QUICK SUMMARY

Prices traded higher overnight led by soyoil, which stabilized bean trade. Bean bullspreads are working again, finding support after Monday’s sell-off. Morning trends feature beans gaining on corn, and soyoil on meal, as traders buy oilshare. Demand for corn and beans remains good. Corn needs to average 61 mln bu of exports/week to match the USDA projected 2.775 bln bu, beans just over 15 mln bu /week to match USDA’s 2.280 bln bu. wheat exports stand at 917 mln bu with the USDA projecting a 965 mln bu export program, which could fall short. World cash basis levels are steady/firm for corn, but bean premiums in Brazil are lower. Crush margins in China are in the red which is slowing some bean buying. Lower European wheat values are lower, with the world uncertain about Russian prices.

STORIES

China has been on the move to contain commodity prices. China stated they would strengthen price controls on iron ore, copper, corn and other major commodities in its 14th five year plan from 2021-2025 to address abnormal fluctuations.

WEATHER

US weather is warm but this week will feature cooler conditions mid-week which could persist through the first week of June. Close to 1″ of rain is expected for many parts of the US, with Crop Watch 2021 stating that up to 1″ could hit parts of Ill., Iowa, Neb., and Kansas. Western IOwa needs more rainfall along with Ohio. Minnesota received more than 3″ of rainfall in the last few days after a historically dry April and May. Brazil continues to pick up showers in the very south but cannot help what has already been lost. Gist of the weather is bearish.

REPORTS

Crop progress: Note: conditions will start next week. corn: 90% planted vs. expected 91%, Emergence: 64%, with Kansas and Colorado behind. beans: 75% planted vs. 61% wk ago and vs. 5-yr ave of 54%. Illinois is 80% planted vs. 53% ave., Iowa at 89% planted vs. 66% ave. Louisiana lags the pace at only 58% done vs. 85% ave. Emergence: 41% vs. 25% ave. Spring wheat: 94% planted and 45% good/excellent winter wheat: 67% headed vs. 69% average. Lowered 1% to 47% good/excellent. Progress report was negative, but probably now factored into prices. From NASS: NASS announced in the first two weeks of June they would gather information about this season’s crop production, supplies of grain in storage, and livestock inventory. This information will help producers, suppliers, traders, buyers and others to make informed business. The result will be available on June 24 in the Hogs and Pigs report and on the June 30 Acreage and Stocks report.

ANNOUNCEMENTS

Australia’s wheat crop could be a record as good APril and so far in May have helped to boost soil moisture levels. The state weather bureau recently placed an 80% chance that over the next three months above average precip would be seen in key growing areas of Southern Australia and New South Wales, with average rainfall in AUstralia, the largest wheat producing state. Calls are as follows: beans: 8-10 higher meal: 1.8-2.20 lower soyoil: 80-90 pts higher corn: 3 1/2-4 1/2 lower wheat: steady/mixed Nov. canola: 1.00 lower Outside markets have crude oil prices trading lower to $65.41/barrel, and the US dollar falling to 89.53. The stock market is 80 pts. higher.

TECH TALK

July soyoil established double lows at 6450c last week, and the bounce over 66c sets the market in motion to rally again. Though sell-stops were triggered under 6450c, the market did find its footing and a nice bounce in re-establishing its uptrend. Look for prices to now target 6750c to 68c. Jul meal prices test $395.00 with a low of $396.00, and once again appears ready to keep hold of this level as value. The market lows appear ready to receive another test, however, as meal prices are once again back under $400.00. Continue to scale-down price towards $395.00, and keep some aside in case this major level is violated. July beans build on gains over $15.15, turning higher from lower. This is the first start to trading range activity, and would look to target $15.50/$15.55 high end. Likewise it appears that November beans established a trading range at $13.40 and is ready for retracement towards $13.80. Would view this as a likely range heading into the 3 day weekend. July wheat prices found its downside target of $6.55, and as if typical of this market is now trading between the 50 day moving average of $6.70 and the 100 day at $6.65. That still does not represent stability despite the bounce, and would need a close back over $6.75 in order to do so. Would look for another possible leg lower, and a likely test of $6.55 again. July corn is congesting in a triangle pattern at the bottom of the large break from last week, trading between major support at $6.35 and major resistance at $6.70. The ADX trend has weakened so would look to move sideways from $6.35 to $6.75. For now, would prefer to own breaks rather than to be short, particularly if the market moves to the upside of $6.80 where there is no back resistance to stop a further rally. December corn closed its small down-side gap from yesterday with trade at $5.43, but that now becomes resistance as prices begin lower on the day. Look for any pullback towards the 50 day moving average of $5.26 as a buying, pricing, or short-covering opportunity for now should we break down there.

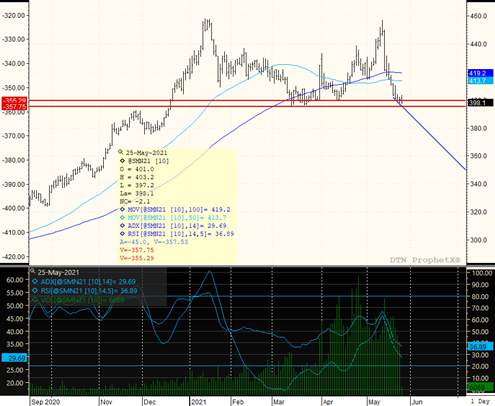

JULY MEAL

A weaker trend sends prices down to major support and monthly lows at $395.00, a level that has held since last March and appears ready to do so as well again. The market is trending towards oversold, but not significantly so to warrant a major upward correction. Prices turn higher from lower, and back over $400.00, but still need to trade back over the downtrend channel on the chart at $410.00 to stabilize. Still, if needing to price this down-turn is presenting a good opportunity to do so, given that prices have been on the cusp of breaking down before. THe ADX trend at 28 denotes weak trend, so buyers should be heads up

.

Receive Relevant and Timely Grain Market Reports that Matter!

Get updated twice a week with concise, direct information that you can use in grain trading, marketing, and farm management

Better yet, become a customer and get DAILY updates, fundamental, and technical, sent straight to your Inbox! Contact Us now to get started.

RISK DISCLAIMER: Trading in commodity interest products such as futures, options and otc swaps entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. The placement of contingent orders by you or broker, or trading advisor, such as a stop-lossor stop-limitorder, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Long options strategies could lose their entire premium plus transactional costs. Short options strategies entail unlimited risk of loss plus transactional costs. The information presented represents the opinion of Ag Optimus. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Futures prices factor in the seasonal aspects of supply and demand. This communication may cite historic data and should not be taken to mean certain trades can produce dramatic profits year in and year out. This information does not imply customers have or will experience profits based on seasonal trades or trade data. All information, communications, publications, and reports, including this specific material, used and distributed by Optimus Futures, LLC (“Optimus”) shall be construed as, or is in the nature of, a solicitation for entering into a derivatives transaction. Optimus does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This email may include information produced by third parties. Material not labelled Optimus Futures should be considered to be third-party, and is provided for informational purposes only. Third-party material is from sources believed to be reliable, but its accuracy is not guaranteed by Optimus Futures. Optimus Ag and Ag Optimus are registered dbas of Optimus Futures LLC [NFA ID 0481133] CONFIDENTIALITY NOTICE: Privileged/Confidential information may be contained in this message. If you are not the intended recipient, please notify the sender immediately and you must not use the message for any purpose nor disclose it to anyone. Communications on all mediums may be recorded.