Author: Nathan Harris, Ag Optimus, Akron Iowa

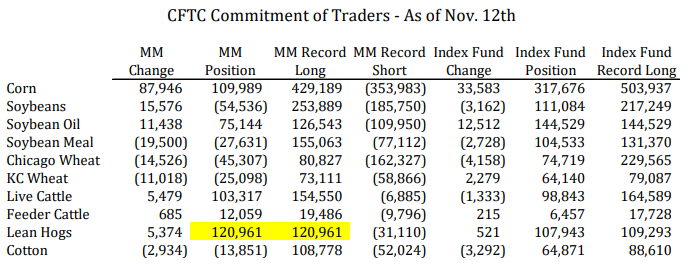

COT report data attached from Friday’s release, showing positions by reportable traders as of 11/12/24.

Managed Money added 87k contracts to its net long position in corn, pushing the total exposure to 109k contracts. The last time funds held this much length was in the spring of 2023 when the spot corn price was trading at $6.50. Domestic carryout is getting a touch smaller as low prices have brought more buyers to the table. I am concerned that the selling across the ag space will again be an anchor for corn, and the funds will give up on their long play soon. Time will tell.

Funds added 5k longs to Live cattle, 700 to feeders, and 5k to hogs. Note the record net long in hogs as of last Tuesday. The funds may have pushed a bit too far as the market reversed lower late in the week. Watch the moving averages in that market. We closed under “the numbers” on Thursday and Friday. Will funds go to the door?

Source: ADMIS

Have a Great Week!

Nathan Harris