Futures continue to head into trading ranges, with this week’s focus shifting more to demand and less on supply and demand numbers. Values are firmer this morning. Features remain that of surging crush values and higher oilshare. The focus of trade is slowly shifting to demand, and export inspections yesterday for beans and corn were solid yesterday. Corn inspections were 978 vs. 843 shipped wk ago. Beans at 2.298 mmt were also better than expected with China getting 559 tmt out of the Gulf, and 1.070 mmt off the PNW.

Brazil’s CONAB released some numbers, showing 21/22 bean planting at 23.7% complete as of Oct. 16, up 12.4% from wk ago. First season corn planting is 32.1% done vs. 29.0% wk ago, with wheat harvest at 38.3% vs. 34.7%. Weather in Brazil continues to be a neutral factor, which is allowing for a good planting pace to begin the SA season.

WEATHER – This week features mostly dry weather which will allow for harvest to advance. 6/10 day and 8/14 day outlooks are warmer but wetter, which could slow the pace once more.

Global – conditions remain favorable for bean planting and establishment in Brazil. More showers are needed for planting and development in Argentina.

REPORTS

Crop progress:

corn: 52% harvested advancing 11% WOW, but slightly behind expected at 54%. Rain did slow harvest. Mature: 97%. 60% of the corn was rated good/excellent.

beans: 60% vs. 49% wk ago. Harvest progress is faster in the WCB and slower in the ECB. Dropping leaves: 95%.

winter wheat: 70% planted vs. 76% yr ago, and 71% average.

ANNOUNCEMENTS

Brazil’s AgRural reaches 22% planted for beans, which is the second fastest pace on record. They also said despite good pace, excessive humidity has been hurting fieldwork in the southern states of RIo Grande do Sul and Santa Catarina.

Egypt’s GASC will suspend the 15% advantage the state run shipping line has in transporting wheat from its tenders in order to add more competition into parallel freight tenders and to attempt to lower shipping costs.

Ukraine’s Ag Ministry forecast that as of Oct. 18 around 5.0 mln hectares of winter wheat had been planted, which is around 75% of the 6.69 mln acres expected.

Calls are as follows:

beans: 3-5 higher

meal: 2.00-3.00 higher

soyoil: steady

corn: 1/2-1 higher

wheat: 5-7 higher

Outside markets feature higher crude oil prices at $83.58/barrel, and the US dollar trading down to 93.50. Stocks are 160 pts higher.

Tech talk:

Soy: November bean chart continues to add to gains and in the process is alleviating all oversold technical signals. The advance to new highs will invite more buying on pullbacks, and the target high is now likely to be towards the $12.40/$12.45 level. Would look to now target $12.35 as a sideways congestion pattern forms. The December meal chart actually has a better recovery low that is signaling a “u” shaped bottom. This would be the type of reversal signal that could sponsor a better rally, but prices will have to clear tops at $325.00. Think that we likely go to $325.00, but may stall out temporarily. Beyond $325.00 is air, so would look to generate a better rally towards $335.00 if the market trades beyond $325.00. December soyoil trades to new highs at 6234c and well over the 100 day moving average and middle of the 58-63c trading range of 6050c. This chart is likely targeting a top of 63c again in a re-test of its recent highs, as it is prone to do. Pullbacks of size are good buying opportunities, but for the day we could see some profit-taking in oil share which may keep values congested from 61c-62c.

Grains: December wheat chart is now constructive with prices trading over minor trendline resistance which crossed at $7.40. Prices were trending into resistance lines yesterday which was a foreshadowing of higher prices to come. Target high now that prices have traded past $7.35/$7.40 is at the recent high at $7.55-$7.63. Look to likely go there on further technical strength. December corn also builds on gains over $5.33, and is moving towards its 100 day moving average of $5.47. THis would be back at recent highs. Look for pullbacks to see buying interest as prices trend upward, but the major direction remains sideways and think we move back and forth between $5.30-$5.40 for a bit. Overall trading range is from $5.20-$5.45.

