Prices were weaker yesterday and are mixed this AM, with soyoil sporting the largest losses. Oilshare is lower again as traders buy meal/sell soyoil. Liquidating Sep. positions and load disruptions due to Hurricane Ida in the Gulf impacted prices negatively. The size of the break yesterday was a surprise to many traders, as has been the case for a bit now. End-users were there on the break to get some coverage on. Funds were net sellers of around an estimated 15K corn yesterday, 13K beans, 4K meal, and 5K soyoil yesterday. Traders were even in wheat.

Flooding from Hurricane Ida and power outages slowed efforts by energy firms to assess damage at oil production facilities, ports, and refineries. It may take 2-3 weeks to restart production given the damage. CHS Global Grain and Processing said that they may have to divert export shipments over the next month to their Kalama Washington terminal.

The pace of exports continues to be bearish, with bean exports at 13 mln bu vs. 30 mln bu yr ago. A slower Chinese pace of demand and larger SA bean acreage could weigh on the market. There is talk that China continues to be around the bean market. US beans and corn remain the cheapest in the US. Domestic crush margins remain positive. Meal prices work lower due to reports of increased cases of ASF in China, but gain stability from buy meal/sell soyoil trade.

Weekly corn exports were 22 mln bu vs. 16 mln bu yr ago. Corn export inspections were in fact the lowest for the 20/21 marketing year with much of it going to Mexico and China. Traders are still waiting for exports to kick in in lieu of lower Brazilian Safrinha product. Like the bean market, higher 2022 corn supplies remain a negative feature.

Wheat remains a global issue, and heavier than expected deliveries are weighing on prices this AM. Egypt tendered for wheat yesterday but purchased Black Sea product.

WEATHER – Rains continue across upper portions of the Midwest which will help aid crops in that region. The rains from Ida are moving southeast. Beans could benefit from rains in Iowa, central Illinois, and parts of Indiana. The impact of the hurricane could have caused damage to a grain export elevator, with bids for US gulf values dropping. The extended forecasts for the southern plains calls for a warmer and drier outlook.

Global: Russia’s New Lands remain drier than normal as well. Talk of La Nina could impact SA crops, and the start or delay of the bean planting season in Brazil. Argentina and Paraguay continue to see lower river levels due to ongoing drought conditions, with limited vessel loadings.

REPORTS

Crop progress:

beans: 56% good/excellent, unchanged from wk ago, and meeting trade expectations. Setting pods: 93% vs. 88% wk ago, and vs. 5 yr MA. Dropping leaves: 9% vs. 3% wk ago. States showing deterioration were Ohio, MO., Kansas and Ohio.

corn: 60% good/excellent unchanged from the prev. wk. Dented: 59% vs. 55% ave. Dough: 91% vs. 93% yr ago. Mature: 9% vs. 10% average. States that improved the most were Illinois, Wisconsin, and Colorado.

spring wheat harvest: 88% complete, vs. 77% prev. wk, and ahead of the 5-yr average of 71%.

Next week will include its first estimate of planting progress for the 2022 US winter wheat crop.

DELIVERIES

Chicago wheat: 1,000 Wells Fargo put out 1,000 scattered stopping

soyoil: 236 JP Morgan put out 236

ANNOUNCEMENTS

USDA attache to Brazil forecast the 2021 cattle herd up 4% this year, and up 4% in 2022. The attache expected 2021 beef production off 6.0% to 9.5 mln mt in CWE, but then rising 2.0% in 2022.

Ukraine’s Ag ministry said that wheat harvest was complete, with 32.52 mln mt of grain harvested this season, with an average yield of 4.62 mt/hectare.

Calls are as follows:

beans: 3-5 lower

meal: 80-1.00 higher

soyoil: 50-60 pts lower

corn: 2-4 lower

wheat: 1-3 lower

Outside markets continue with crude weaker at $68.72/ barrel, and the US dollar at 92.62. Stocks are up 16 pts.

