Prices remain in congestion mode defining trading ranges. While some markets are sky-rocketing higher, (oats finished yesterday limit – bid), others are marking time. Soyoil continues to gain on meal, while grains pullback. Wheat is lower on profit-taking this AM while beans are pulling back as well. Russian wheat prices continue to rise on the back of tightening supplies and a strong Ruble.

Corn continues to suffer from a lack of export interest. Export inspections for corn were underwhelming, with year-to-date shipments at 4.713 mmt vs. 6.170 mmt yr ago. Bean inspections were down from last week’s 2.450 mmt,, but doing well with yesterday’s 2.104 mmt mostly from China who remains active. China loaded 57 tmt out of the South Atlantic, 442 out of the Gulf and 1.003 mmt off the PNW.

WEATHER – Showers continue to move through the Midwest creating harvest delays. Temperatures are near to below normal in the north and above normal in the south. 6/10 day outlook is for scattered showers east through Saturday.

Globally favorable conditions remain for Brazil and conditions are good for bean planting and establishment. More showers will soon be needed in Argentina. Next week turns drier for the Midwest.

REPORTS

Crop progress:

corn: 66% harvested up 14% WOW. Kentucky and Tennessee are behind average, other states are in line with expectations. Eastern Iowa corn was finished last Monday with a yield score of 4.75, above the 4.5 predicted prev. SD corn was completed on Friday with the expected score of 2.75.

beans: 73% harvested vs. 70% expected. Illinois, Indiana, and the southeast remain behind and weather this week will not help. Iowa and other western states are fastest along.

winter wheat: 80% planted, 55% emerged, vs. 60% yr ago, and average of 59%. Crop ratings were 46% good/excellent, up from 41% yr ago, but behind expectations of 54%.

ANNOUNCEMENTS

Brazil’s bean exports up to the 4th wk of Oct. averaged 182.3 mmt vs. 121.1 yr ago.

Brazil’s CONAB forecast bean planting progress at 36.8% complete vs. 23.7% wk ago, and 20.5% yr ago.

Russia’s largest pork producer, privately held Miratorg, reported an outbreak of ASF at a site in central Russia.

Calls are as follows:

beans: 1-2 lower

meal: 1.20-1.40 lower

soyoil: 5-10 higher

corn: 1-2 lower

wheat: 5-7 lower

Outside markets have crude oil at $84.12/barrel with the US dollar weaker at 93.70. Stocks are higher up 110 pts.

Tech talk:

