Author: Nathan Harris, Ag Optimus, Akron, IA Branch

Good Morning!

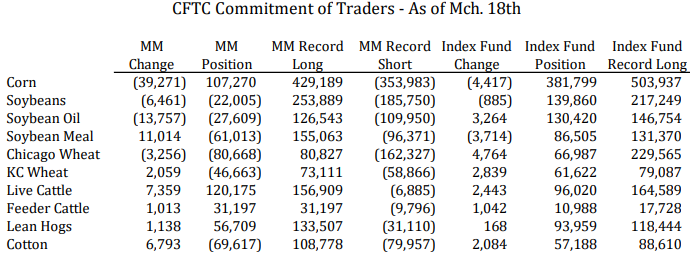

Friday’s CFTC Commitment of Traders report showed what we believe to be a clear trend:money is flowing out of grains and into cattle. See the table below for a full breakdown.

Image: ADMIS

🌽 Grains: Funds Keep Liquidating Corn & Adding to Bean Shorts

- Corn: Funds trimmed their net long position to just 107k

- Soybeans: Net 22k short, with additional shorts in meal and oil

📉 The entire bean complex is now under pressure from managed money.

We believe beans are the sleeper of 2025—and if weather becomes a concern during the growing season, we could see a sharp upside move.

Both corn and soybeans are now in a holding pattern, awaiting one of the year’s most impactful reports:

🗓️ USDA Prospective Plantings.

Expectations: More corn acres, fewer beans.

🐄 Cattle: Funds Keep Buying Into Strength

Managed money continues to build long positions:

- Week ending March 18th:

- +7k live cattle → net long 120k

- +1k feeder cattle → net long 31k

I suspect they added another 10k live and 1k feeders since then, based on open interest growth (+14k in live cattle over the last three sessions).

This appears to be fund buying met by commercial hedging.

⚠️ Friday’s price action could have been a warning sign for bulls, especially with month- and quarter-end approaching—some liquidation may be expected.

But…

🔥 Cattle On Feed data had bulls pounding their chests again:

- On Feed: 97.8%

- Placed: 82.2%

Have a great week!

Have questions about your marketing strategy? Call Nathan today! 📞 712-435-7879