Author: Author: Nathan Harris, Ag Optimus, Akron, IA Branch

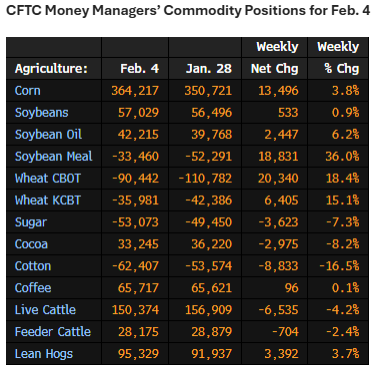

The commitment of traders data is shown below, showing reportable trader positions as of last Tuesday, 2/4.

Managed money has piled into the corn market and maintains their bullish stance with a 364k contract net long position. Their bean length is smaller, at just 57k. As you can see in the table below, MM$ started going to the door in wheat. They covered 20k shorts last week but still hold a 90k net short as of Tuesday. The charts show the result, with the market now 50 cents off the lows. At some point in 2025 we believe funds will cover this bearish position and work into length, pushing the wheat market to higher levels. It’s been an anchor on grains, and the short leg of most spreads for quite some time. The tide may be changing…

The cattle market has corrected off of record high levels, yet the fund position has barely budged. This could be cause for concern. With 150k net longs in live cattle, and 28k longs in feeders, the funds hold a large percentage of open interest in these relatively lightly traded CME contracts. The door won’t be big enough for an orderly exit if they decide to go elsewhere. Tread lightly!

Source: ADMIS

Monthly WASDE report tomorrow. Carryout estimates are 799m bushel of wheat, 1.526b bushel of corn, and 374m bushel of soybeans.

Have a great Monday!

Nathan