Author: Nathan Harris, Ag Optimus, Akron, IA Branch

Good morning,

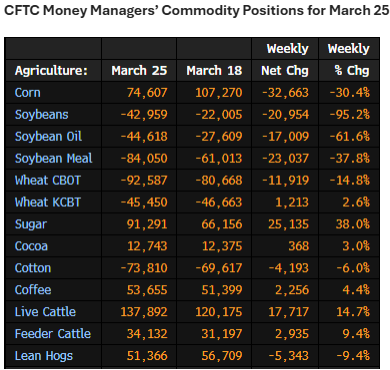

COT data from Friday’s release is attached.

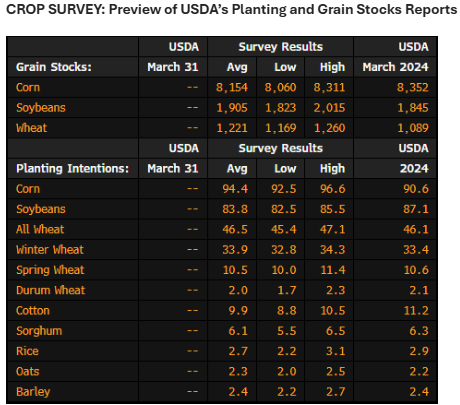

Today wraps up the month, the first quarter, and brings with it two major market-moving USDA reports:

📊 Prospective Plantings & Grain Stocks.

March 31 is always a wild day in our industry. Buckle up!

🌽 Grains: Funds Selling Across the Board

💰 Money flow is king—and this week’s Managed Money table tells the story:

(opinion)

Funds were sellers of all CBOT grain/oilseed products and buyers of the cattle complex during the week ending March 25.

- Corn: Net long position trimmed to just 74k

- Soybeans: Net short 42k, with some short covering seen since Tuesday

📉 Analysts expect a big bump in corn acres, likely at the expense of beans and cotton.

🛑 I believe beans are still the sleeper. I think funds will be spooked out of their short bias at some point this growing season.

👀 For now, we wait and see what today’s USDA numbers bring.

Temptation: Buy the bad news. But I’m holding off on any big directional plays… for now.

🐄 Cattle: Gravity-Defying Fund Length

- Feeder Cattle: New record—34k net long

- We believe strong cash feeder prices justify the position, but caution is still warranted.(opinion)

- When the exit door gets crowded, it’ll be tight

- Live Cattle: Now estimated at 145k+ net long

- Funds added significantly on Wednesday and Thursday

📌 Positioning feels heavy. Timing, as they say, is everything!

🐖 Hogs: A Choppy March & Tariff Troubles

- Quarterly Hogs & Pigs report: Less supply than expected

- But tariffs are keeping traders on edge

- March has been choppy, with Managed Money uncertain

📉 Funds have reduced their net long from a record earlier this year to just 51k as of March 25.

This week—dubbed “Liberation Week” by some—could give us clarity on tariff impacts.

Images: ADMIS

Let’s see what the USDA serves up today.

Have a great week! Have questions about your marketing strategy? Call Nathan today! 📞 712-435-7879