Prices are firmer this AM. Wheat prices are leading the way once again on more reports of active tenders. US wheat follows a strong European performance. Beans are higher as reports are that China has been purchasing a combination of US and Brazilian beans. China’s crush margins have been good, and the price drop via macro market concerns over the variant was a buying opportunity.

Spreads are firm as well indicating that there was export activity taking place. Corn spreads are firmer on a stronger basis which is helping to get corn into the pipeline given futures that are staying within trading ranges. As to corn acreage, Scott Irwin from the Univ of Illinois stated that it would most likely rise 3% for 2022 in spite of soaring fertilizer prices, putting the amount close to 96.0 mln vs. 93.3 mln in 2021.

WEATHER – US plains still are in need of more rainfall while a drying pattern begins for SA. To this point, the drying pattern is not a worry, but southern Brazil and Argentina weather bears watching.

REPORTS

Export sales:

beans: 21/22 net 1.56 tmt and 22/23 net 6,000 tmt (vs. an expected 800-1.8 tmt)

meal: 21/22 net 136,900 tmt and 22/23 net minus 800 tmt (vs. an expected 100-200,000)

soyoil: 21/22 net 42,000 tmt (vs. an expected 30,000-60,000 tmt)

corn: 21/22 net 1.43 tmt and 22/23 net 90,000 tmt (vs. an expected 600-1.25 tmt)

wheat: 21/22 net 105,900 tmt (vs. an expected 150-600,000 tmt)

Exports were better than expected as lower prices seemed to find demand. Wheat was low end as global competition continues to outpace the US, with 79,900 sold for 21/22 which was a marketing year low and down 80% from the prior 4-wk average, according to the USDA. Corn and beans were respectable but in line with expectations. Buyers for corn were traditional, with traders still looking for signs of China.

USDA Oct. monthly grain crush:

crush: 5.908 mln tns vs. 5.858 mln tns expected

soyoil ending stocks: 2.386 bln lbs vs. 2.34 bln expected

meal: 363,969 tons

Oct. 2021 corn for fuel alcohol: 469,312 mln bu

ANNOUNCEMENTS

Brazil’s trade ministry forecast Nov. 2021 bean exports at 2.59 mt vs. yr ago at 1.44 mln mt.

Russia’s ag ministry estimated total grain harvest at 126.3 mln mt, vs. 137.8 mln mt yr ago, which includes 79.0 mln mt of wheat and 15.6 mln mt of corn.

Argentina’s crushers group CIARRA_CEC estimated Nov. ag export value at just over $2 bln, which was off 15.4% from oct, but up 17.7% vs. yr ago.

DELIVERIES

meal: 1

corn: 2

wheat: 204

Calls are as follows:

beans: 5-7 higher

meal: 2.80-3.50 higher

soyoil: 10-20 pts higher

corn: 5-7 higher

wheat: 13-15 higher

Outside markets have the Dow up 250 pts with crude oil prices trading down to $65.17/barrel, and the US dollar weaker at 95.82.

Tech talk:

