Prices were mixed overnight with corn starting the evening on the defensive and beans higher as more inter-market spread trade, buy bean/sell corn trade, continued. Higher soyoil prices once again helped beans to trade upward, though by morning veg oils were mostly two-sided. Export sales will be released Friday morning as it is Veteran’s day today, a banking and federal holiday.

Corn: The EIA report for ethanol yesterday showed a 6% WOW slide in production, which would consume 5.5 bln bu of corn. Ethanol stocks were slightly higher to 852 mln glns. Ethanol margins remain very favorable, with more analysts believing ethanol demand could be 150-200 mln too low as margins remain profitable into Q1 2022. Exports remain tepid for both corn and beans, running well behind yr ago. China continues to purchase Ukraine corn, while US wheat loses out to the Black Sea. China’s Dalian corn prices continue to rise suggesting tight supplies, and a better potential to at some point buy US origin.

Beans: China seems to be waiting for Brazil beans to arrive, as the daily export sales system remains quiet. A fast planting pace in Brazil due to good weather is resulting in falling soy prices. Brazi’s Safras and Mercado showed that bean port premiums at Paranagua are 130c/bu for Jan, and 50c/bu for Feb, vs. 125c yr ago for Feb. when drought delayed planting.

Wheat: futures targeted higher prices again on the back of positive technicals and a continued story that fed the bull. Headlines yesterday were that Russia would continue to put on wheat export quotas while prices there continue to rise. EU may need to ration demand, and Australia is having quality issues due to too much rain.

WEATHER – Harvest is in the final stages and the next 10/14 days plus long term maps turn back to normal coverage. Brazil weather remains favorable with widespread showers in the north, with small pockets in the south trending a bit drier. All told the weather in SA remains bearish. Excessive moisture in Australia could bring problems for wheat and canola, hurting quality.

REPORTS

Weekly broiler hatchery date found broiler eggs sets up 7% YOY, with actual broilers placed down 1% YOY.

DELIVERIES

Nov beans: 283

ANNOUNCEMENTS

Brazil’s CONAB released production figures:

beans: 21/22 at 142.0 mmt vs. 140.75 mmt prev.

total corn: 21/22 at 116.71 mmt vs. 116.31 mmt prev.

Russian exports of wheat decreased to 23.9 mln tonnes in the first nine months of 2021 from 24.7 mln tonnes a yr ago, official customs data showed.

Calls are as follows:

beans: steady/firm

meal: 1.20-1.30 higher

soyoil: 25-35 lower

corn: 1-1 1/2 lower

wheat: 1 lower

Outside markets show crude oil breaking down to $80.20/barrel with the US dollar trading higher to 95.04. The higher US dollar is negative this AM for wheat. Stocks are up 35 pts.

Tech talk:

Soy: The Jan. bean reversal likely showed the trading range into the Thanksgiving holiday, which appears to now be from $12.00-$12.50. The ADX has softened again to 14 which is more typical of a market that is likely to chop sideways. Would look for prices to perhaps pivot 20-25c around $12.25, but breaks may not follow-through to the downside as before the numbers were released. December meal is congesting at higher levels with the lower end of the trading range now moving up to $330.00, while the top of the market could be a bit higher if prices can climb over the 100 day moving average of $345.00. Target high is $350.00, and would look for an eventual $325.00-$350.00 trading range. December soyoil futures trades from 58c-60c, moving sideways for the time being. Overall trading range remains 58c-65c. The chart is still favorable for a further upmove, so would continue to take profits on major corrections.

Grains: December wheat chart continues to climb higher, with prices once again back over the $8.00 towards recent highs. Lines of support continue to look strong on the chart while the major move is higher. After stabilizing at $7.60 the trade back over $8.00 suggests that the overall highs have not been set. Would look to target $8.12/$8.15 which is next visual trendline resistance. December 21 corn prices evolve higher, but the price action here is more congestive. Trading range is from $5.45-$5.85, and the trend remains sideways for now. However, the ADX trend has strengthened to 26 which means that traders will be there to own breaks of size. Would look for any pullback towards $5.55 to $5.60 as a buying opportunity now.

