Author: Nathan Harris, Ag Optimus, Akron Branch.

COT report data is attached, showing positions by reportable traders as of last Tuesday’s close.

The table below shows managed money movement. Mixed in the grains and oilseeds without much of a shift overall. Funds are still long 88k corn, short 72k beans, short a big bean meal position (73k), and short wheat (69k Chicago and 38k KC).

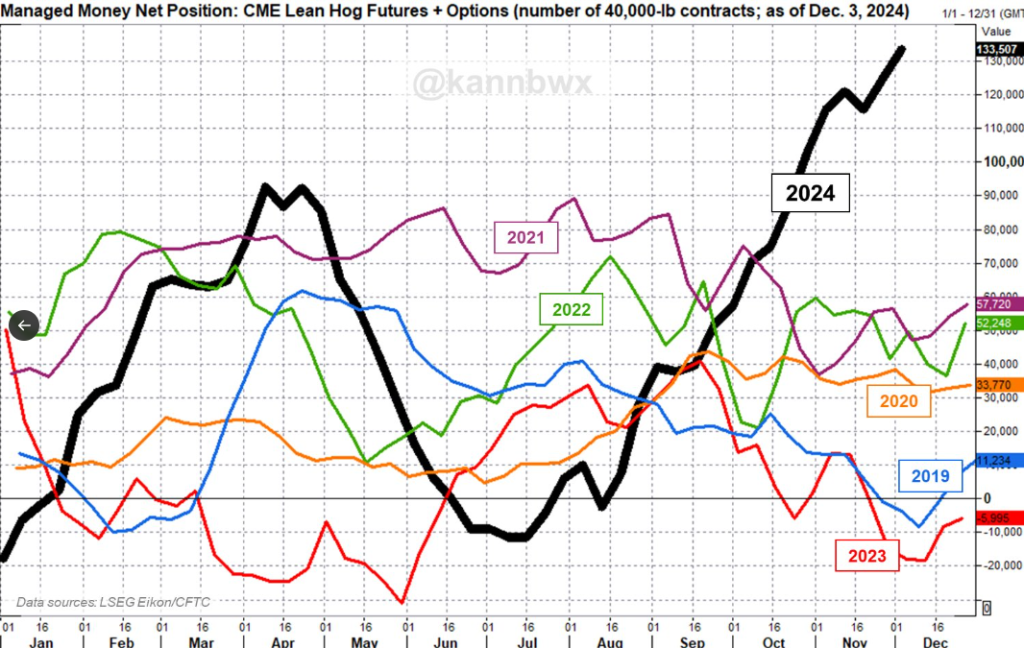

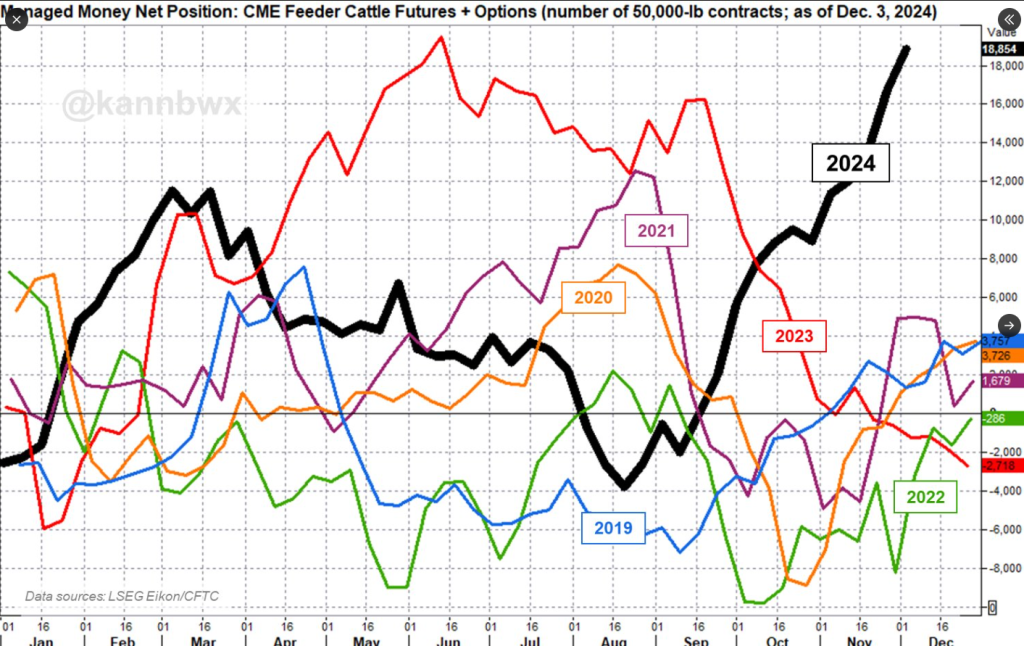

Meats continue to see interest from funds. Managed money added another 7k longs to live cattle, taking their net long up to 122k. In the feeders, another 2k contracts pushed their net long to 18,854 which is within 3 k contracts of the record. Lastly the incredible fund buying in hogs continues, with another 8k taking their net long to 133k.

This chart, posted by Karen Braun on X over the weekend (@kannbwx), shows the fund position in the hogs, and how out of the ordinary it is. When they go to the door, how will the market handle the selling???

Source: ADMIS

By the way, here’s a similar chart for the feeder cattle. The record long is 22k from 2012. As you can see, it’s unusual for managed money to hold much exposure going into year end.

Have a great week!