Overnight prices proceeded with caution after last week’s rally. Strength did not fade, although corn prices have suddenly become the sell leg of both wheat and beans. Oilshare Monday found traders booking profits, as meal has found a surge off the lows. This morning soyoil futures are higher as crude oil prices gain as well along with palm. This week Biden and Xi will hold a call to discuss trade and tariffs.

Beans got a lift from business confirmations, higher crush numbers, and chatter that China has been in the market. The meal led rally always is a helpful input for bean prices, and the funds flipping from a short to long meal position only helps the bean bull’s cause. Crush margins remain robust, and talk of meal substitution feed for animals in place of higher priced lysine stimulates the market to move higher. Lysine shortages may even increase some corn into feed rations along with meal for pigs and poultry, or at least the market is talking about it. The type of rally in meal this week felt a bit as though shorts were being squeezed out, caught flat-footed by the rally. A strong meal basis is also adding strength. Technicals help as well, with market watchers looking at the fulfillment of a key reversal in beans as well as a solid uptrend in meal. Egypt tendered after the close for 30,000 tmt of soyoil, but no purchase has been made.

Demand remains on a better path, weekly bean inspections higher. China totaled 1.318 mmt in yesterday’s inspections report, with marketing year to date still off 29% from yr ago. Ocean freight rates are beginning to head lower off their recent high which will help exports. Crush margins remain good, and the NOPA report yesterday was positive for beans but negative for soyoil stocks, which grew to 1.835 bln lbs. Meal production was higher at 4,288,928 st, up from a month ago. Corn inspections were OK with year-to-date shipments at 6.979 mmt vs. 8.465 mmt yr ago.

WEATHER – Harvest will likely come to a close as the weather has permitted most places to clean up. The US needs rainfall in the Plains, with scattered showers elsewhere on Thursday.

Brazil has widespread rains with pockets of concerns for dryness in central and southern areas. La Nina concerns remain in place for Argentina and southern Brazil.

REPORTS

Commitment-of-traders report (COT) disaggregated futures / options combined as of Nov. 9:

beans: net long 12,127

meal: net long 9,299

soyoil: net long 72,605

corn: net long 319,609

wheat: net long 3,328

Funds sold out a bit of corn length and flipped from a net short meal position to a net long one. Funds are basically even now in beans, holding the smallest position of the season.

Crop progress:

corn: 91% harvested vs. 94% yr ago, and 86% ave.

beans: 92% complete vs. 87% wk ago.

winter wheat: 94% planted vs. 96% yr ago and 94% ave. Emerged: 81%, vs. 84% yr ago and 83% ave. Conditions are 46% good/excellent.

ANNOUNCEMENTS

Brazil’s bean planting pace reached 78%, while dry weather concerns are now coming into focus, as reported by Agrural. Some areas with too much rain are raising quality concerns.

Japan confirmed bird flu H58 at a poultry farm in the third outbreak of influenza so far this winter, the Ag ministry reported.

India’s cost for veg oil was 63% higher in 20/21 to a record 1.17 trillion rupees, ($15.71 bln), as overseas prices surged.

Calls are as follows:

beans: 1-3 lower

meal: 1.20-1.60 higher

soyoil: 70-80 pts higher

corn: 1-2 lower

wheat: 3-5 lower

Tech talk:

