Author: Nathan Harris, Ag Optimus, Akron, Iowa

The CFTC released its weekly Commitment of Traders report on Friday. The report shows positions as of last Tuesday, November 5th. See the table below.

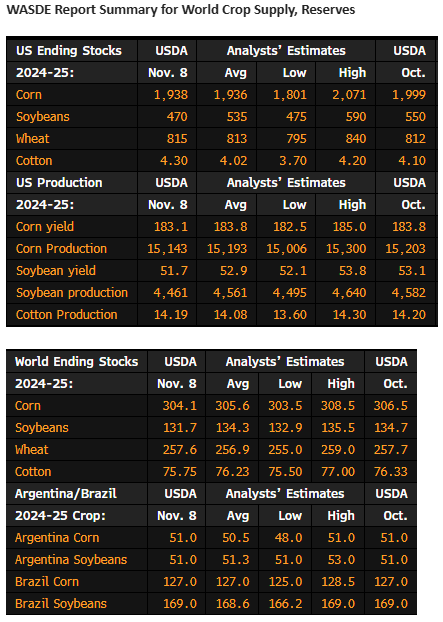

Managed Money has flipped to a net-long corn for the first time in what feels like forever. Now long 22k. We’re above the moving averages of importance, in my opinion, so funds may choose to continue pushing this market a touch. Exports have improved, and the USDA has the carryout pegged just under 2b bushel with the potential for more reductions over the winter. The funds haven’t shown the same love to the bean market; they still hold 70k net shorts. The WASDE on Friday showed a carryout of 470m bushels, which is comfortable for now.

Big ownership in the livestock markets has my attention. The Managed Money record net long in hogs of 115k contracts could potentially become a problem. For now, trends are higher, and the fundamentals seem to support the upward bias. We are watching for sell signals to trigger hedging in q1 of 2025. Note the fund roll that is taking place at the moment. Dec hogs have felt the pressure, losing $3 to Feb in just a week.

MM$ is net long 97k Live cattle and 11k Feeders as well. This feels like plenty to me, and charts are giving us reason for concern as I see it. Producers should be managing risk here, preparing for year-end fund liquidation, JUST IN CASE.

Source: ADMIS

See WASDE data below. The bean number was no surprise to those in the country experiencing significant dryness since the 4th of July. It is hard to finish a bean crop without August-September rains. Still, supplies are plentiful. A production issue in South America will be needed to turn this market into a bull.