Author: Author: Nathan Harris, Ag Optimus, Akron, IA Branch

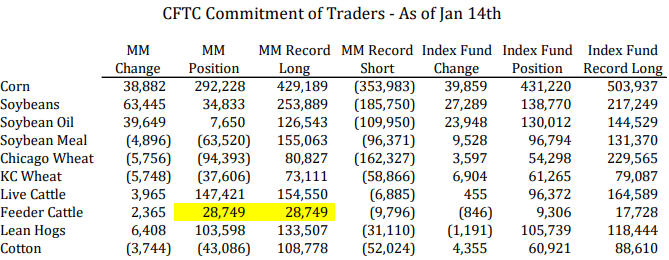

COT report data attached and shown in the table below.

Managed money was a big buyer of corn and beans in the week ending last Tuesday. The USDA report on 1/10 may have been the catalyst. Funds have strong charts, and now better fundamentals behind what has turned into a pretty significant shift in price action as of late.

I would point out the MM$ position in wheat, still a net short and continuously the short leg of the CBOT spread trade. At some point in 2025, one would think a massive unwind is in the cards where wheat sees short covering and a significant rally in flat price.

The cattle complex has benefitted from fund buying over the last 4 months, and last week was no different! New record length in FC once again, now a net long 28k contracts and growing. We believe the liquidation of that position will be ugly, but timing, of course, is everything. Most of the fund position is in the March contract, which leads me to believe “the roll” will be active in early February. On the Live Cattle side of things, managed money has built a net long of 147k contracts.

Hogs bounced significantly from 1/8 through 1/15, and it appears managed money had their hand in that movement. The close on Friday was concerning and opens the door to a possible second round of liquidation if technical support levels are violated this week. Watch $88 in April.

Have a great week!

Source: ADMIS