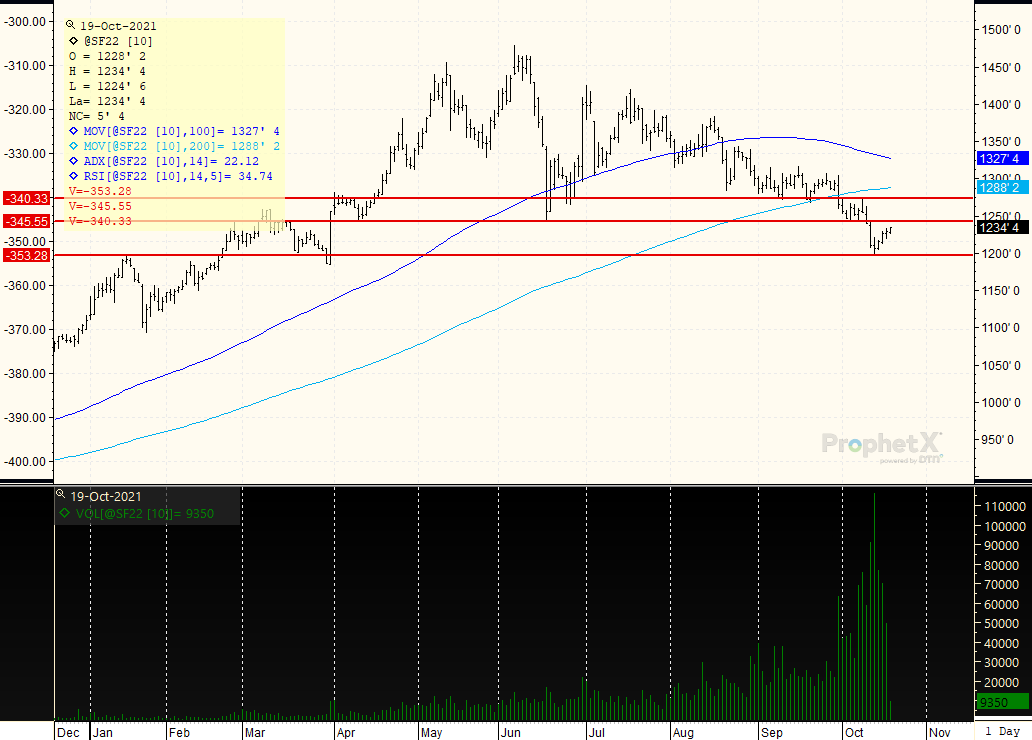

JANUARY BEANS: The market has stopped moving lower and is now in the process of defining trading range lows from the bottom. Trading range between the lower red lines defines the current possible levels of $12.00 and $12.45/$12.50. Beyond $12.50 is $12.75. For the moment, the downtrend is stronger than an uptrend, which could keep prices up and down between 12.00-$12.45/$12.50. Cannot even rule out another drop towards the lower end of the range to be certain that $12.00 is indeed value. The market is slightly oversold at 34%, which is not enough to warrant corrective price action.

Receive Relevant and Timely Grain Market Reports that Matter!

Get updated twice a week with concise, direct information that you can use in grain trading, marketing, and farm management

Better yet, become a customer and get DAILY updates, fundamental, and technical, sent straight to your Inbox! Contact Us now to get started.

RISK DISCLAIMER: Trading in commodity interest products such as futures, options and otc swaps entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. The placement of contingent orders by you or broker, or trading advisor, such as a stop-lossor stop-limitorder, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Long options strategies could lose their entire premium plus transactional costs. Short options strategies entail unlimited risk of loss plus transactional costs. The information presented represents the opinion of Ag Optimus. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Futures prices factor in the seasonal aspects of supply and demand. This communication may cite historic data and should not be taken to mean certain trades can produce dramatic profits year in and year out. This information does not imply customers have or will experience profits based on seasonal trades or trade data. All information, communications, publications, and reports, including this specific material, used and distributed by Optimus Futures, LLC (“Optimus”) shall be construed as, or is in the nature of, a solicitation for entering into a derivatives transaction. Optimus does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This email may include information produced by third parties. Material not labelled Optimus Futures should be considered to be third-party, and is provided for informational purposes only. Third-party material is from sources believed to be reliable, but its accuracy is not guaranteed by Optimus Futures. Optimus Ag and Ag Optimus are registered dbas of Optimus Futures LLC [NFA ID 0481133] CONFIDENTIALITY NOTICE: Privileged/Confidential information may be contained in this message. If you are not the intended recipient, please notify the sender immediately and you must not use the message for any purpose nor disclose it to anyone. Communications on all mediums may be recorded.