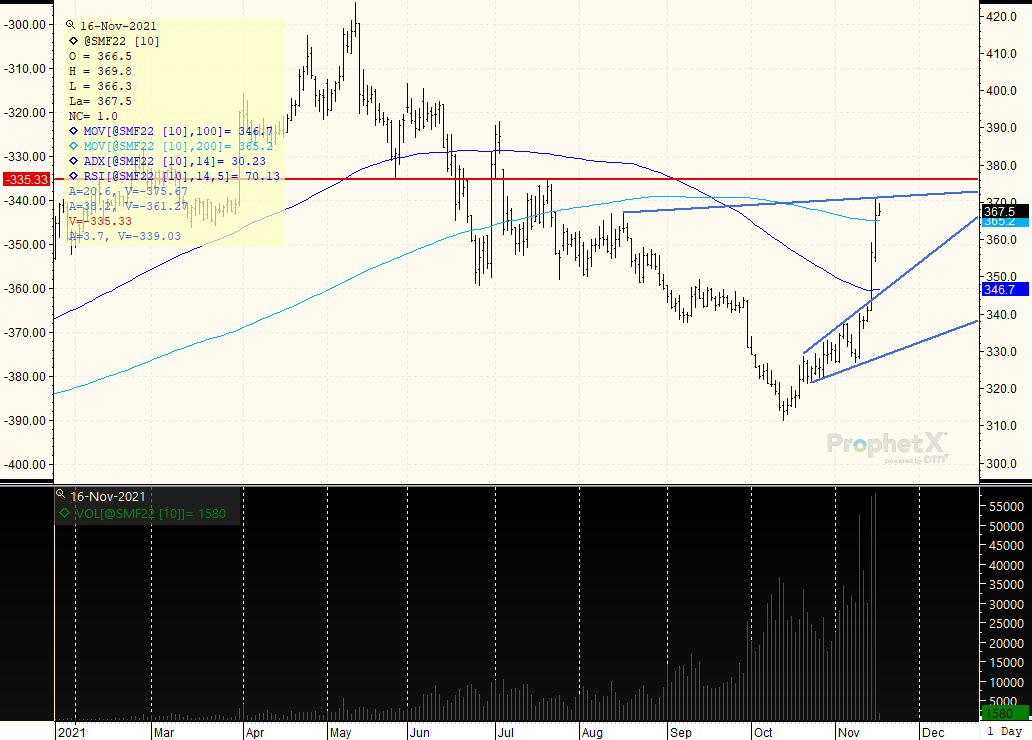

Soy: Jan meal continues to rally with two vertical days of higher trade, forming a potential pole for an eventual bull flag. Prices are verging on overbot at 70%, but once meal places a new high it typically places on more before pulling back. Target high is now $375.00 given the chart construct. Jan beans now bump up against key resistance from $12.55-$12.65. The downtrend has dissolved post USDA report with lower support in a trading range now moving up to $12.10, and any trade beyond $12.65 having the potential to move prices towards the two converging 100 and 200 day moving averages of $13.00. The trend ADX of 14 suggests that this will continue to be a go-slow rally, unlike the meal chart. Jan soyoil is starting to trend sideways from 57c to 60c, would if short would probably take something off the table. THis is still very much appearing like a sideways trade for a market that could quickly recover and trade back over 60c again towards 62c. Would consider the Jan soyoil market a 57c to 62c trading range, and we are just at the bottom.

Grains: March corn trades sideways from $5.65 to recent highs of $5.93 1/2. The current week features a pennant pattern of price congestion, with an ADX of 30 meaning buyers will still be looking for good pullbacks to own. Double lows of $5.75 are in place, but anything under this level would promote a bit of profit-taking, sending prices back towards $5.65. The chart is still more constructive than bearish, so could straddle/strangle this level with the potential to target $6.00. March wheat takes a time out from its recent rally from $8.40 and would look for further weakness as some minor resistance is beginning to form at the top from $8.35-$8.40. A target high over $8.40 is $8.50, but the market is attempting to alleviate some overbot signals now which have climbed to 70%, (anything over 70% is verging on overbot and signaling that a correction could take place).

JANUARY MEAL: After hitting a season low of $311.20 the market has rebounded and is now trading strongly above both the 100 and 200 day moving averages. These moving averages will now turn into support as the market targets higher ground. The vertical advances suggest the rally is a combination of new buying but short-covering as well. Turnover has been high which is supporting firmer price action as well. The minor resistance for today crosses at the high of $370.00, but the potential is for prices to target the summer July highs of $375.00 before reversing. At the very least the sharp upside break-out pulls up the trading range from what was a $311.00 to $350.00 high to $345.00 to possibly a $375.00 or higher target.

Receive Relevant and Timely Grain Market Reports that Matter!

Get updated twice a week with concise, direct information that you can use in grain trading, marketing, and farm management

Better yet, become a customer and get DAILY updates, fundamental, and technical, sent straight to your Inbox! Contact Us now to get started.

RISK DISCLAIMER: Trading in commodity interest products such as futures, options and otc swaps entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. The placement of contingent orders by you or broker, or trading advisor, such as a stop-lossor stop-limitorder, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Long options strategies could lose their entire premium plus transactional costs. Short options strategies entail unlimited risk of loss plus transactional costs. The information presented represents the opinion of Ag Optimus. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Futures prices factor in the seasonal aspects of supply and demand. This communication may cite historic data and should not be taken to mean certain trades can produce dramatic profits year in and year out. This information does not imply customers have or will experience profits based on seasonal trades or trade data. All information, communications, publications, and reports, including this specific material, used and distributed by Optimus Futures, LLC (“Optimus”) shall be construed as, or is in the nature of, a solicitation for entering into a derivatives transaction. Optimus does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This email may include information produced by third parties. Material not labelled Optimus Futures should be considered to be third-party, and is provided for informational purposes only. Third-party material is from sources believed to be reliable, but its accuracy is not guaranteed by Optimus Futures. Optimus Ag and Ag Optimus are registered dbas of Optimus Futures LLC [NFA ID 0481133] CONFIDENTIALITY NOTICE: Privileged/Confidential information may be contained in this message. If you are not the intended recipient, please notify the sender immediately and you must not use the message for any purpose nor disclose it to anyone. Communications on all mediums may be recorded.