✅ Key Takeaways:

- Grains remain under pressure from managed money—watch weather shifts closely.

- Wheat saw some short-covering, worth tracking for follow-through

- Livestock continues to lead—speculative support remains firm

- Moisture trends and export demand will shape next fund moves

Author: Nathan Harris, Ag Optimus, Akron, IA Branch

Managed Money Trends | Weather Outlook | Grain & Livestock Positioning

FTC COT Recap – May 20 Data (Released May 23)

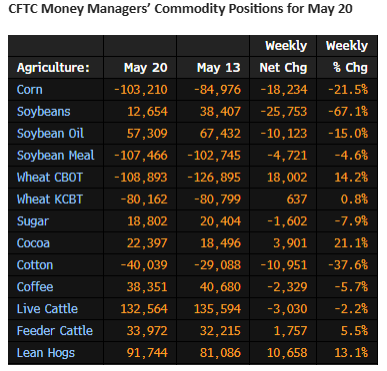

The CFTC released its Commitment of Traders (COT) report on Friday, May 23, detailing fund positions as of Tuesday, May 20. The data shows continued bearish sentiment in row crops, while livestock remains heavily favored by speculative money.

🌾 Grains: Funds Stay Bearish—Except a Hint of Short-Covering in Wheat

Managed money remains net short in:

- Corn

- Soybean Meal

- Chicago Wheat

However, funds reduced their short wheat exposure by buying back 18,000 contracts in Chicago Wheat—potentially a sign of caution or profit-taking.

🌱 Weather outlook:

- So far, conditions across the Corn Belt remain non-threatening

- Some pockets of dryness exist

- Subsoil moisture is lower than last year, meaning timely rains will be critical moving forward

🔍 Bottom line:

Funds currently see no need to add a weather risk premium to row crops.

🐂 Livestock: Managed Money Keeps Buying Dips

Livestock remains the darling of the ag sector:

- Live Cattle: Net long 132,000 contracts

- Feeder Cattle: Net long 34,000 contracts

- Lean Hogs: Net long 91,000 contracts

💬 Funds continue to buy dips and push markets toward new highs whenever momentum allows. The persistent strength in positioning suggests bullish sentiment remains intact.

Images: ADMIS

Have questions about your marketing strategy? Call Nathan today! 📞 712-435-7879