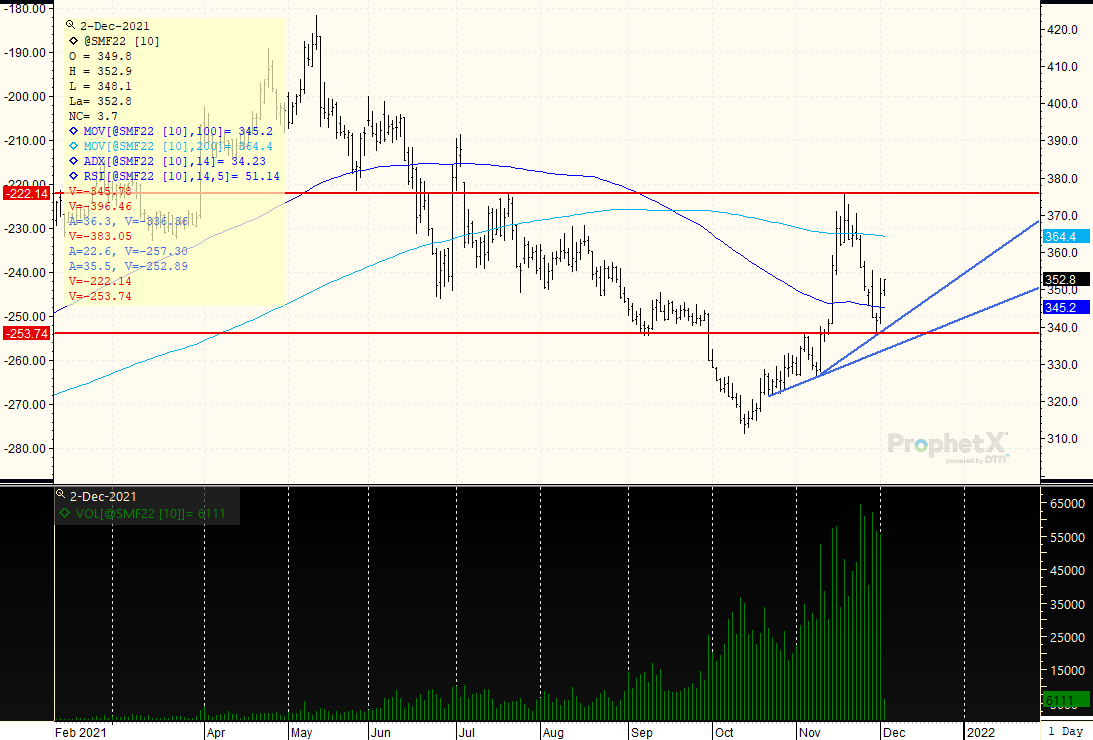

Soy: Jan bean prices finds support at the $12.20 level and is once again building on gains. The ADX is weak at 16 indicating that sideways is still the major direction for now. Would look for a trend towards $12.20-$12.80, with prices needing a close over $12.50 to work higher. Jan soyoil chart is still more vulnerable to a further break-down, posting a new low for the break today at 5459c. Prices are closing in on the last monthly low of 5425c, but there is no real stability here. The ADX has moved to a weak 16, and prices are trending towards oversold status. If short, the cycle low of 5425c is close and prices are back over 55c. Would still look for a congestive trade here from 55c to 58c into the month of December. Jan meal chart is more positive with major support now defined at visual trendline support of $338.00, with a nice bounce back over the 100 day moving average line of $345.00. WOUld look for meal to continue to find strength on pullbacks as we trade into a $345.00-$375.00 range.

Grains: March corn remains a sideways affair from $5.62 to $5.96, recent highs. The fall to $5.62 likely marks a trading range low as prices begin to trend back towards the middle of the trading range with a move back towards $5.80. Given that the major direction has been higher to this point, would look for prices to be able to rally back towards a $5.90 high, and for pullbacks to be buying opportunities as prices bounce up and away from the low this week. March wheat also confirms that its uptrend is fully intact, trading back over $8.00. The low of the break at $7.82 1/2 marks a cycle break for a trading range that could adjust back up to $8.00-$8.75. Though the uptrend has weakened a bit with an ADX falling to 30, still think the path of least resistance now is higher. Would look to trend into the middle of the range at $8.35/$8.40.

JANUARY MEAL: The uptrend here remains strong with prices confirming a likely trading range low on the break this week at $340.00, with a current high at $375.00. The bounce back over the 100 day moving average of $345.00 shows that this market remains firm, and if needing to price have to take advantage of breaks in order to do so. The 200 day moving average is at $365.00, and becomes a target high on further strength. Would look for the strong possibility given the ability to bounce and hold lower support that prices move back towards the middle of this range, and at least up to the 200 day MA.

Receive Relevant and Timely Grain Market Reports that Matter!

Get updated twice a week with concise, direct information that you can use in grain trading, marketing, and farm management

Better yet, become a customer and get DAILY updates, fundamental, and technical, sent straight to your Inbox! Contact Us now to get started.

RISK DISCLAIMER: Trading in commodity interest products such as futures, options and otc swaps entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. The placement of contingent orders by you or broker, or trading advisor, such as a stop-lossor stop-limitorder, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Long options strategies could lose their entire premium plus transactional costs. Short options strategies entail unlimited risk of loss plus transactional costs. The information presented represents the opinion of Ag Optimus. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Futures prices factor in the seasonal aspects of supply and demand. This communication may cite historic data and should not be taken to mean certain trades can produce dramatic profits year in and year out. This information does not imply customers have or will experience profits based on seasonal trades or trade data. All information, communications, publications, and reports, including this specific material, used and distributed by Optimus Futures, LLC (“Optimus”) shall be construed as, or is in the nature of, a solicitation for entering into a derivatives transaction. Optimus does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This email may include information produced by third parties. Material not labelled Optimus Futures should be considered to be third-party, and is provided for informational purposes only. Third-party material is from sources believed to be reliable, but its accuracy is not guaranteed by Optimus Futures. Optimus Ag and Ag Optimus are registered dbas of Optimus Futures LLC [NFA ID 0481133] CONFIDENTIALITY NOTICE: Privileged/Confidential information may be contained in this message. If you are not the intended recipient, please notify the sender immediately and you must not use the message for any purpose nor disclose it to anyone. Communications on all mediums may be recorded.