Author: Nathan Harris, Ag Optimus

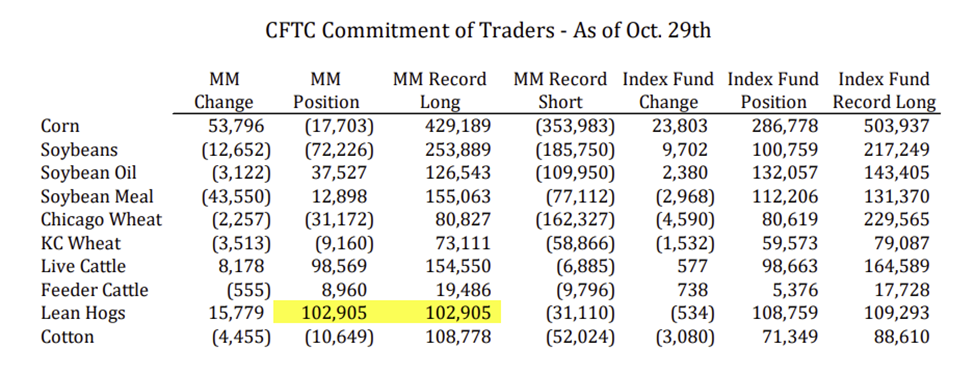

COT data below highlights managed money movement in the week ending Tuesday, Oct 29th. Tuesday, Oct 29 Publication

Source: ADMIS

Funds have covered nearly all of their net short corn position (short only 17k). MM$ holds a net short of 72k beans after adding lightly last week. The bear market in the grain space has perhaps gotten a little “long in the tooth”. Technically, the markets are showing some signs of life. It likely takes a significant catalyst to get funds to believe in the long side. Perhaps the strong export sales as of late can provide a spark?

On the livestock side, note the new record net long position of 103k lean hogs. This should come as no surprise as open interest seems to charge higher every day. Funds have also added to their net long in live cattle, pushing it to 98k.

The Goldman Roll out of Dec contracts starts Thursday of this week. With funds holding heavy exposure in the Dec hogs and cattle, it will be interesting to see how the spreads handle this move from the front to the deferreds.

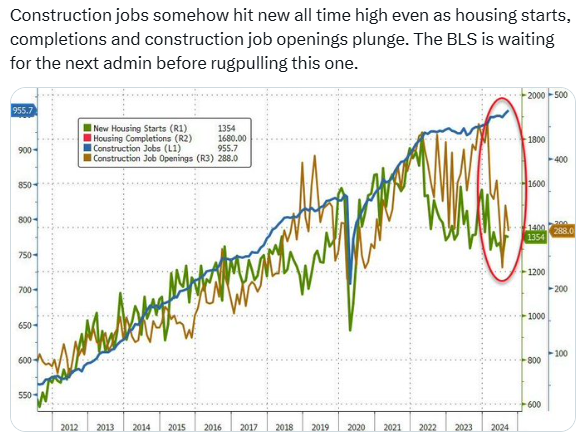

Big day, Tuesday. Markets will all be a touch jittery regardless of the results in my opinion. I am concerned with the state of the economy. It “feels” like the equity markets are plenty high. Take a look at the chart below, posted by ZeroHedge over the weekend. Plenty of scary data points to go around.

Have a great week!