Author: Author: Nathan Harris, Ag Optimus, Akron, IA Branch

📊 Commitment of Traders (COT) Report – Key Insights

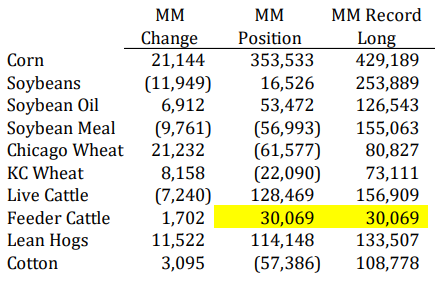

- Reportable position movements as of February 18 are now available.

- Managed Money Positions:

✅ Corn: Net long 350k+ contracts, creating downside risk if liquidation starts.

✅ Soybeans: Minimal fund exposure ahead of South American harvest.

✅ Live Cattle: Shrinking fund positions causing sharp sell-off.

✅ Feeder Cattle: Record-length positions above 30k contracts, a risky setup for bulls.

🌽 Corn Market: Price Rally Stalling?

- Corn prices surged back to last spring’s highs but are now losing momentum.

- Managed money is heavily long, increasing the risk of price declines if they begin liquidating.

- Recent strategy: Recommended old crop sales and light new crop marketing.

- Carryout remains tight, supporting prices for now, but producers should sell into strength.

🌱 Soybean Market: Funds Stay Cautious

- Minimal managed money exposure to soybeans, indicating lack of speculative interest.

- South American harvest is near, keeping the market in a wait-and-see mode.

- Spec funds are staying on the sidelines rather than taking positions.

🐂 Livestock Markets: Funds Driving Volatility

- Live Cattle:

🔻 Fund liquidation triggered a sharp sell-off, pushing the market into oversold territory. - Feeder Cattle:

🔺 Funds added length last week, now at a record 30k+ contracts.

⚠ Risk Warning: If funds exit quickly, the market could face a disorderly sell-off.

🔑 Key Takeaway: “Timing is everything” when it comes to cattle positioning.

📢 Final Thoughts: What Should Producers Do?

✔ Corn: Reward the rally with sales while keeping an eye on fund liquidation risk.

✔ Soybeans: Monitor South American harvest impact before making major moves.

✔ Livestock: Cattle bulls should be cautious—funds may not stick around forever.

💬 Questions about your marketing strategy? Contact Nathan today! 📞 712-435-7879

Image below by ADMIS.

Seasonal trends in agricultural futures are based on historical planting and harvest cycles but do not guarantee future performance. Weather conditions, government policies, and global supply chains can significantly impact prices