Author: Author: Nathan Harris, Ag Optimus, Akron, IA Branch

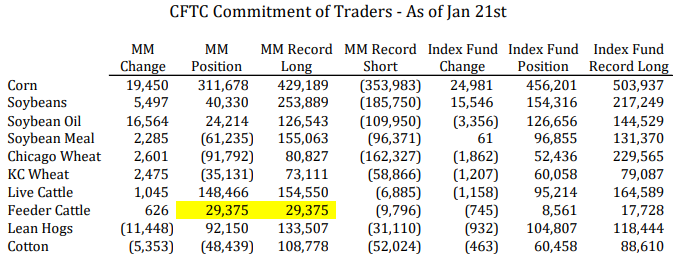

It’s important to track managed money, as they seem to be the main driver in all market trends. There’s no doubt, the rally in grains and livestock have been aided by massive fund buying. The net long in corn (311k), live cattle (148k), feeder cattle (29k), and lean hogs (92k) are all significant levels of exposure historically. With the funds in buy mode, the farmer has seen the benefit of large rallies in flat price.

Have a great week!

Source: ADMIs