Author: Author: Nathan Harris, Ag Optimus, Akron, IA Branch

COT Report & Market Recap: Managed Money’s Big Impact – March 1 Update

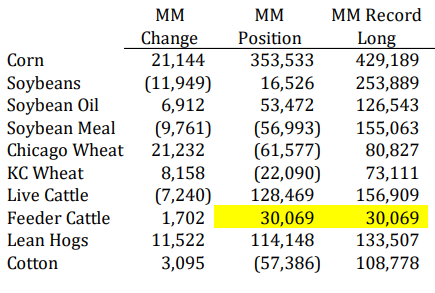

📊 Commitment of Traders (COT) Report – Key Takeaways

- Managed Money flow played a major role in last week’s price action.

- CFTC report (released Friday) is based on Tuesday’s data, meaning it lags recent market moves.

- Ag markets took a hit since the report’s data cutoff—suggesting even bigger position shifts have occurred.

🌽 Corn Market: Liquidation & Planting Season Impact

- Managed Money lightened positions before last week’s sell-off.

- Current estimate: Net long below 300k contracts after additional liquidation.

- Key Question: Will funds continue to exit, or find stability ahead of planting?

- Market View: Some stability may return as we build risk premium for the 2025 crop.

🌱 Soybeans & Wheat: Speculators Stay on the Sidelines

- Soybean Market:

✅ Minimal Managed Money exposure—funds waiting for trade war updates & planting progress. - Wheat Market:

🔻 Managed Money deeply short Chicago Wheat (-67k contracts) and continued selling last week.

🐂 Cattle Markets: Fund-Driven Rally Faces Resistance

- Live Cattle:

🔺 Funds built positions to 130k+ net long but charts now show technical weakness.(opinion)

🔻 Friday saw large liquidation, likely due to month-end selling. - Feeder Cattle:

🔺 Managed Money record long at 30k+ contracts—indicating high risk if a sell-off occurs.

⚠ Market View: Funds still comfortable for now, but chart damage raises concerns.

🐖 Hog Market: A Wild Ride Due to Tariff Risks

- Hogs have defied gravity, thanks to massive fund buying in recent months.

- Last week showed how quickly liquidation can hit, wiping out over half of the gains since mid-August.

- Tariff concerns are shaking up the market, making funds rethink their positions.

- Summer Outlook:

🔹 Fund length is a risk, but market conditions could support a rebound.

🔹 Limited hog supply for packers (due to disease concerns) could tighten availability.

🔹 Bullish Setup? Some traders may consider the long side of summer hogs.

📢 Final Thoughts: What to Watch in March

✔ Corn: Stability may return as risk premium builds for the new crop.

✔ Soybeans: Funds staying on the sidelines—watch trade war & planting updates.

✔ Wheat: Heavy short positions mean potential volatility ahead.

✔ Cattle: Fund liquidation could create turbulence after last week’s sell-off.

✔ Hogs: Tariff concerns and fund selling have shaken the market—supply issues could support a rebound.

Image by ADMIS.

💬 Have questions about your marketing strategy? Call Nathan today! 📞 712-435-7879