in feeders, isn’t big enough to unwind such a position IF/WHEN funds see a reason to exit. Funds also added to net length in hogs once again, taking their exposure back over 100k last week and pushing them to contract highs.

Reminder- February is the month we determine your crop insurance coverage levels in new crop corn and beans. We welcome the rally we’ve seen for the sake of the producer! Weather in South America is front and center at the moment, and the US is the “only show in town” when it comes to the corn export market. If we get a big spike higher going into late Feb/early March I’ll be tempted to start with a round of marketing. Give us a call if you’d like to discuss!

Have a great week!

Nathan