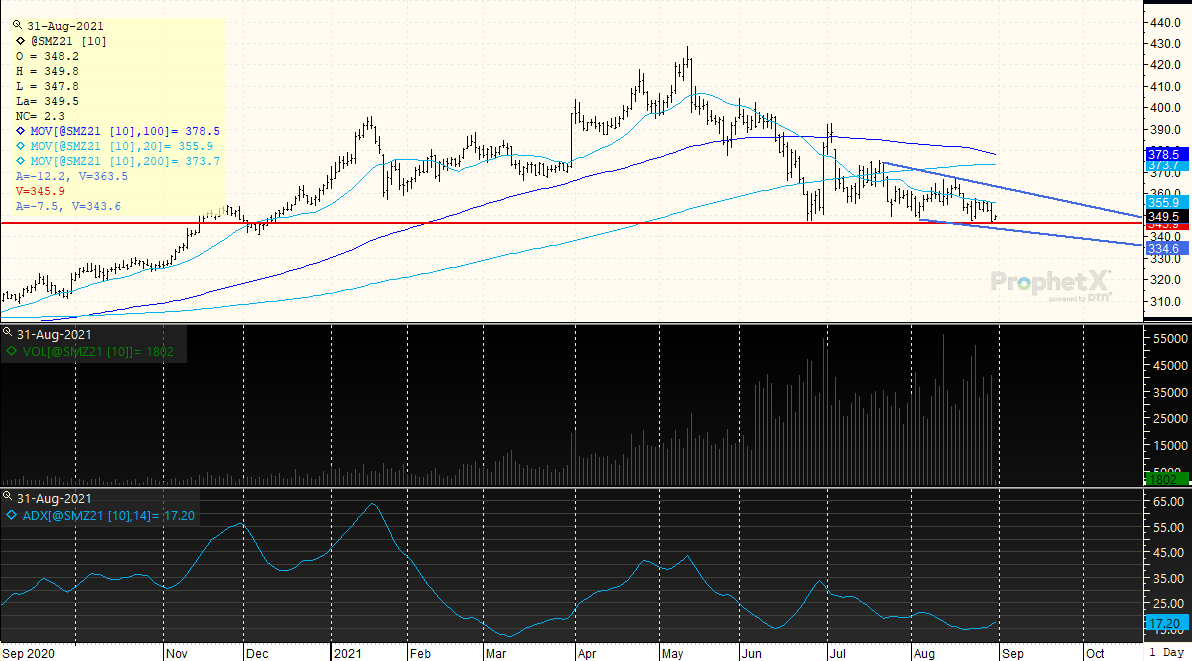

Tech talk: November bean chart appears negative with the last rally failing and prices now back below $13.00. Taking out major benchmarks is never a sign of inherent strength, and suggests that prices probably retest recent lows at $12.90, or slightly lower. Funds appear to be selling small rallies which is bearish. December meal prices could not trade over the less important 20 day moving average of $355.00 which led to another break-down and test of trading range lows of $347.00. Prices are not oversold which will allow for trade to continue to target $345.00, and then $340.00 on further price erosion. However, for the morning meal prices once again appear to have support at $347.00, so if short would probably elect to get something covered in here, or price. December soyoil trades to the 100 day moving average of 5880c, and is under the 20 day moving average of 6065c. Prices are merely sideways, but breaking the 100 day moving average is more important as to price direction, opening the market up to a return to major support which does not cross until prices reach 57c. Overall trading range is from 57c to 62c. While prices may go to 57c, would be a good place to price as major visual support does now cross there.

December wheat continues its journey as a possible head and shoulders top. Though it appears to be a bearish top, the idea is to not sell this one until we break and close solidly under $7.22 which is the neckline. In that case, the downside projection targets $6.98 and then $6.65 on downside follow-through. So far this remains the most interesting visual technical formation of any of the other markets, where price action remains trendless. December corn price is sideways establishing support at $5.30 and resistance at $5.60. The corn market does appear to head downward with more ease, while prices remain labored on the upside, which is a clue that the support at $5.30 remains weak. Trade under $5.30 Dec. corn targets $5.15.

DECEMBER MEAL: Prices continue to trend weak, with an ADX of 17, and rallies continuing to fail. The market treaded water just underneath the 100 day moving average of $356.00, but broke down from there to hit a new trading range low of $346.40. The major direction is sideways/lower, and the presence of a new low continues to suggest that further price erosion may be next. Target low on a break of $345.00 is $338.00/$340.00. Since rallies continue to fail it increases the chance for a trend towards $340.00, and the lack of an oversold status, (RSI at 43%), is neutral to bearish for the market.

Receive Relevant and Timely Grain Market Reports that Matter!

Get updated twice a week with concise, direct information that you can use in grain trading, marketing, and farm management

Better yet, become a customer and get DAILY updates, fundamental, and technical, sent straight to your Inbox! Contact Us now to get started.

RISK DISCLAIMER: Trading in commodity interest products such as futures, options and otc swaps entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. The placement of contingent orders by you or broker, or trading advisor, such as a stop-lossor stop-limitorder, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Long options strategies could lose their entire premium plus transactional costs. Short options strategies entail unlimited risk of loss plus transactional costs. The information presented represents the opinion of Ag Optimus. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Futures prices factor in the seasonal aspects of supply and demand. This communication may cite historic data and should not be taken to mean certain trades can produce dramatic profits year in and year out. This information does not imply customers have or will experience profits based on seasonal trades or trade data. All information, communications, publications, and reports, including this specific material, used and distributed by Optimus Futures, LLC (“Optimus”) shall be construed as, or is in the nature of, a solicitation for entering into a derivatives transaction. Optimus does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This email may include information produced by third parties. Material not labelled Optimus Futures should be considered to be third-party, and is provided for informational purposes only. Third-party material is from sources believed to be reliable, but its accuracy is not guaranteed by Optimus Futures. Optimus Ag and Ag Optimus are registered dbas of Optimus Futures LLC [NFA ID 0481133] CONFIDENTIALITY NOTICE: Privileged/Confidential information may be contained in this message. If you are not the intended recipient, please notify the sender immediately and you must not use the message for any purpose nor disclose it to anyone. Communications on all mediums may be recorded.