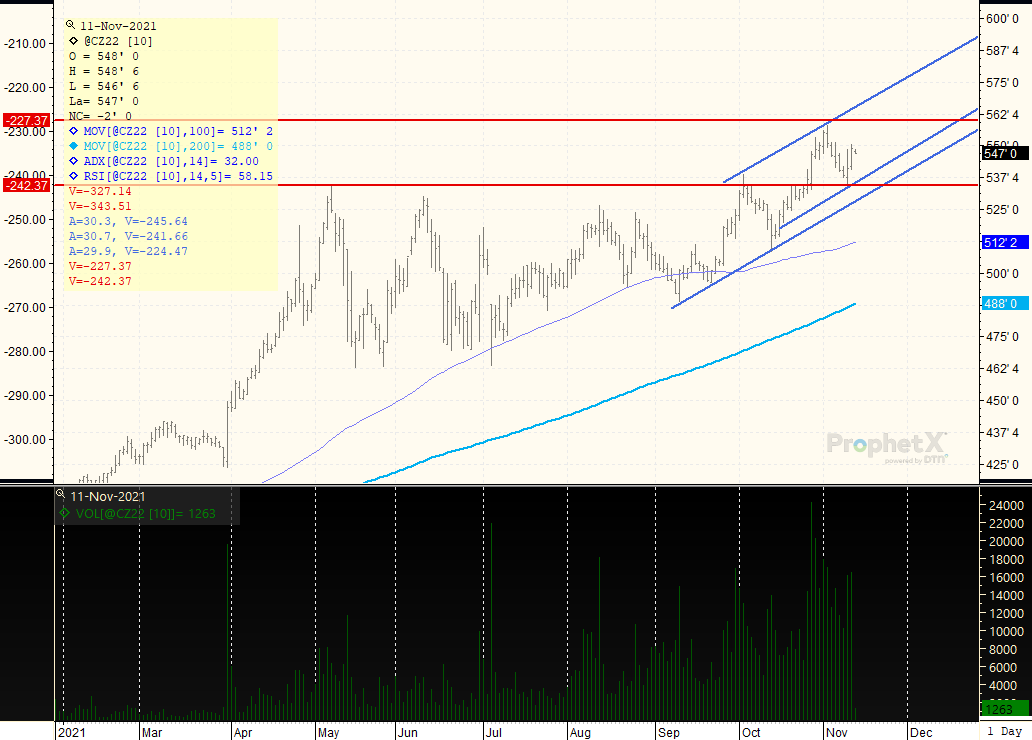

DECEMBER CORN 2022: The major move is sideways/higher, with the uptrend strong with an ADX of 32, meaning buyers will be interested in owning pullbacks. The overall trading range for now as shown between the red lines is from $5.35 up to $5.58. Would look for corrections to the downside to hold, as the trend is clearly higher. Target highs over $5.60 includes a trade towards $5.75/$5.80. Until the current uptrend channel is broken with a close under $5.35, the ability to trend towards new highs is likely.

Receive Relevant and Timely Grain Market Reports that Matter!

Get updated twice a week with concise, direct information that you can use in grain trading, marketing, and farm management

Better yet, become a customer and get DAILY updates, fundamental, and technical, sent straight to your Inbox! Contact Us now to get started.

RISK DISCLAIMER: Trading in commodity interest products such as futures, options and otc swaps entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. The placement of contingent orders by you or broker, or trading advisor, such as a stop-lossor stop-limitorder, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Long options strategies could lose their entire premium plus transactional costs. Short options strategies entail unlimited risk of loss plus transactional costs. The information presented represents the opinion of Ag Optimus. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Futures prices factor in the seasonal aspects of supply and demand. This communication may cite historic data and should not be taken to mean certain trades can produce dramatic profits year in and year out. This information does not imply customers have or will experience profits based on seasonal trades or trade data. All information, communications, publications, and reports, including this specific material, used and distributed by Optimus Futures, LLC (“Optimus”) shall be construed as, or is in the nature of, a solicitation for entering into a derivatives transaction. Optimus does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This email may include information produced by third parties. Material not labelled Optimus Futures should be considered to be third-party, and is provided for informational purposes only. Third-party material is from sources believed to be reliable, but its accuracy is not guaranteed by Optimus Futures. Optimus Ag and Ag Optimus are registered dbas of Optimus Futures LLC [NFA ID 0481133] CONFIDENTIALITY NOTICE: Privileged/Confidential information may be contained in this message. If you are not the intended recipient, please notify the sender immediately and you must not use the message for any purpose nor disclose it to anyone. Communications on all mediums may be recorded.