Overnight prices continued on the defensive on good South American weather, lack of export activity, and ideas that the report today will lean bearish beans. Meal sustains a bid over soyoil again. Wheat prices remain firm as world supplies are expected to remain tight. Beans and soyoil futures trend lower at the start of the night but find support, while corn continues to have a more steady hand.

USDA November WASDE will be released at 11:00 central time. Funds have sold beans in front of the report and one has to wonder how much bearish data has now been factored into the prices. Sell-the-expectation and buy-the -fact? We will see.

Export inspections were good for beans which only had funds selling any strength that the numbers would provide. China was part of the inspections package for beans, loading out 112 tmt from the Atlantic, 717 tmt out of the Gulf, and 945 tmt off the PNW. Bean export inspections reached 13.851 mmt which is 31% lower than a year ago. Corn inspections were low end, without any sign of China in the mix. Into the 21/22 marketing year, the US has shipped 6.037 million metric tons of corn vs. 7.603 yr ago. After the close Egypt tendered for vegoils.

WEATHER – 6/10 day outlook is mostly clear through tomorrow and then rains return to the western cornbelt. South American weather remains good despite the talk of La Nina, which is currently not having an impact. Weather for the most part leans bearish.

REPORTS

Crop progress

corn: 84% harvested, up 10% WOW. Four states are behind which are Ind., Ohio, Tenn., Kentucky, and Ind.

beans: 87% complete, near the five yr ave. of 88%. The eastern cornbelt remains behind the most with Illinois at 85% vs. 92% average and Ind. at 77% vs. 89% ave.

winter wheat: 91% planted vs. 92% yr ago, and 91% average. Emerged: 74% vs. 78% yr ago, and 77% average.

ANNOUNCEMENTS

Brazil’s Agrural forecast the bean crop at 67% planted vs. 52% wk ago, and 56% yr ago.

Russia has set its export tax for sunflower oil at $276.7/ton for Dec., vs. $194.5/ton in Nov, the ag ministry announced.

Brazil’s IMEA estimated 20/21 forward sales at 44.4% of the crop vs. 40% mo ago, but below 64.4% yr ago, and the long term average of 42.6%.

China’s Ag Ministry reported 20/21 bean import projections at 99.78 mln mt, up 1.18 mln mt vs. prev. outlook. 21/22 bean production, imports and consumption figures unchanged in Nov. vs. mo ago.

DELIVERIES

beans: 26 Bunge stops 26

Calls are as follows on early indications:

beans: mixed/lower

meal: 90-1.00 higher

soyoil: mixed

corn: 2-3 higher

wheat: 4-5 higher

Outside markets show the Dow down 30 pts. with crude oil trading up to $82.82/barrel, and the US dollar at 93.87. The lifting of travel restrictions helped crude oil to turn into the green as more demand developed.

Tech talk:

