Author: Nathan Harris, Ag Optimus, Akron, IA Branch 🌐

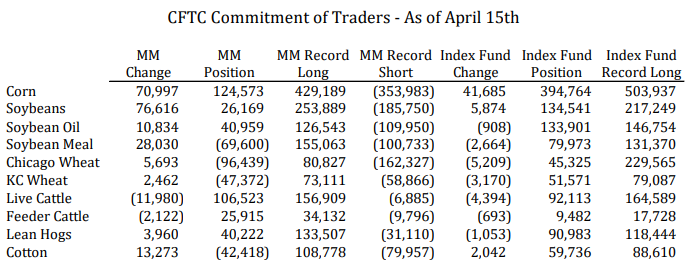

COT data for the week ending April 15 shows a clear pattern: managed money is pouring into the grain markets. The driver? A classic “flight to quality”, in our opinion, as investors seek safety in tangible assets like gold and agricultural commodities.

With the stock market and U.S. dollar under pressure once again this morning, gold has surged to new overnight highs—fueling continued buying across the grain complex.

🌾 Grain Markets: Benefiting from Macro Uncertainty

- Funds were net buyers across grains

- In our opinion Gold’s breakout signals deepening inflation and currency hedging behavior

- Soft equities + weak dollar = fund support for tangible commodities

🐄 Livestock: Rebound After Early Selling

Selling pressure in live cattle and lean hogs was limited to the early part of the week.

By Wednesday, funds had resumed buying, cleaning up their positions and reestablishing length:

- Live Cattle: Net long 106,000

- Lean Hogs: Net long 40,000

Despite early weakness, this shows renewed fund interest in livestock, potentially supported by technical stabilization and improved cash signals.

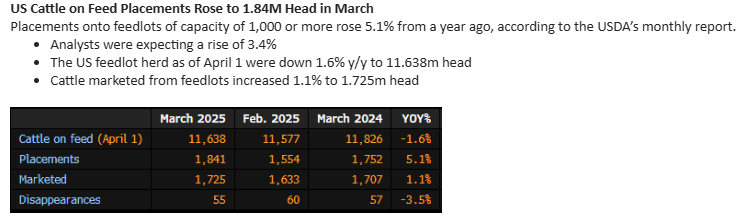

📉 Cattle on Feed: Slightly Negative

The Cattle on Feed report was mildly bearish, with placements above expectations.

However, this was measured against unusually light placements from March last year.

On the positive side, cash cattle markets surged Thursday—just ahead of the long weekend.

Still, packers are feeling the pinch, struggling to move product at current levels.

Their only real tool—kill cuts—hasn’t been effective enough to relieve margin pressure.

Images: ADMIS

✅ Key Takeaways:

- Grains are receiving broad fund support amid macro stress

- Livestock markets are holding ground, with technical rebounds underway

- Packers and cash trade remain key pressure points in cattle

- Watch gold, dollar strength, and equity trends as directional cues

Have a Great week!

Nathan

Have questions about your marketing strategy? Call Nathan today! 📞 712-435-7879