Author: Author: Nathan Harris, Ag Optimus, Akron, IA Branch

Good morning!

There are plenty of headlines to evaluate as we start the month of February! Trade wars with Canada, Mexico and China will dominate the news feed this morning as Trump takes a hardline stance in an attempt to secure our borders. This situation will be fluid, and already this morning it’s reported that both Canadian and Mexican officials will meet with Trump today.

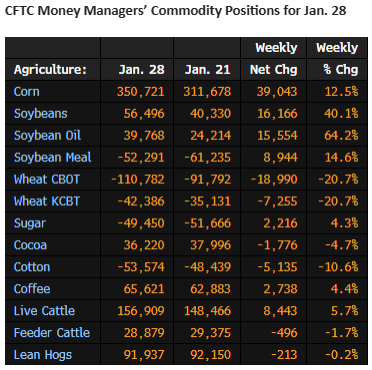

The commitment of traders report released on Friday shows some significant managed money length in our Ag markets. See the table below.

Funds are net long 350k corn and 56k beans, long a record 156k live cattle and 29k feeders, and 91k hogs as well. The only net shorts in the ag space at the time being are in wheat and cotton. Fund buying has been a good thing for the farmer, pushing prices up significantly. Be prepared for a significant break IF managed money takes some chips off the table.

The cattle complex will be reacting to both the annual cattle inventory report from Friday, and an announcement by the USDA this weekend that imports of feeder cattle from Mexico will now resume after the screwworm delays. Expect the extreme volatility we’ve witnessed of late to continue for the foreseeable future!

Source: ADMIS

Option markets are providing plentiful opportunity on both sides of the trade. Give us a call to discuss! https://agoptimus.com/contact-us/

Have a great week!

Nathan