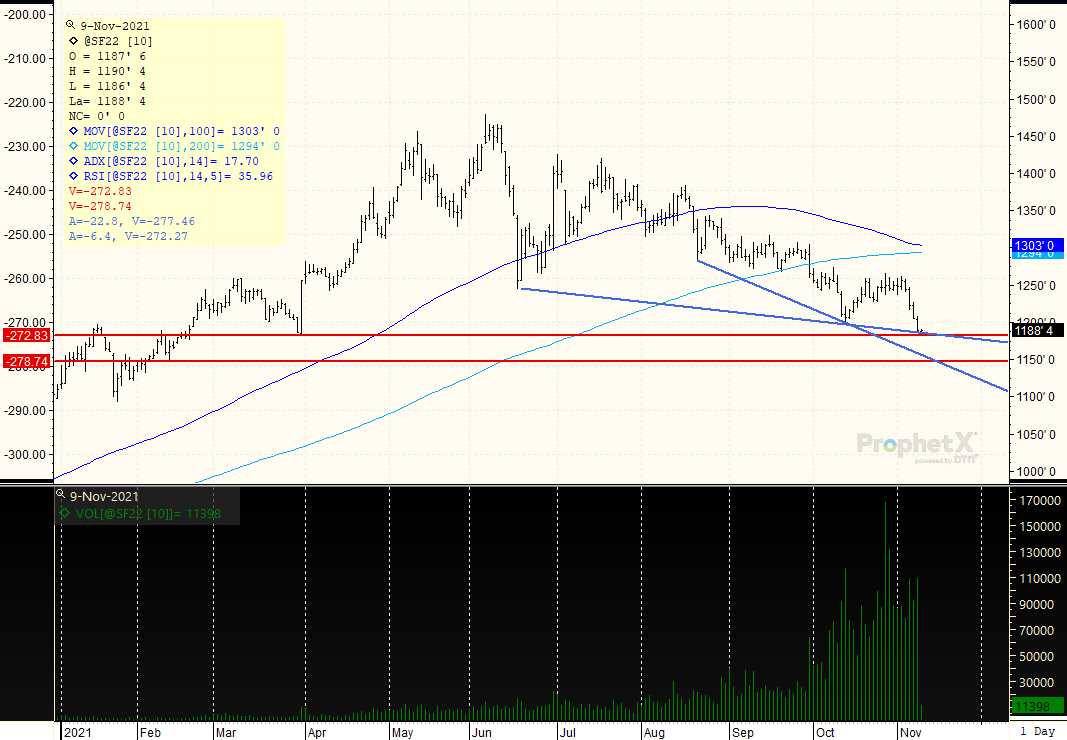

Soy: Jan bean prices trend mixed on the day with the best support at a cycle low of $11.83, which we appear ready to target. Small rallies are not holding up and we are going to see if prices can remain below $12.00. Would look to target $11.80, but below that there is air until prices reached $11.50. December meal chart has congestion from $328.00 to $340.00, and if prices break $328.00 buyers will be likely able to get coverage on at $320.00 again. For now the market remains in a $325.00-$335.00 congestion zone. December soyoil trades about 20 pts under 58c, and the chart appears a bit toppy now. However, this market has been able to bounce time and again. The 200 day moving average is now the best support but it is far away at 5535c. Think we could hold 58c for a return to a 58c – 64c trading range.

Grains: December wheat prices remain well bid, with prices turning higher from lower trading up and away from the low of $7.62. The market shows a tendency to not want to break, likely a foreshadowing that buyers are there to cover shorts or try the long side again. The long term visual support line has not been broken, and prices would have to settle under $7.55 in order to even turn sideways. Would look for a possible test of $7.95/$8.00. December corn remains in a range from $5.45 – $5.85. Though end-users would like to see prices break towards the 100 day moving average of $5.43, the chart is not presenting that chance. The ADX remains more constructive than before the rally at 25, meaning buyers are still there on dips. Bears need to see prices break $5.45 in order to turn lower.

JANUARY BEANS: Major trend turns sideways /lower as prices trend below $12.00 looking for the low end of the trading range. Would look to now target $11.83, the low from last March, but below that the only support that emerges visually is $11.50. The market is beginning to trend towards a slightly oversold status trading to 36%, but that is not enough to warrant a short-covering bounce. The trend is weak with an ADX of 14. New lows beget new lows, and there is not yet a good reversal signal to suggest that the down-move is over. However, would look for $11.80 to offer up the first sign of support.

Receive Relevant and Timely Grain Market Reports that Matter!

Get updated twice a week with concise, direct information that you can use in grain trading, marketing, and farm management

Better yet, become a customer and get DAILY updates, fundamental, and technical, sent straight to your Inbox! Contact Us now to get started.

RISK DISCLAIMER: Trading in commodity interest products such as futures, options and otc swaps entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. The placement of contingent orders by you or broker, or trading advisor, such as a stop-lossor stop-limitorder, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Long options strategies could lose their entire premium plus transactional costs. Short options strategies entail unlimited risk of loss plus transactional costs. The information presented represents the opinion of Ag Optimus. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Futures prices factor in the seasonal aspects of supply and demand. This communication may cite historic data and should not be taken to mean certain trades can produce dramatic profits year in and year out. This information does not imply customers have or will experience profits based on seasonal trades or trade data. All information, communications, publications, and reports, including this specific material, used and distributed by Optimus Futures, LLC (“Optimus”) shall be construed as, or is in the nature of, a solicitation for entering into a derivatives transaction. Optimus does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This email may include information produced by third parties. Material not labelled Optimus Futures should be considered to be third-party, and is provided for informational purposes only. Third-party material is from sources believed to be reliable, but its accuracy is not guaranteed by Optimus Futures. Optimus Ag and Ag Optimus are registered dbas of Optimus Futures LLC [NFA ID 0481133] CONFIDENTIALITY NOTICE: Privileged/Confidential information may be contained in this message. If you are not the intended recipient, please notify the sender immediately and you must not use the message for any purpose nor disclose it to anyone. Communications on all mediums may be recorded.