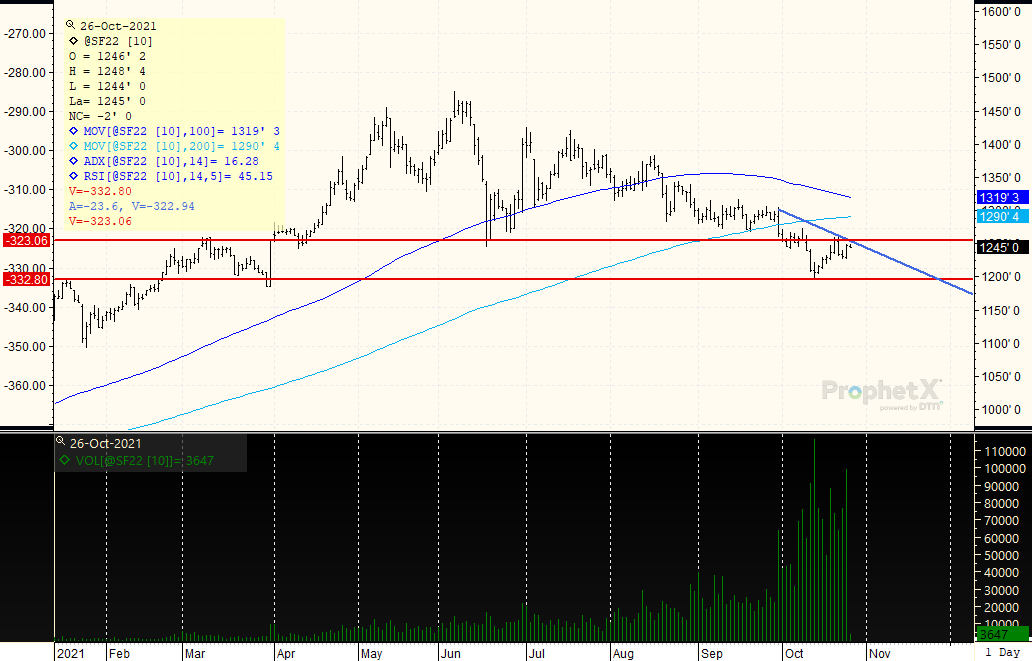

Soy: November beans are sideways but the major trend remains sideways/lower and is dominating. Nov. futures are backing away from double highs at $12.49 1/2, with lower support still at $12.10-$12.15. However, despite early weakness the downtrend has been interrupted and prices could continue to trend sideways with pullbacks seeing more support than before the rally. December meal prices are congesting from $320.00-$335.00 and the chart is working to define trading ranges from the target low achieved at $310.00. ADX has been moving lower, meaning the strength of the downtrend has been muted. Look to maintain a sideways path from $315.00-$335.00. December soyoil range is from 60c-65c, and congesting in the middle at 63c. The major trend is higher and there are multiple support lines under the market to cushion a pullback, starting at 62c should we go there. The best bargain buying opportunity would be a pullback to where trendline support and the 100 day moving average meet which is 6050c, but it may be tough to go there now.

Grains: December corn is tightly congested from $5.30-$5.40, with a weak ADX of 13 meaning there is virtually no trend here at all. While prices are drifting higher, the market has been unable to trade above $5.40 which could signal further weakness. Trendline support which has formed recently is at $5.32, and should it continue to hold on weakness will become a buying opportunity. December wheat prices are in a trading range from $7.30-$7.65/$7.68, but the new high at $7.67 stood all day on Monday and a small correction is taking place today. Trendline support under the market crosses at $7.43, and if we go there think it holds for a further move higher. Chart has started a new uptrend, and the top may still be from $7.70/$7.80.

January beans: The sideways range is from $12.20 to double highs of $12.58. Prices are trending sideways to higher approaching key resistance at $12.55 but unable so far to get over the major blue trendline resistance which crosses at the top. The ADX trend is still weak at 16, with little upside or downside follow-through. Most notable item on the bean chart is that the down-trend has been interrupted, which suggests that prices may stay sideways now. A larger rally would have to come from a settlement over $12.60. Should that happen would trigger more fund buying and a trade towards the 200 day moving average of $12.90. For now, seems the market is more content to drift sideways at lower levels, given the bearish fallout from the stocks report and lack of demand right now.

Receive Relevant and Timely Grain Market Reports that Matter!

Get updated twice a week with concise, direct information that you can use in grain trading, marketing, and farm management

Better yet, become a customer and get DAILY updates, fundamental, and technical, sent straight to your Inbox! Contact Us now to get started.

RISK DISCLAIMER: Trading in commodity interest products such as futures, options and otc swaps entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. The placement of contingent orders by you or broker, or trading advisor, such as a stop-lossor stop-limitorder, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Long options strategies could lose their entire premium plus transactional costs. Short options strategies entail unlimited risk of loss plus transactional costs. The information presented represents the opinion of Ag Optimus. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Futures prices factor in the seasonal aspects of supply and demand. This communication may cite historic data and should not be taken to mean certain trades can produce dramatic profits year in and year out. This information does not imply customers have or will experience profits based on seasonal trades or trade data. All information, communications, publications, and reports, including this specific material, used and distributed by Optimus Futures, LLC (“Optimus”) shall be construed as, or is in the nature of, a solicitation for entering into a derivatives transaction. Optimus does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This email may include information produced by third parties. Material not labelled Optimus Futures should be considered to be third-party, and is provided for informational purposes only. Third-party material is from sources believed to be reliable, but its accuracy is not guaranteed by Optimus Futures. Optimus Ag and Ag Optimus are registered dbas of Optimus Futures LLC [NFA ID 0481133] CONFIDENTIALITY NOTICE: Privileged/Confidential information may be contained in this message. If you are not the intended recipient, please notify the sender immediately and you must not use the message for any purpose nor disclose it to anyone. Communications on all mediums may be recorded.