- Cash Cattle last week averaged $1.24 FOB for 80%+ Choice

- Light cash trade this week floating between $123 and $126, with limited packer interest so far

- Choice Boxed Beef ended 9/15/21 at $319.82 and Select at $283.89

- Slaughter last week estimated at 577,000 vs. 624,000 the prior week and 581,000 same week last year, mostly because of Labor Day. Slaughter levels this week could struggle to hit 630,000

- Last Weeks Slaughter weights still on the rise, ending last week at 1357 estimated average

- Black Swan #2 for the year 2021

Source: USDA AMS

What are they thinking?

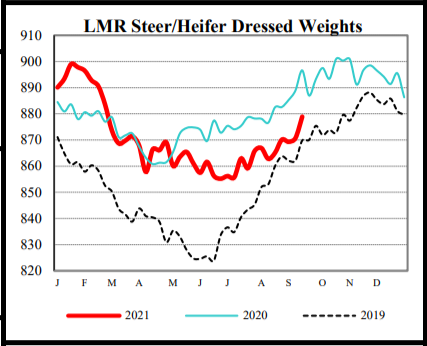

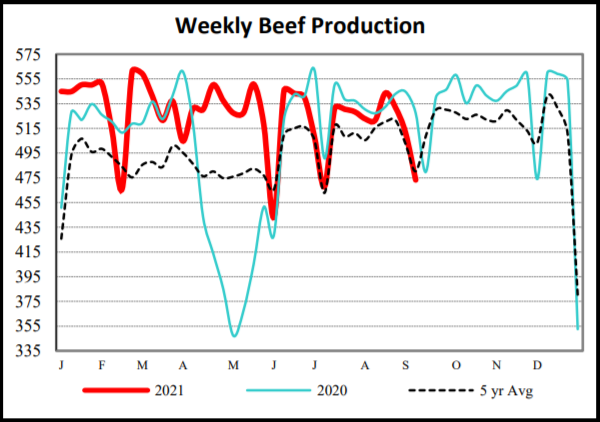

There is a ton of suggestions coming from brokers and industry expertsthis week about what to do with hedges after the recent 3 week free-fall in the livestock markets. They all look at the data, fundamentals and technicals, and make their best recommendations. Many of them are bullish, from what Ive seen. Technically, their right. Were due for a bounce. And some are calling for $150 spring fat cattle. (I heard $10 corn earlier this summer too). In the two charts above, youll notice the red line, 2021, is at or above the dotted 5-year average. I must admit, that does give me hope, especially comparing to the blue COVID year lines. But shouldnt we have beef production below the 5-year average to legitimately have a big bullish break out?

Ronald Reagan said once, Surround yourself with the best people you can find, delegate authority, and dont interfere as long as the policy youve decided upon is being carried out.With that in mind, why are these experienced professionals recommending people pull their hedges, or take profits? Dont interfere as long as the policy youve decided upon is being carried out.You put that hedge on, hopefully where the cattle have some profit. Keep it on! That recommendation doesnt mean Im bearish, but what if the high is in for the year? What if JBS in Grand Island decides to pause slaughter to repair the fire damage next month? Or what if the governments vaccine mandate compels enough workers at these plants to go on strike, or worse quit? With what has been paid for yearlings in the last 60 days, and what cost of gains are running, can you afford to take a hit for the 3rd year in a row? Dont change the policy halfway through because you think youre finally going to out-smart the market. Stick to the plan!

The million-dollar question is- what is the plan? A month ago, we recommended hedging spring fats off the December contract. Then 2 weeks later, we recommended lifting that hedge and rolling into a simple February or April put, to set a floor with the premium mostly paid for by that December spread trade. The market continued to free fall, but without worry as the put gained substantial value. Also mentioned then was waiting to sell an option against that put, to add a little jingle in your pocket. This isnt a bad time to consider doing some of that. A person could look at selling a $122.00 Feb put for ~$1.50/cwt, while still protecting the top 12% of this market. I would also keep my eye on calls in the coming weeks. Might get a chance to set a ceiling for some good premium.

Feeder Cattle have not been able to escape the sell-off either. For grow yards and grazers, this decline has not hit the cash market as hard as futures. Which leads me to believe the high may be in for the fall, speaking to futures only. That is big call to make, but next weeks cattle on feed report is likely going to show placements higher than August of 2020. No that doesnt mean were going to run out sooner. Combined with corn working up a bit, we could see some sideways trade, and eventually a break lower on our winter contracts. Keep those Dec through March hedges on feeders, you never know what the grains will do next.

Going to start one new thing for this weekly newsletter. At the end of the letter each week, were going to list a cash feeder quote that we feel is worth a look. Our goal is to show you that week after week, there is an opportunity waiting to be snatched up. Give us a call if youd like to know where that quote came from. Or better yet, call your Check-Off representative and ask them to buy these slaughter houses some fire extinguishers with our money.

58 Head of 878# Steers at $152.60 Returns >$100/HD

Looking to Trade or Hedge Cattle Please reach out and let’s chat…

Dan Gerhold

319.320.4774

Receive Relevant and Timely Cattle Market Reports that Matter!

Better yet, become a customer and get DAILY updates, fundamental, and technical, sent straight to your Inbox! Contact Us now to get started.

RISK DISCLAIMER: Trading in commodity interest products such as futures, options and otc swaps entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. The placement of contingent orders by you or broker, or trading advisor, such as a stop-lossor stop-limitorder, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Long options strategies could lose their entire premium plus transactional costs. Short options strategies entail unlimited risk of loss plus transactional costs. The information presented represents the opinion of Ag Optimus. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Futures prices factor in the seasonal aspects of supply and demand. This communication may cite historic data and should not be taken to mean certain trades can produce dramatic profits year in and year out. This information does not imply customers have or will experience profits based on seasonal trades or trade data. All information, communications, publications, and reports, including this specific material, used and distributed by Optimus Futures, LLC (“Optimus”) shall be construed as, or is in the nature of, a solicitation for entering into a derivatives transaction. Optimus does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This email may include information produced by third parties. Material not labelled Optimus Futures should be considered to be third-party, and is provided for informational purposes only. Third-party material is from sources believed to be reliable, but its accuracy is not guaranteed by Optimus Futures. Optimus Ag and Ag Optimus are registered dbas of Optimus Futures LLC [NFA ID 0481133] CONFIDENTIALITY NOTICE: Privileged/Confidential information may be contained in this message. If you are not the intended recipient, please notify the sender immediately and you must not use the message for any purpose nor disclose it to anyone. Communications on all mediums may be recorded.